Precious Metals Market Report

Thursday 16 March, 2017

Fundamentals and News

Gold price rebounds after dovish Fed

After drifting sideways since Monday, gold spiked back above the important $1,200 an ounce level on Wednesday after dovish talk from the US Federal Reserve following a widely expected hike in interest rates.

Gold for delivery in April, the most active contract on the Comex market in New York with nearly 23m ounces traded, was trading just below $1,200 before the decision, but shot up $20 after Fed officials signaled only two more rate hikes this year, below what most economists had been predicting. Today’s rate hike was only the third adjustment higher in a decade.

Because gold is not yield-producing and investors have to rely on price appreciation for returns, the metal has a strong inverse correlation to US government bond yields which slumped on the news.

The metal also usually moves in the opposite direction of the US dollar and as the charts show the greenback also came in for punishment after the statement.

Latest data also showed a jump in inflation in the world’s largest economy, with the rate of price growth nearly doubling in the twelve months to end January this year. Gold traditionally is viewed as a hedge against inflation.

Gold’s downtrend ahead of today’s decision and the subsequent spike is a familiar pattern Ole Hansen, head of commodity strategy at Saxo bank recently pointed out:

The last two times the FOMC raised rates gold reacted negatively in the run-up to the announcement only to rally afterwards. In December 2015, gold lost 2% during the month leading up to the hike, only to rally by 2.6% the following month. The before-and-after reaction to December 2016 was a drop of 5% (Trump’s election win playing its part) followed by a 3.4% rally.

(*source Bloomberg)

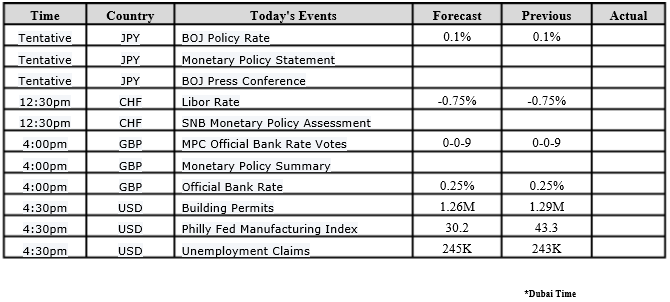

Data – Forthcoming Release

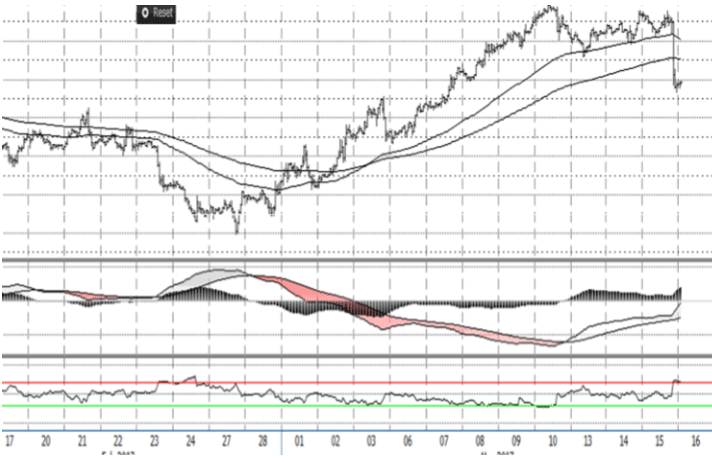

Technical Outlook and Commentary: Gold

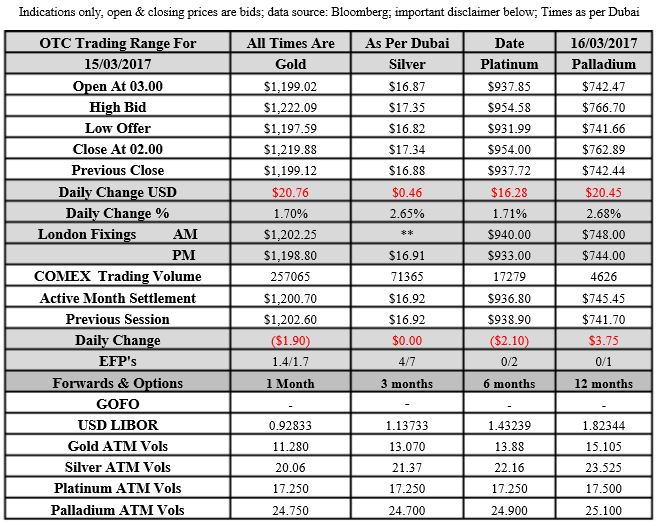

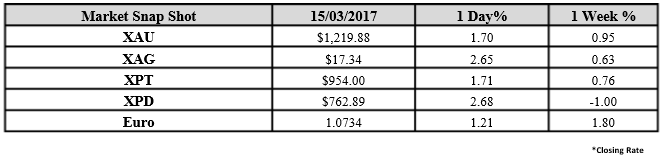

Gold for Spot delivery was closed at $1219.88 an ounce; with gain of $20.76 or 1.70 percent at 2.00 a.m. Dubai time closing, from its previous close of $1199.12

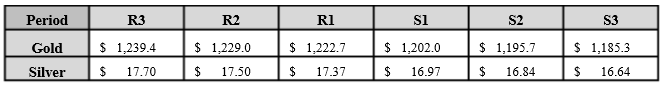

Spot Gold technically seems having resistance levels at 1222.7 and 1229.0 respectively, while the supports are seen at $1202.0 and 1195.7 respectively

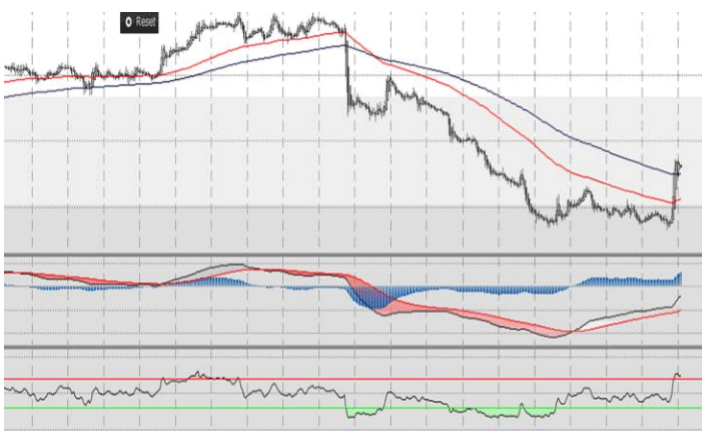

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.34 an ounce; with gain of $0.46 or 2.65 percent at 2.00 a.m. Dubai time closing, from its previous close of $16.88

The Fibonacci levels on chart are showing resistance at $17.37 and $17.50 while the supports are seen at $16.97 and $ 16.84 respectively

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply