![]()

Bullion Directory aims to help our visitors make educated decisions about gold’s role in retirement planning through our interactive gold retirement calculators.

Access our full range of calculators on our Gold Price Calculators page.

Select your choice of gold retirement calculators to start…

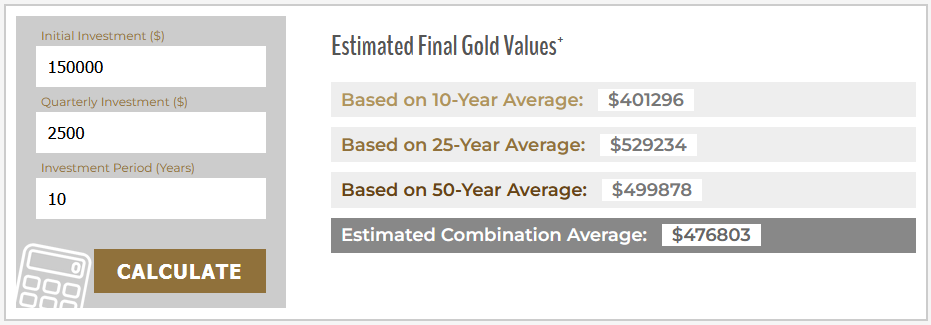

Gold Accumulation Plan Calculator

The calculator will estimate your gold’s final value based on an intial investment, quarterly additions made and historical price change data over the past 10, 25 and 50 years.

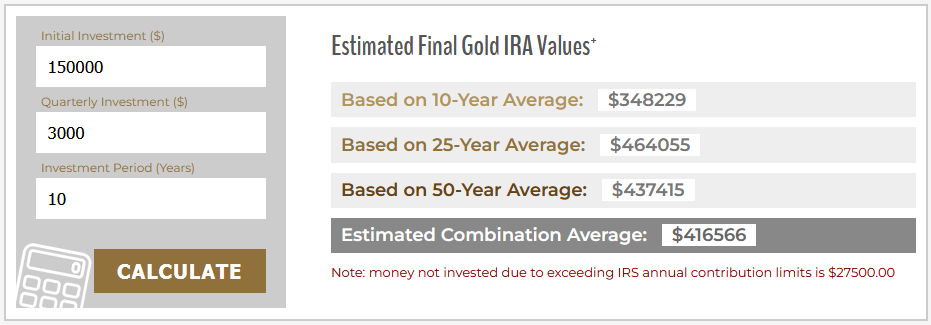

Gold Accumulation Calculator (IRA)

The calculator will estimate a gold IRA’s final value based on initial investment, quarterly additions allowing for IRS limits and historical price change data over 10-50 years.

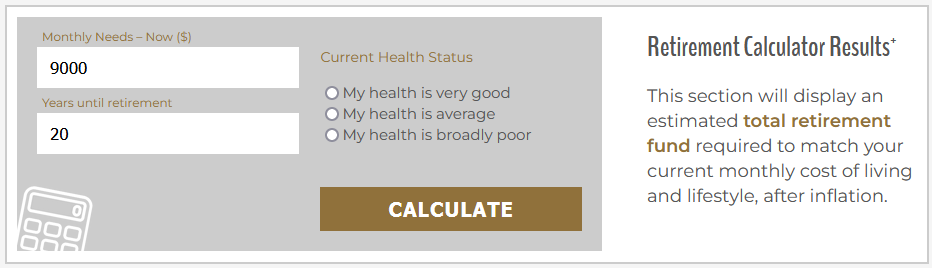

Retirement Living Standard Calculator

The calculator will estimate the total pot you will need at retirement to maintain a lifestyle throughout a typical post-retirement duration, making allowances for inflation and longevity.

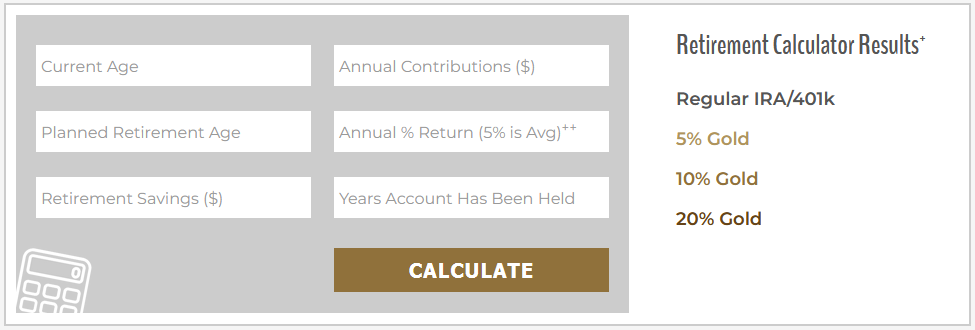

Gold Retirement Calculator

This calculator will estimate your retirement account’s final value without gold and compare this with similar accounts maintaining a 5%, 10% and 20% gold allocation for the whole duration.

Why Gold Retirement Calculators?

Individual Retirement Accounts (IRAs) in the U.S. are pivotal for retirement savings, offering tax benefits as detailed in IRS Publication 590. These accounts are bolstered by government incentives for long-term retirement investments.

Navigating IRAs can be complex, with diverse opinions prevalent in the market.

Our gold retirement calculators offer a solid starting point, but it’s crucial to grasp the full range of available options. Most populr among IRAs are Traditional and Roth IRAs. Roth IRAs involve contributions from taxed income but permit tax-free withdrawals in retirement. In contrast, Traditional IRAs benefit from tax-deductible contributions, but withdrawals during retirement are taxed. Many prefer Traditional IRAs, particularly if they expect a lower tax rate in retirement.

Both types of IRAs beat standard taxable accounts when it comes to wealth accumulation due to their tax efficiency.

In addition, SEP IRAs are favored by the self-employed and small business owners, whereas SIMPLE IRAs are tailored for smaller enterprises with no more than 100 employees.

Quick IRA Overview

Traditional IRAs, popular for their tax advantages, are ideal for individuals aiming to boost their retirement savings and reduce current tax liabilities.

Traditional IRAs, popular for their tax advantages, are ideal for individuals aiming to boost their retirement savings and reduce current tax liabilities.

These IRAs incur taxes upon withdrawals, either before or during retirement, with certain exceptions avoiding early withdrawal penalties. Deductible contributions are based on specific income and tax-filing criteria. Withdrawals become penalty-free after 59 ½, with mandatory distributions commencing at 73.

Roth IRAs

Roth IRAs, managed by individuals with taxed funds, encourage tax-free investment growth and withdrawals.

Withdrawals post-59 ½ are free from penalties, with no obligatory distributions during the owner’s lifetime, facilitating ongoing tax-free growth. Visit our Roth Retirement Calculator for detailed analysis.

SEP IRAs

SEP IRAs, initiated by employers, are straightforward in setup and maintenance, making them optimal for smaller businesses and self-employed professionals.

They share tax treatment similarities with Traditional IRAs, with higher contribution limits in 2023 – up to 25% of income or $66,000. These IRAs grant immediate 100% vesting but lack catch-up provisions for those aged 50 and above.

SIMPLE IRAs

SIMPLE IRAs, designed for smaller companies, offer reduced administrative costs compared to 401(k)s.

Employers can match up to 3% of employee compensation or provide a fixed 2% contribution. The 2023 contribution cap is $15,500 (or $19,000 for over 50s), with a notable early withdrawal penalty of 25%, higher than Traditional or Roth IRAs.

IRA Rollovers

Retirement plans such as 401(k)s and 403(b)s can seamlessly transition into Traditional IRAs, avoiding tax penalties.

Retirement plans such as 401(k)s and 403(b)s can seamlessly transition into Traditional IRAs, avoiding tax penalties.

These rollovers must be declared on tax returns using specific IRS documentation.

Rollovers retain similar investment options to the original plans and can merge with new contributions. Options include keeping assets in former employer’s plans or moving them to a new employer’s scheme.

Comparing 401(k)s and Traditional IRAs

Traditional IRAs and 401(k)s, both offering tax-deferred saving mechanisms, are among the most chosen retirement plans.

In 2023, the maximum contributions are $6,500 ($7,500 for those over 50) for Traditional IRAs and $22,500 for 401(k)s, applicable to specific income brackets. While they share similarities, notable differences are the higher contribution limits and potential employer matches in 401(k)s. Traditional IRAs offer a wider array of investment choices.

Differentiating SEP and SIMPLE IRAs from Traditional IRAs

SEP and SIMPLE IRAs stand out with their employer matching features, unlike Traditional IRAs.

These IRAs cater to smaller businesses that might not be viable for 401(k) offerings.

Gold Retirement Options

![]() A plethora of investment choices is available through IRAs from most financial institutions.

A plethora of investment choices is available through IRAs from most financial institutions.

Options include active stock investments, mutual or index funds, and robo-advisors, each with unique advantages and drawbacks. Some IRAs also accommodate annuities, land, REITs, or CDs, tailored to individual preferences.

Notably, for Bullion.Directory users, IRAs can diversify into precious metals, a prime reason for our creation of these free gold retirement calculators.

Self-Directed IRA (SD-IRA) Possibilities

SD-IRAs, comprising about 2% of all IRAs, permit investments in precious metals, alongside a variety of unique assets like private companies, real estate, and digital currencies.

These IRAs demand expertise and are closely monitored by the IRS. We strongly advise consulting with Gold Retirement specialists when incorporating physical precious metals into your retirement strategy.

Remember, certain investments are excluded from all IRAs, including life insurance, select derivatives, and real estate for personal use.

Gold IRA Fees Versus Regular 401k/IRA Management Fees

The gold retirement calculators do not take into consideration management fees and other charges, which for a typical paper-asset based 401k or IRA tend to run from 0.5% to 5% depending on the level of holdings and services provided.

The gold retirement calculators do not take into consideration management fees and other charges, which for a typical paper-asset based 401k or IRA tend to run from 0.5% to 5% depending on the level of holdings and services provided.

Clearly these fees will have an impact on overall annual gains, especially if these gains are lower than the average 5%++

Gold IRAs or IRAs containing part of their investment basket in physical gold will also be subject to management fees and storage costs, however with the majority of our best-rated gold IRA providers these fees and costs are fixed, rather than percentage based, and typically total $80 – $250/year, with several leading companies charging zero set-up or storage fees.

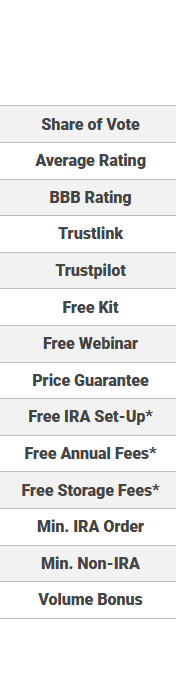

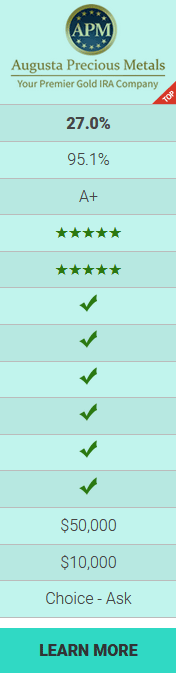

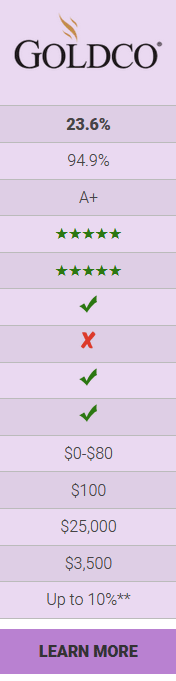

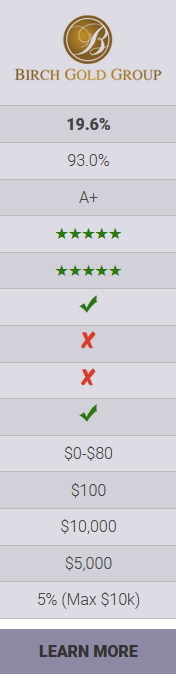

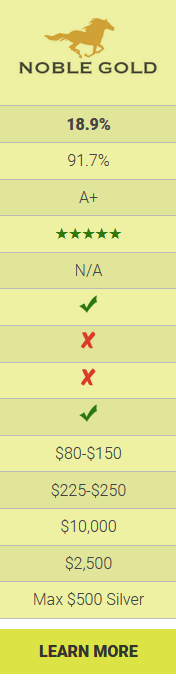

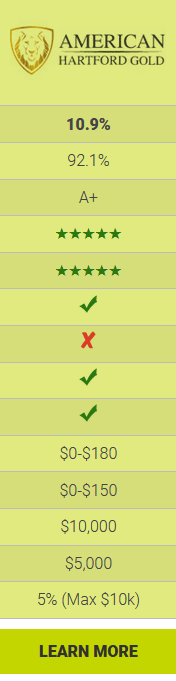

Bullion Dealer of the Year Winners Compared on Fees, Costs and Bonuses

The following table illustrates the low fees and sign-up bonuses that can be available to new investors with our current Bullion Dealers of the Year winners in the specialist Gold IRA category.

The following table illustrates the low fees and sign-up bonuses that can be available to new investors with our current Bullion Dealers of the Year winners in the specialist Gold IRA category.

As can be seen, annual fees and costs can be zero or significantly lower than regular percentage-based IRA charges seen across the whole market, meaning you keep more market gains where it matters – in your account!

Savings become even more apparent when considering bonus metals deals available as loss-leader incentives for new customers. These can range from $500 to $10,000 in bonuses depending on initial qualifying investment amounts.

*Free storage, free IRA set-up fees and free annual fees are available on qualifying accounts and under certain minimim order values – check with companies concerned

**Applies only to qualified orders with Goldco’s premium products. Get up to 5% back in FREE Silver when you invest $50,000 – $99,999. Get up to 10% in FREE Silver when you invest $100,000 or more. Cannot be combined with any other offer. Additional rules may apply.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.