Precious Metals Market Report

Tuesday 11 July, 2017

Fundamentals and News*

Gold Elite Challenged by Base Metals Bourse on Market Future

The world’s biggest industrial metals exchange is taking on the most powerful players in the gold market with the launch on Monday of its first futures contract for the commodity since the middle of the 1980s.

The London Metal Exchange and its partners aim to grab a piece of the action in a city where almost half the world’s gold changes hands. At stake are rival visions of how best to run the market, pitching the LME, Goldman Sachs Group Inc. and Morgan Stanley on one side and the London Bullion Market Association representing some of the biggest trading firms on the other.

Three years in the making, the gold contract, launched alongside another for silver, aims to draw investors from the off-exchange deals that currently dominate the city’s $5 trillion-a-year market.

“The gestation period has been longer than that of an elephant, but the baby is finally here,” Jeffrey Rhodes, founder of Rhodes Precious Metals Consultancy DMCC with more than 30 years in the industry, said from Dubai. “They’ve been coveting this for years and having waited so long, I think they’ll make it work.”

The LME, World Gold Council — representing miners — and partner banks hope to capitalize on regulators’ push for more scrutiny by allowing investors to trade contracts on an exchange where transactions are tracked and risks managed. Their LMEprecious venture including Goldman, Morgan Stanley, Natixis SA, ICBC Standard Bank Plc, Societe Generale SA and OSTC Ltd. will centrally clear daily, monthly and quarterly futures contracts using LME Clear.

The group will need to overcome inertia among those wary of moving to a new venue for pricing precious metals. Adding to that, the bullion association, which represents firms trading in the market including HSBC Holdings Plc, JPMorgan Chase & Co. and UBS AG, is already revamping the current go-to system to improve over-the-counter transactions.

(*source Bloomberg)

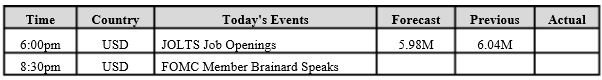

Data – Forthcoming Release

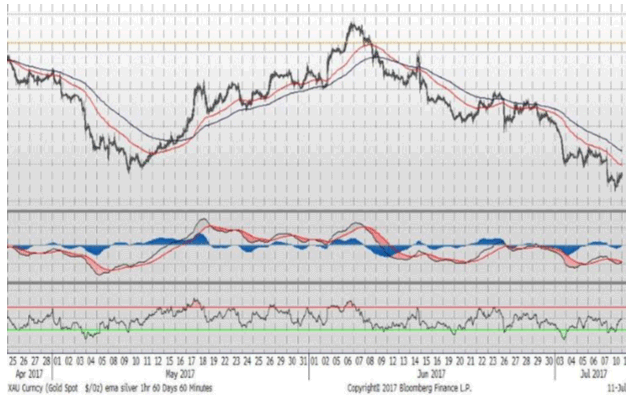

Technical Outlook and Commentary: Gold

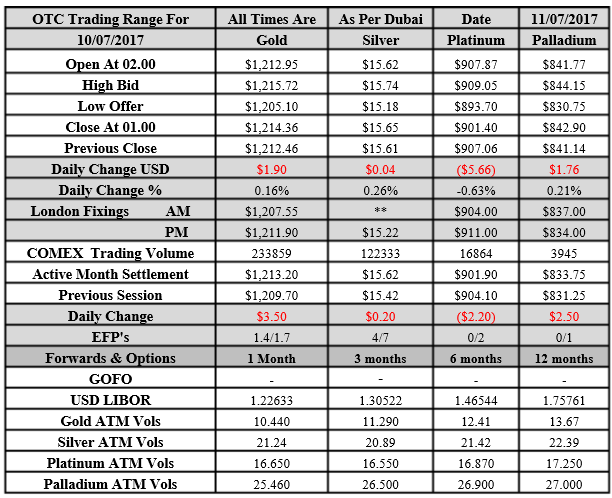

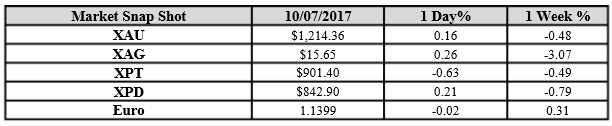

Gold for Spot delivery was closed at $1214.34 an ounce; with gain of $1.9 or 0.16 percent at 1.00 a.m. Dubai time closing, from its previous close of $1212.46

Spot Gold technically seems having resistance levels at 1225.5 and 1231.3 respectively, while the supports are seen at $1207 and 1201.3 respectively.

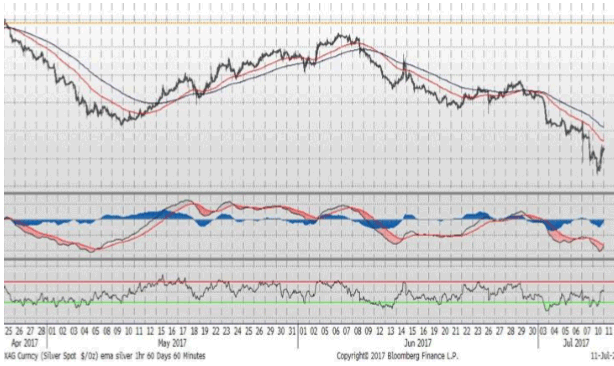

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $15.65 with gain of $0.04 or 0.26 percent at 1.00 a.m. Dubai time closing, from its previous close of $15.61

The Fibonacci levels on chart are showing resistance at $16.08 and $16.33 while the supports are seen at $15.29 and $ 15.04 respectively.

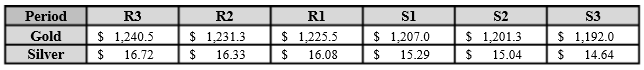

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply