Gold Prices ‘Close to Bottom’ as China GDP Slows, Trump Meets Putin, Comex Bulls Vanish’

Bullion.Directory precious metals analysis 16 July, 2018

Bullion.Directory precious metals analysis 16 July, 2018

By Steffen Grosshauser

European Operations Executive at Bullion Vault

After its biggest weekly rise in a month, the US Dollar fell 0.7% on the FX market versus its major peers.

Gold recovered $5 of last week’s $13 drop but remained range-bound close to Friday’s 7-month low at $1237 per ounce.

Asian shares fell along with the Chinese Yuan after data showed that GDP growth in the world’s second-largest economy slowed to 6.7% per year in the second quarter as the new US import tariffs hit.

Officials from the EU and China were set to hold talks today to discuss how to respond to the US tariffs.

“Higher US Dollar, looming trade war between the US and China, downward adjustment in Eurozone outlook and the slide in the Chinese Yuan have contributed to price weakness,” says a gold-price analysis from Dutch bank ABN Amro’s Georgette Boele.

But while Boele considers a further decrease to $1225 in Q3, she expects gold rise again to $1250 towards the end of the year.

“Weakness in precious metal prices is not over yet, but prices are close to the bottom.”

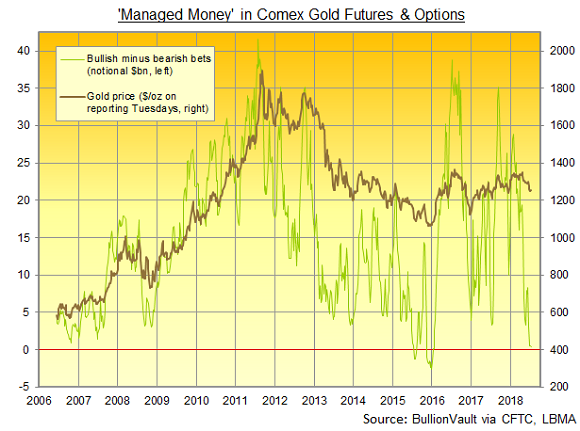

Hedge funds and other speculators trading Comex futures and options cut their net long position in gold by nearly 25% to a 2.5-year low in the week to 10 July, according to the latest data from US regulator the Commodity Futures Trading Commission (CFTC).

The size of the metal-backed SPDR Gold Trust (NYSEArca:GLD) last week shrank by 7.1 tonnes to 785 tonnes. Its holdings have not seen any inflows for 11 weeks.

Ahead of today’s meeting with Putin, Trump said he will do “just fine” when asked by journalists whether he would confront the former KGB agent over claims of meddling in the 2016 US presidential election.

“The Dollar has been traditionally a safe haven asset, and could be re-positioned as such especially if risk events and uncertainties continue to brew into the backdrop,” reckons Singapore-listed bank OCBC’s analyst Barnabas Gan.

Like gold, silver also stayed around last week’s close on Monday in London, trading at $15.81 per ounce after hitting a 7-month low at $15.73 on Thursday.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply