Gold Prices Firm After US Jobs Data, Fed Creeps Towards Unwinding $4t QE

Bullion.Directory precious metals analysis 06 April, 2017

Bullion.Directory precious metals analysis 06 April, 2017

By Adrian Ash

Head of Research at Bullion Vault

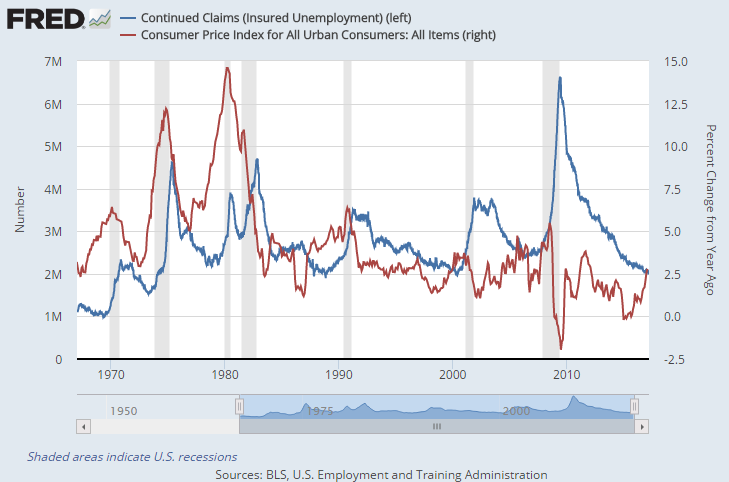

After the private-sector ADP report suggested tomorrow’s official non-farm payrolls estimate for March could beat Wall Street forecasts by 40%, new data today said the number of people claiming jobless benefits for the first timee fell again last week, extending the longest run below 300,000 since 1970.

With continuing claims back down to their 4-decade floor around 2 million, that looks like “full employment” according to the Reuters news agency.

The second half of the Fed’s mandate – targeting inflation at 2.0% per year – meantime rose above that level for the first time in 5 years at last count.

Notes from the Fed’s mid-March decision – when it voted to raise interest rates to a ceiling of 1.00% – said policymakers discussed various targets for starting to unwind the central bank’s quantitative easing program, begun when the financial crisis exploded in 2008.

Almost 4 years after gold prices sank at their fastest pace in three decades amid the ‘Taper Tantrum’ spurred by Fed hints about not adding any new QE to the near-$4 trillion done by 2013, “most participants anticipated that…a change to the Committee’s reinvestment policy would likely be appropriate later this year,” according to the March minutes.

“The number of years we’re thinking about just based on the arithmetic is something like 5 years,” said San Fran Fed President John Williams to reporters today, commenting on how long it might take to let the existing portfolio of QE-paid bonds to mature.

US stock markets slipped for the second day running and Treasury prices rose with commodities, nudging yields lower.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply