Precious Metals Market Report

Tuesday 02 May, 2017

Fundamentals and News*

U.S. Stocks Rise on Earnings as Treasuries Slump

U.S. technology stocks rallied to fresh records amid optimism over corporate results, while major indexes ended mixed on tepid economic data and comments by President Donald Trump on banking structure. Treasuries fell as Steven Mnuchin suggested ultralong bonds can “absolutely” make sense.

The Nasdaq Composite Index closed at an all-time high, while a late-session dip left the S&P 500 Index barely higher on the day. Trump roiled markets when he told Bloomberg News that he’s considering breaking up giant Wall Street banks. The dollar was flat as consumer spending stalled in March andfactories expanded less than estimated. The yield on the 10-year Treasury note jumped five basis points as the Treasury secretary said his department is considering debt longer than 30 years. Oil dropped to a one-month low.

Trump’s interview with Bloomberg whipsawed markets as he suggested raising the gas tax to fund infrastructure and reintroducing rules that keep commercial and investment banking operations separate. Earnings remain in focus, with 73 percent of S&P 500 firms topping profit estimates, with tech shares outperforming. Data Monday contributed to a mixed picture of the American economy even as measures of consumer and business sentiment point to acceleration. The agreement to keep the government funded erased a near-term threat.

Investors will be watching comments from a policy meeting of the Federal Open Market Committee Wednesday.

The monthly U.S. government jobs report is due Friday.

Australia will deliver a monetary policy decision Tuesday. The benchmark interest rate will remain unchanged at 1.5 percent for a ninth month, traders and economists predict, after data last week showed quickening inflation.

The second round of the French presidential election takes place May 7; Marine Le Pen said Monday she would begin negotiations on a euro exit immediately if elected.

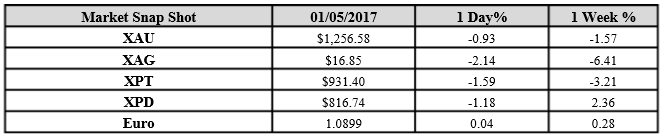

Gold futures slid 1 percent to settle at $1,255.50 an ounce, the lowest close since April 10. The metal declined 1.3 percent last week, paring a yearly advance to 10 percent.

Comex copper for July delivery rose 2 percent to settle at $2.6605 a pound, touching a threeweek high as the dollar weakened.

West Texas Intermediate crude fell 1 percent to settle at $48.84 a barrel as Libyan output surged, more rigs were added in the U.S. and Saudi Arabia cut prices to Asian customers.

Oil lost 2.5 percent in April, and is down almost 9 percent this year.

(*source Bloomberg)

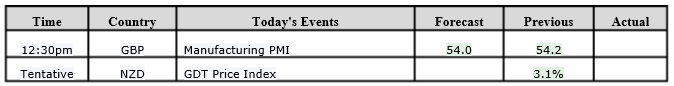

Data – Forthcoming Release

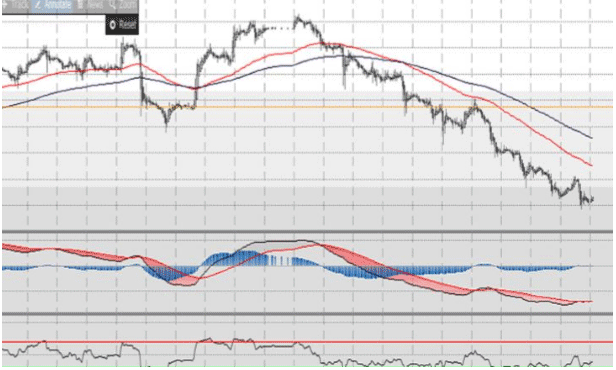

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1256.58 an ounce; with loss of $11.70 or 0.93 percent at 1.00 a.m. Dubai time closing, from its previous close of $1268.28

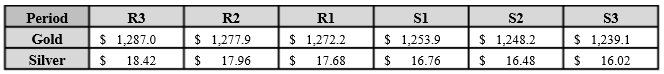

Spot Gold technically seems having resistance levels at 1272.2 and 1277.9 respectively, while the supports are seen at $1253.9 and 1248.2 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.85 with loss of $0.36 or -2.14 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.21

The Fibonacci levels on chart are showing resistance at $17.68 and $17.96 while the supports are seen at $16.76 and $ 16.48 respectively.

Resistance and Support Levels

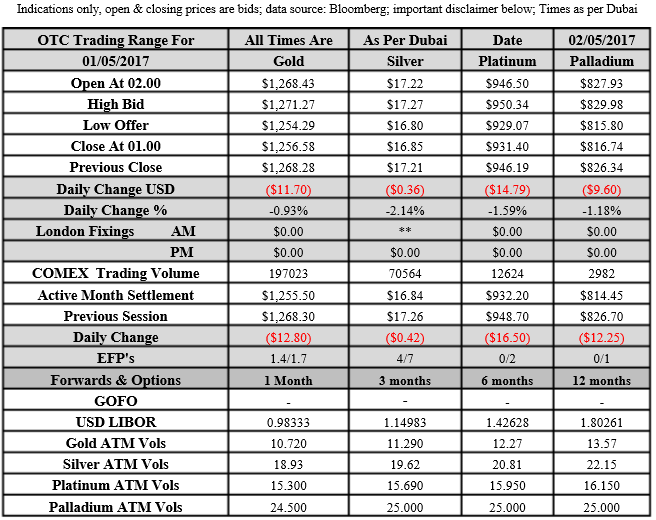

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply