Precious Metals Market Report

Tuesday 15 August, 2017

Fundamentals and News*

Gold Rally Falters Near $1,300 as Dollar Climbs; Platinum Slumps

Gold futures retreated from a two-month high on diminished demand for haven assets after top U.S. national security officials said nuclear war with North Korea wasn’t imminent. Platinum fell the most in more than a month.

Bullion for delivery in December slipped 0.3 percent to settle at $1,290.40 an ounce at 1:38 p.m. on the Comex in New York. On Friday, the price settled at $1,294, the highest close for a most active contract since June 6. The dollar rose against a basket of 10 major currencies and Treasury yields climbed.

While bullion approached $1,300 last week for the third time this year, prices haven’t been able to reach that level since late 2016. Gains this time around have been fuelled by tougher rhetoric from U.S. President Donald Trump and North Korea’s improved ability to manufacture nuclear weapons. On Sunday, Central Intelligence Agency Director Mike Pompeo and national security adviser H.R. McMaster said there’s no indication war will break out.

A test of $1,300 “would be an important checkpoint for gold,” Joni Teves, a strategist at UBS Group AG in London, said in an emailed statement. “This area has proven to hold strong resistance so far this year and is likely to attract some selling.”

The dollar rose against the yen for the first time in five days as Treasury yields climbed after top U.S. national security officials said nuclear war with North Korea wasn’t imminent.

The greenback rebounded after its biggest weekly drop versus the Japanese currency since May. The Asian nation’s importers returned from a three-day weekend, with the spot at their preferred end of the broader range, according to a regional foreign-exchange trader, who asked not to be identified as the person isn’t authorized to speak publicly. The Australian dollar pared earlier gains after China’s factory output and fixed-asset investment data missed economists’ estimates

(*source Bloomberg)

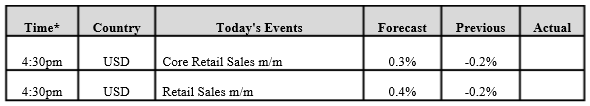

Data – Forthcoming Release

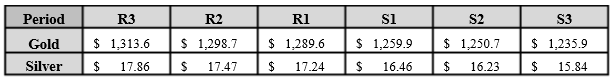

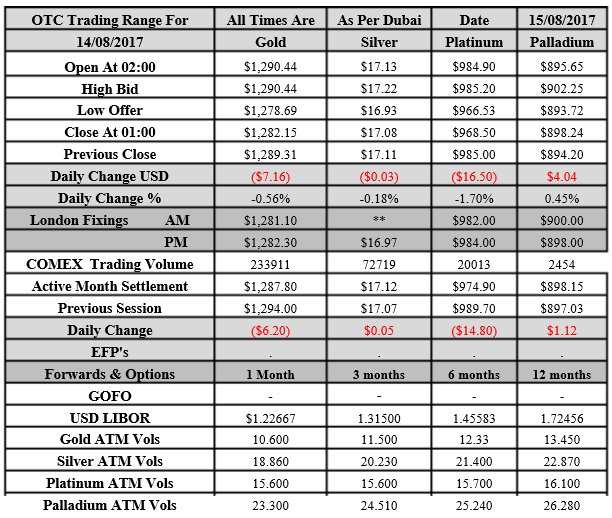

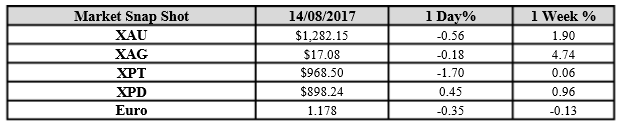

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1282.15 an ounce; with loss of $7.16 or -0.56 percent at 1.00 a.m. Dubai time closing, from its previous close of $1289.31

Spot Gold technically seems having resistance levels at 1289.6 and 1298.7 respectively, while the supports are seen at $1259.9 and 1250.7 respectively.

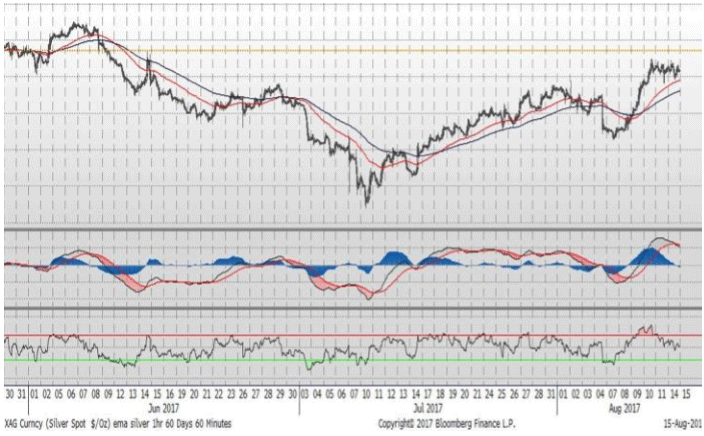

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.08 with LOSS of $0.03 or -0.18 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.11

The Fibonacci levels on chart are showing resistance at $17.24 and $17.47 while the supports are seen at $16.46 and $ 16.23 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply