Precious Metals Market Report

Tuesday 1 August, 2017

Fundamentals and News*

Gold Has Its Best Month in Five as Dollar Drop Attracts Funds

Gold posted its biggest monthly gain since February as the dollar’s slump bolstered demand and enticed hedge funds back into the metal.

Bullion futures, which reached a six-week high earlier on Monday, gained 2.5 percent in July as the dollar is set to cap its longest run of monthly declines in six years. As the weaker greenback boosted demand for an alternative asset, money managers more than doubled their bullish wagers on gold in the week to July 25, U.S. government data show.

Last week’s Federal Reserve policy meeting, where officials signaled they’re in no rush to raise interest rates because of muted inflation, has also benefited gold, Simona Gambarini, a commodities economist at Capital Economics Ltd. in London, said in a note. “Owing to the lack of inflationary pressures so far, we expect only one additional rate hike in 2017.”

Gold for delivery in December slipped 0.1 percent to settle at $1,273.40 an ounce at 1:39 p.m. on the Comex in New York, after reaching $1,277.30, the highest for a most-active contract since June 14.

Dollar weighed by month-end flows and political tensions

Bullion has also been supported by haven demand after North Korea test-fired an intercontinental ballistic missile, Sam Laughlin, a precious metals trader at refiner MKS Switzerland SA, said in an emailed note. Prices may extend advance toward $1,280 if they hold above $1,260, he said.

Hedge funds boosted net-long futures position by 160% in latest week o That’s the steepest advance since January 2016

Exchange-traded fund investors have been selling

Holdings in SPDR Gold Trust, the largest fund, -7.1% this month – Assets haven’t increased in more than a month

Gold volume totaled 3.5 million ounces last week – That’s up from 2.6 million ounces in first week

Volume exceeded 1 million ounces on Thursday

LME introduced new precious-metals contracts July 10

In other precious metals: Silver futures also advanced on the Comex, while platinum and palladium futures gained on the New York Mercantile Exchange

(*source Bloomberg)

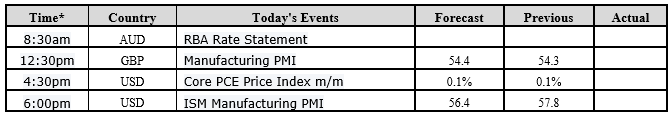

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

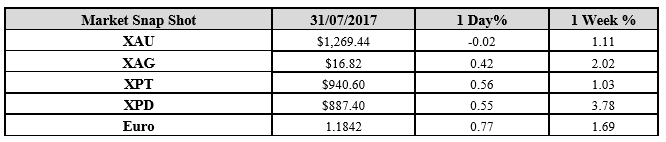

Gold for Spot delivery was closed at $1269.44 an ounce; with little change of $0.20 or -0.02 percent at 1.00 a.m. Dubai time closing, from its previous close of $1269.64

Spot Gold technically seems having resistance levels at 1272.0 and 1278.4 respectively, while the supports are seen at $1251.1 and 1244.6 respectively.

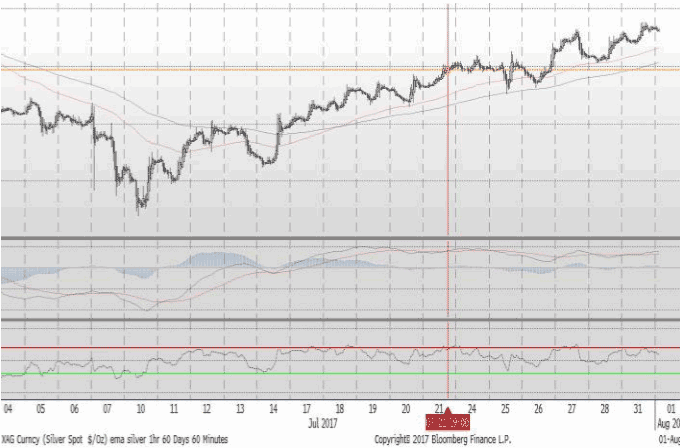

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.82 with the gain of $0.07 or 0.42 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.75

The Fibonacci levels on chart are showing resistance at $16.89 and $17.04 while the supports are seen at $16.41and $ 16.26 respectively.

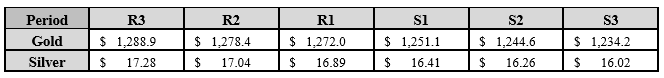

Resistance and Support Levels

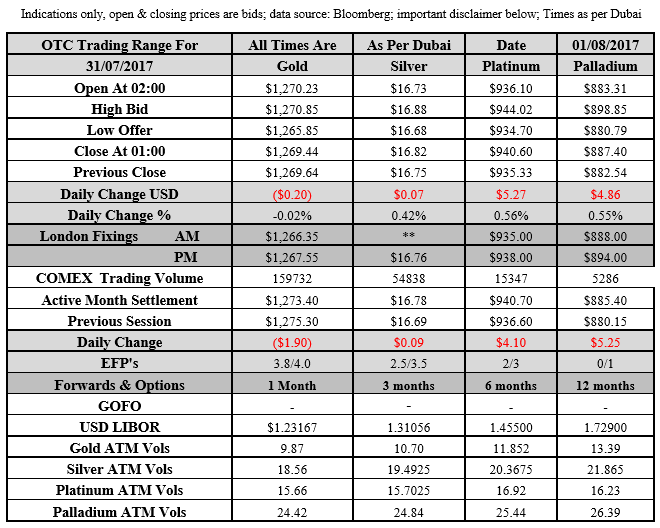

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply