Gold Prices Drop after ‘Hawkish’ Fed Meeting as BoJ Continues Ultra-Easy Monetary Policy

Bullion.Directory precious metals analysis 21 September, 2017

Bullion.Directory precious metals analysis 21 September, 2017

By Atsuko Whitehouse

Head of Japanese Market at Bullion Vault

The Fed made no change to the 1.25% ceiling on its key interest rate, but Wednesday’s new forecasts repeated the committee’s view from June of one more hike to 1.50% before year-end.

The Dollar Index, measuring the US currency against a basket of other currencies, surged 0.5% as soon as the announcement was made Wednesday. The yield on 10-year Treasuries rose to 2.27 percent, reaching the highest in more than seven weeks on its fifth consecutive advance.

A December hike was already expected by the interest-rate market ahead of Wednesday’s decision, with betting on Fed Funds futures seeing a 62% probability.

Those odds rose above 70% as stocks and gold prices fell immediately after the announcement, jumping from the 37% possibility seen by interest-rate betting just a month ago.

“The lack of movement in the dot [plot] signals that the committee is still comfortable that the recent dip in inflation is a blip,” said Rob Carnell, Asia head of research at ING,in a note. The dot plot charts Fed members’ targets for future interest rates.

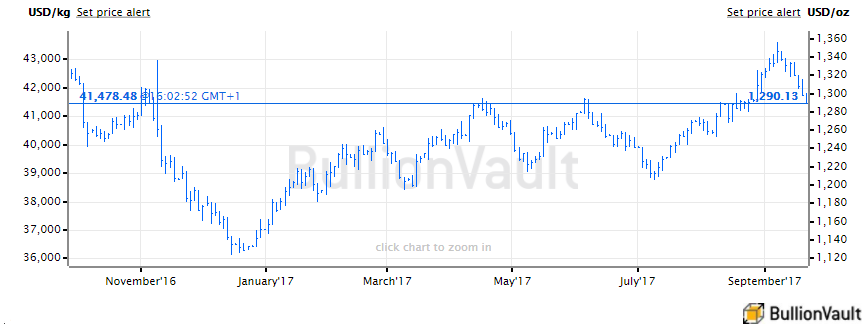

“In the bigger picture” for gold prices, said Jeffrey Halley, a senior market analyst at derivatives brokerage OANDA, “I still see the price action as corrective.

“It should base in this $1280-$1296 region. I see global uncertainty, diversification as continuing to underpin gold for now.”

Following the Fed’s decision, the Bank of Japan on Thursday left its policy unchanged, maintaining its bond-purchase plan at an annual pace of ¥80 trillion ($718bn) and keeping its short-term interest rate target at minus 0.1% and the 10-year government bond yield targeted around zero percent.

However, new board member Goushi Kataoka dissented from the BOJ’s decision to hold monetary policy unchanged, saying it is insufficient to push inflation in consumer prices up to the 2.0% annual target during fiscal-year 2019.

Back in April this year, Japan’s parliament replaced two members who had frequently dissented against the policy direction set by Governor Haruhiko Kuroda by nominating banker Hitoshi Suzuki and economist Goshi Kataoka to the Bank of Japan board.

“The nominations show Prime Minister Shinzo Abe wants the BOJ to continue the current reflationary stimulus program,” said Yasuhiro Takahashi, an economist at Nomura Securities Co.

The Japanese Yen fell 0.2% to 112.49 per Dollar on Thursday, hitting its weakest level in more than two months.

“While the BOJ meeting will highlight the US-Japan monetary policy divergence, the currency market is likely to take its policy decision in its stride,” said Ishizuki at Daiwa Securities.

The Nikkei stockmarket today ended 0.2% higher at its strongest level since mid-August 2015.

In Europe the Dax index of German equities gained 0.3% and France’s CAC 40 advanced 0.5% on the back of the Fed and BOJ decisions, plus a report about a possible merger between two of Europe’s largest banks, Germany’s Commerzbank and French lender BNP Paribas.

Silver fell harder than gold prices meantime, down 2.3% to $16.99 per oz after the Fed announcement.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply