Gold Prices +1.1% for Week Even as Real US Rates Rise Amid Junk Bond Sell-Off, Saudi Tensions

Bullion.Directory precious metals analysis 10 November, 2017

Bullion.Directory precious metals analysis 10 November, 2017

By Adrian Ash

Head of Research at Bullion Vault

Silver held the same weekly gain at $17.02 per ounce, while platinum prices traded 1.7% higher from last Friday above $936.

Crude oil held near this week’s 2-year highs as France’s president Emmanuel Macron made an unscheduled visit to Saudi Arabia, which has now — amid the “purge” of new crown prince Mohammed Bin Salman’s rivals — ordered its citizens to leave Lebanon, suggesting an attack against Iran-backed Hezbollah may be imminent.

The Euro touched 1-week highs above $1.1660 on the FX market, cutting gold’s weekly gain for Eurozone investors to 0.9% after it reached the highest price since mid-September on Wednesday at EUR 1110 per ounce.

Betting on next month’s Federal Reserve decision on US interest rates meantime sees zero chance of “no change” — down from a likelihood of 12.2% this time last month — with the consensus continuing to expect a 0.25 point rise in rates to a ceiling of 1.50% on 13 December.

The likelihood of a shock 0.5 percentage point hike however — up to a ceiling of 1.75% — has jumped from zero to 8.5% according to the CME’s FedWatch tool.

“Based on the previous relationship between the price of gold and expectations for US interest rates,” said a report last week from UK consultancy Capital Economics, “the yellow metal is set for a big fall.”

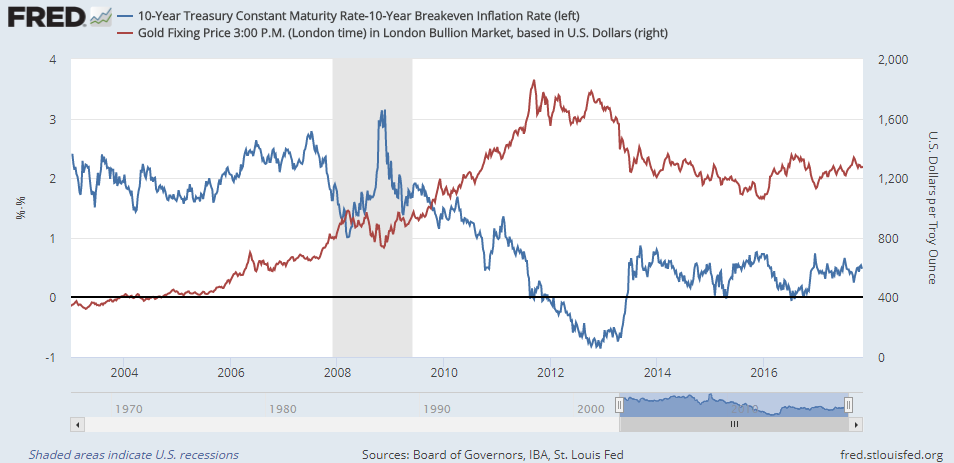

“[But] gold [is currently] ignoring a slight firming in US real 10-year rates,” notes John Reade, chief market strategist at the mining-backed World Gold Council.

Adjusting for market-based inflation expectations, 10-year US Treasury bond yields have shown a strong inverse relationship with Dollar gold prices over the last 15 years, reaching a record strong 5-week average of rolling 5-week correlations at -0.963 this time last month.

With 10-year US Treasury yields rising from 2.34% to 2.37% this week, borrowing costs for lowly-rated US corporate borrowers have risen more sharply still, reports the Financial Times.

The price of so-called “junk bonds” fell yesterday to 7-month lows as tracked by trust-fund ETF investment products.

“Looking like JNK was right. Per usual,” said fund manager Jeff Gundlach of $109bn asset managers Doubleline yesterday, answering his own earlier tweet asking how the junk-bond ETF could drop in price 6 days in a row while the S&P500 index of US equities rose 5 times to yet another all-time record high.

“We absolutely do have concerns over Asia junk bonds,” Bloomberg today quotes ANZ Bank credit strategist Owen Gallimore in Singapore, also pointing to the sell-off in sub-investment grade US debt.

“We are underweight Asia high yield as valuations look frothy.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply