Precious Metals Market Report

Wednesday 12 April, 2017

Fundamentals and News*

Asia Set for Mixed Open as Tension Spurs Haven Bid: Markets Wrap

Investors shift to yen and Treasuries on geopolitical concerns o Gold trades near year’s high; oil steady after six-day rally

Equity futures point to a mixed open in the Asia-Pacific region after geopolitical tensions weighed on U.S. stocks and investors flocked to traditional havens including the yen, gold and Treasuries.

The Japanese currency breached 110 yen per dollar for the first time since November, and its strength is helping push down Nikkei 225 index contracts. Stock futures for Australia, South Korea and Taiwan foreshadow gains. The yield on 10-year U.S. notes closed below 2.3 percent for the first time since November and gold is near its highest level this year as North Korea and Syria tensions ramped up. Oil was steady after rising for a sixth day on Tuesday.

Market volatility climbed as North Korea warned of a nuclear strike if provoked, while President Donald Trump said the U.S. would “solve the problem” with or without China. Secretary of State Rex Tillerson urged Russia to abandon its support of Syrian President Bashar al-Assad’s regime. The VIX, Wall Street’s so-called fear gauge, climbed to a level unseen since November.

The U.S.-Russia relationship will remain in focus as Tillerson visits Moscow, while China inflation data is on tap. Analysts predict the pace of factory-price gains in the world’s second-largest economy will slow, while Japanese producer prices, Australian consumer confidence and South Korean jobs are also on the agenda in Asia.

Here are the main moves in markets:

The yen was steady against the dollar after jumping 1.2 percent on Tuesday, the biggest jump since January.

Futures on the Nikkei 225 traded in Singapore fell 0.4 percent, while contracts on Sydney’s S&P/ASX 200 climbed 0.3 percent. Futures on South Korea’s Kospi were up 0.2 percent, while those on the Hang Seng were down 0.3 percent.

The yield on 10-year Treasuries dropped seven basis points to 2.297 percent on Tuesday.

The S&P 500 finished 0.1 percent lower, while the Stoxx Europe 600 was little changed.

Oil was little changed at $53.39 a barrel, after climbing for six straight sessions.

Gold was flat at $1,274.57 an ounce, after jumping 1.6 percent on Tuesday to the highest since Nov. 9.

(*source Bloomberg)

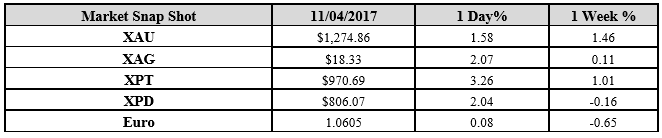

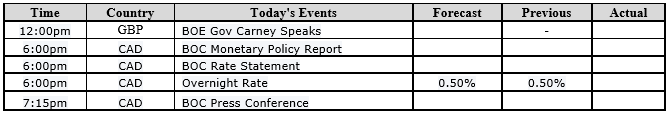

Data – Forthcoming Release

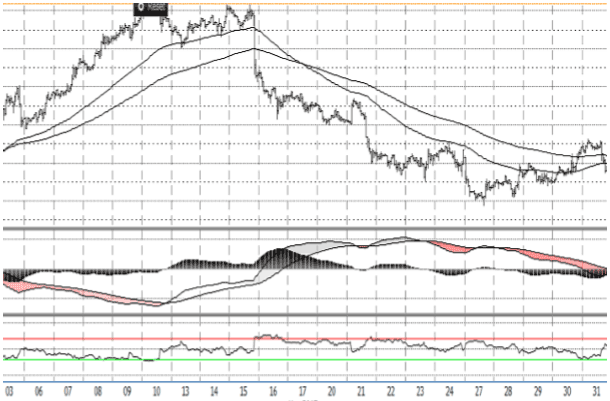

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1274.86 an ounce; with gain of $20.18 or 1.58 percent at 1.00 a.m. Dubai time, from its previous close of $1254.68

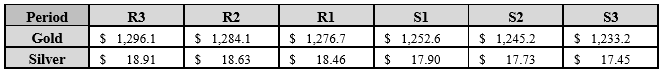

Spot Gold technically seems having resistance levels at 1276.7 and 1284.1 respectively, while the supports are seen at $1252.6 and 1245.2 respectively.

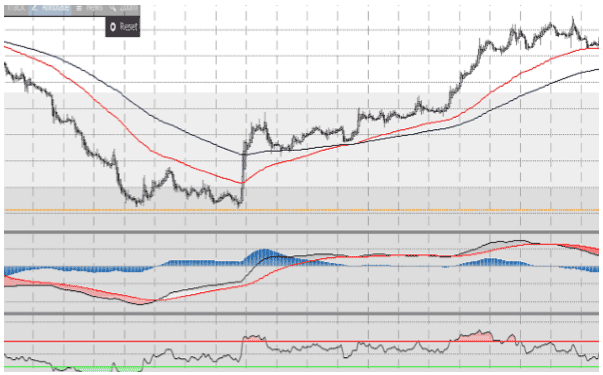

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.33 an ounce; with gain of 38cent or 2.07 percent at 1.00 a.m. Dubai time, from its previous close of $17.95

The Fibonacci levels on chart are showing resistance at $18.46 and $18.63 while the supports are seen at $17.90 and $ 17.73 respectively.

Resistance and Support Levels

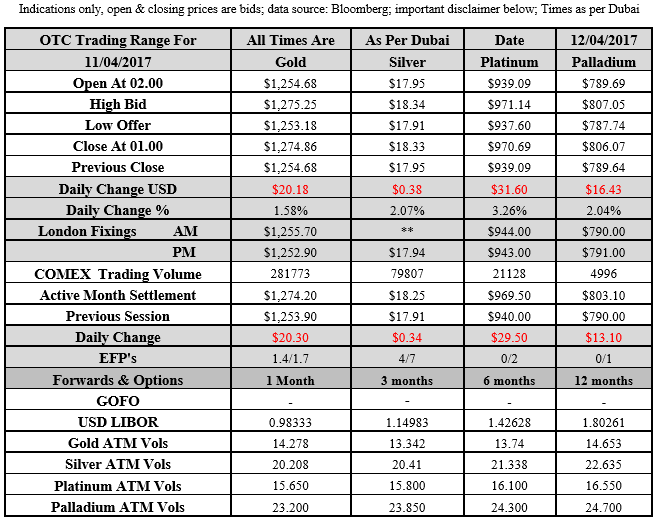

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply