‘Soft Brexit’ Row Sees Sterling Rise, Gold Price in Pounds Near 6-Week Low as Eurozone GDP Hits 10-Year Best

Bullion.Directory precious metals analysis 30 January, 2018

Bullion.Directory precious metals analysis 30 January, 2018

By Adrian Ash

Head of Research at Bullion Vault

With 3 weeks until Chinese New Year – now the heaviest single period for household gold demand worldwide, beating India’s Diwali in recent years – wholesale gold prices in Shanghai held at a $8.40 premium to London quotes.

Rising from this month’s average so far, that was slightly below the typical incentive offered to new bullion imports into the world’s No.1 consumer nation.

“We continue to see interest on dips,” says a note on Asian trading from Swiss refiners MKS Pamp.

“However should further weakness become evident we are likely to stretch long [speculative] positioning and could see an extension [down] toward $1325 or even $1315.”

>The Euro steadied around $1.24, more than a cent below last week’s new 3-year highs against the Dollar, even as new economic data said the 19-nation currency bloc expanded at the fastest pace in a decade in 2017, beating both the US and UK with annual GDP growth of 2.5%.

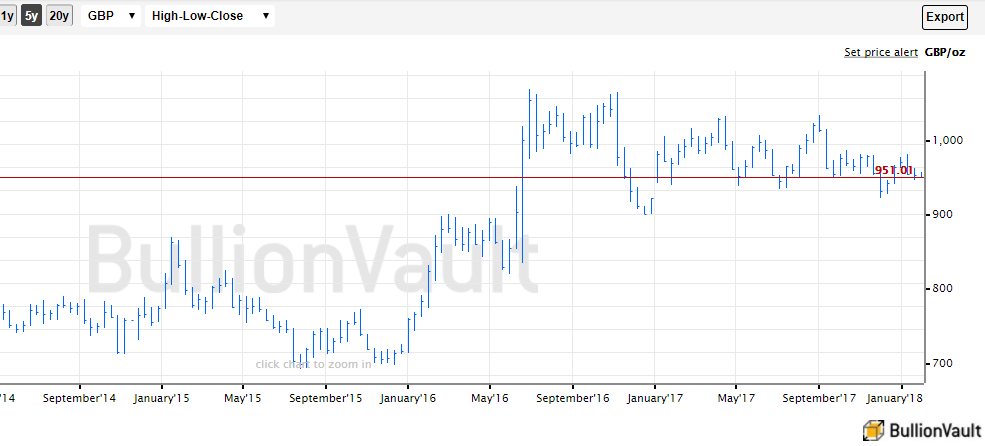

The UK gold price in Pounds per ounce meantime dipped briefly beneath £950, the 5-week low reached last Thursday, as Sterling rose further on an apparent shift towards a “soft Brexit” amongst lawmakers tasked with implementing mid-2016’s narrow referendum decision to leave the European Union.

For US Dollar gold prices “Resistance remains unchanged at $1267.30, the Aug 2017 High,” says the latest technical analysis from Canada’s Scotia Bank.

“Support is at $1329…[Momentum] is marginally bullish and remain biased to the upside.”

With a transition to Brexit scheduled to begin in March 2019, Prime Minister Theresa May’s proposed Bill for exiting the EU was today challenged in the upper chamber House of Lords, where pro-Remain Liberal Democrat Lord Newby said it “exhibits the arrogance and incompetence of the Government in equal measure”.

But he also said the Lib Dems have no plans to block the Bill or of “unnecessarily spinning out debate”.

A day after the EU’s General Affairs Council in Brussels took just 2 minutes to approve a post-Brexit deal giving the UK a “status quo transition without institutional representation” from March 2019 to end-December 2020 – widely called terms imposed on a “vassal state” today – news-site Buzzfeed today published details of an internal British government report saying that UK economic growth will suffer in any Brexit scenario, whether 2% lower over 15 years under a “soft Brexit”, 5% lower if a free-trade agreement is reached, or 8% lower under a “hard Brexit” default to World Trade Organization (WTO) rules for trading with its current EU partners.

British tabloid The Sun meantime published an interview with arch-Brexit lawmaker and current Government Trade Secretary Liam Fox calling for only “modest changes” in the UK’s long-term trading relationship with the rest of Europe.

Variously reported as “live with disappointment” and “LET REMAINERS WIN” by other British tabloids, Fox’s comments had been “misrepresented” he later said, urging that “We must be confident, positive and optimistic.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply