Gold Price Support Resistance Next Week (1-5-2015)

Bullion.Directory precious metals analysis 5 January, 2015

Bullion.Directory precious metals analysis 5 January, 2015

By Terry Kinder

Investor, Technical Analyst

Gold Price Support Resistance Next Week (1-5-2015): Gold appears poised to make another run at the $1,200.00 level this week. Image: pixabay

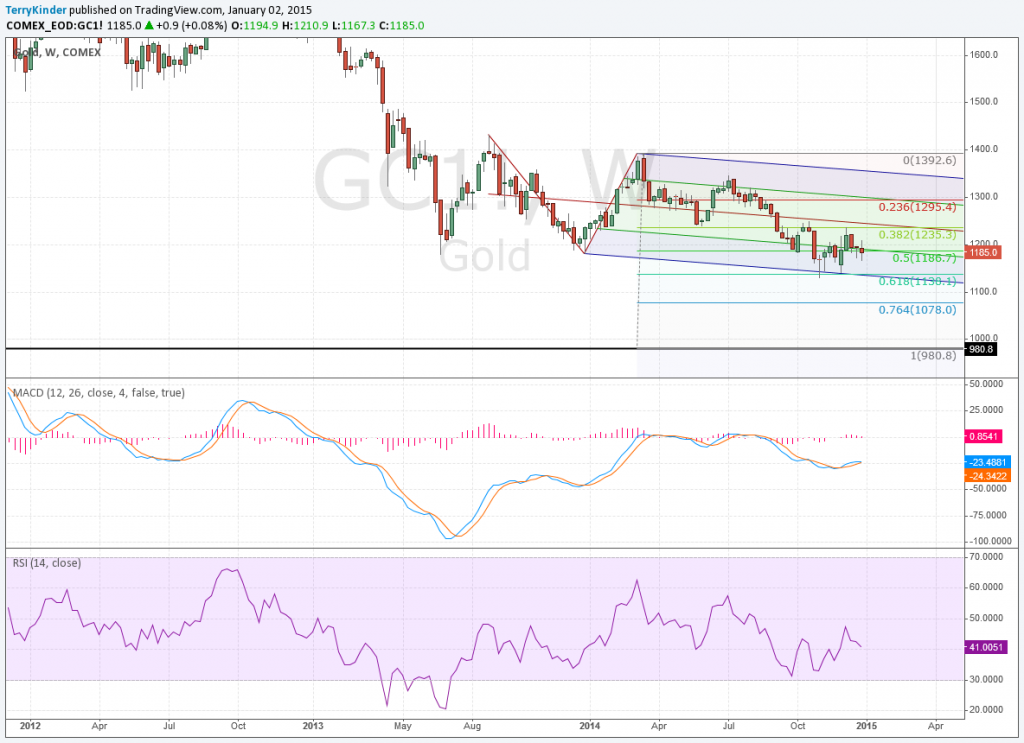

Chart: Gold Price Support Resistance Next Week (1-1-2015):

Gold Price Support Resistance Next Week: Gold spent most of 2014 in a shallow decline as indicated by the Schiff Pitchfork. Price has bounced off the bottom of the pitchfork. The gold price is slightly out of oversold territory as indicated by the Hurst Bands at B. We’ll have a better idea of the strength of the gold price as it approaches the pitchfork midline at A. It it touches the midline and moves lower, that indicates price weakness. If it can push through the midline and head to the upper parallel line that would be a sign of strength.

A few points worth noting from the Gold Price Support Resistance Next Week (1-5-2015) chart:

1. The gold price starts this week less than $10.00 above the critical $1,186.70, or 0.50 Fibonacci Retracment level;

2. Euro Gold Divergence, as highlighted by Tom McClellan of the McClellan Market Report could point to a higher gold price as the divergence in the euro priced in dollars and gold priced in dollars resolves in favor of the gold price;

3. The Hurst Oscillator and KDJ indicators have bounced off fairly low levels which may indicate the gold price could move off of oversold levels;

4. The gold price has bounced several times off of the bottom of the Schiff Pitchfork. While the price action has been a bit weak, price has managed to stay within the pitchfork rather than falling through the bottom parallel line.

Gold Price Support Resistance Next Week: At some point the gold price should move back toward the median line around $1,235.30. However, unless the trend changes, the gold price is likely to be bound in between around $1,120.00 and $1,350.00 until the end of March.

The above gold price support resistance next week chart shows a Schiff Pitchfork which was used in place of an Andrews’ Pitchfork in order to reflect the more shallow nature of the price action. As you can see, the gold price has remained within a descending pitchfork for most of 2014 and into 2015. If price continues within the pitchfork, it could range from around $1,120.00 to a little over $1,350.00 until the end of March.

Key Gold Price Support Resistance Next Week (1-5-15) levels to watch:

Downside –

Upside –

Should the gold price support resistance next week price manage to move above $1,200.00 this week, then the next resistance points it would encounter are $1,212.26 and $1,235.30. I suspect fairly stiff resistance could be enountered at $1,235.30.

Over the medium to long-term, expect the U.S. Dollar Index (DXY) to exert downward pressure on the gold price. In the short-term we could see the U.S. Dollar and gold both move up at the same time.

While I expect the gold price will come under pressure this year, both owing to Martin Armstrong’s forecast, and the fact that the gold price remains within a pitchfork with a downward price bias, it wouldn’t be too surprising if gold made another run above $1,200.00 this week. The gold price has a pretty wide range it can run within the pitchfork, but over the medium to long-term expect the gold price to move generally lower unless price can break and maintain above the upper parallel line of the pitchfork.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.