…Euro on Weak US Jobs Data, ‘Too High’ in Rupees for Key Indian Festival

Bullion.Directory precious metals analysis 6 May, 2016

Bullion.Directory precious metals analysis 6 May, 2016

By Adrian Ash

Head of Research at Bullion Vault

Gold then slipped back, however, trading down to $1287 as silver retreated to $17.40 per ounce – down some 2.5% from last Friday.

The Bureau of Labor Statistics estimates that US non-farm payrolls expanded by just 160,000 in April, the fourth slowest monthly growth of the last two years.

The Euro also spiked versus the Dollar on the jobs news, regaining all of Thursday’s 1-cent drop only to give it back again as European stock markets extended their decline to worse than 1% for the day.

Ten-year US Treasury yields edged higher from an overnight drop, but headed for their lowest weekly close in a month at 1.75%.

US consumer prices were last seen rising at 1.1% annualized by government statisticians.

“A weak jobs release is more likely to boost the yellow metal,” said London bullion market-maker HSBC’s analyst James Steel ahead of Friday’s data, “[but] we sense the path of least resistance for gold is lower.

“Even if the jobs number is low and gold jumps higher, physical demand in Asia remains quite weak. The rally is heavily reliant on investor interest.”

Investors yesterday grew their shareholding in the SPDR Gold Trust (NYSEArca:GLD) to need a further 4 tonnes of bullion backing, taking the total to a new 2.5-year high at 829 tonnes even as gold prices slipped on the day.

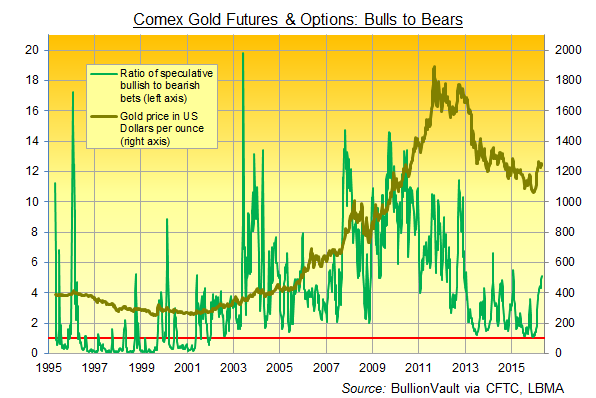

Last week’s data on trader positioning in US gold futures and options showed hedge funds and other speculative players trimming their net bullish position ahead of the Federal Reserve’s April meeting, when it held rates at the 0.5% level reached after 7 years at zero in December.

The ratio of speculators’ bullish to bearish bets, however, rose above 5:1 – a level seen in only 5 weekly positioning reports from regulator the CFTC since 2012.

Meantime in India – the world’s second-largest consumer market for gold in 2015, according to analysts Metals Focus – this weekend’s Hindu festival of Akshaya Tritiya finds jewelry retailers “expecting marginal growth in sales compared to last year,” says All India Gems & Jewellery Trade Federation chair Sreedhar GV.

“Prices are ruling very high” in Rupee terms, he said, up more than 11% from 3 months ago, while demand is being dented by “the present dry weather conditions in the country.”

Many analysts see a link between Indian gold demand and the level of monsoon rainfall, with the size of the earlier spring harvest also affecting rural incomes and therefore gold sales.

A note from Australia’s ANZ Bank meantime points to an extended “closed season” for Hindu weddings in summer 2016, with the Chaturmas period – when there are no auspicious days on the calendar – running right through May to October.

Over in China, the No.1 consumer market, Shanghai gold contract volumes held firm Friday as prices edged 0.3% lower overnight.

Shanghai’s new, separate Yuan gold benchmark price has, over the last week, averaged a premium of just 28 cents in US Dollar terms versus live quotes for London settlement.

That’s markedly nearer world prices than the $2.25 per ounce premium shown by the SGE’s main domestic gold contract over the last 18 months.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply