But Both Rise as US Non-Farms Jobs Miss Forecasts

Bullion.Directory precious metals analysis 02 September, 2016

Bullion.Directory precious metals analysis 02 September, 2016

By Adrian Ash

Head of Research at Bullion Vault

Betting on a US Fed hike from 0.50% to 0.75% at the Fed’s 21 September meeting fell from 1-in-4 to almost 1-in-5 after the Bureau of Labor Statistics estimated only a net 151,000 jobs were added to non-farm payrolls in the world’s No.1 economy in August, sharply below Wall Street’s 180,000 forecast.

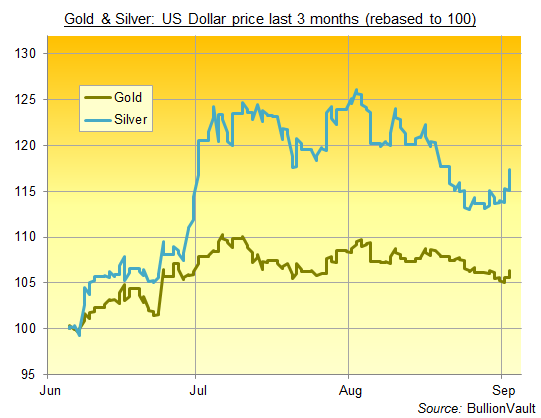

Gold erased the last of this week’s earlier 1.5% investing losses in Dollar terms as the US currency fell on the forex market, and also got back to last Friday’s finish against the Euro, Swiss Franc, Canadian and Australian Dollars.

US stock markets gained – with European shares rising 1.7% from last Friday – as did government bond prices and commodities.

Crude oil bounced 2% but still headed for a weekly loss of 8%.

Silver bullion jumped ahead of gold investing prices following the US jobs data, regaining the last 2 weeks of losses at $19.25 per ounce.

“Thursday’s data led price recovery [looked] promising for gold,” said the trading desk at Swiss refiners MKS Pamp overnight, with yesterday’s larger than expected US jobless benefits claims figure providing a “catalyst” for gold’s rebound from new 2-month lows.

“[But] the weak ISM [manufacturing] data was the key protagonist.”

“US economic growth is weak yet the labour market is tight,” writes French investment bank strategist Albert Edwards – a “juxtaposition [now] keeping the Fed in a quandary on whether to raise interest rates.

“Only the US consumer is keeping the economy out of recession…Business investment’s contribution to GDP [is] now consistent with recession.”

“Correlation over the last 60 sessions between Comex Gold contracts and the S&P500 stock index is minus 0.61,” writes Yuichi Ikemizu, branch manager for ICBC Standard Bank’s Tokyo office – “a very strong inverse correlation…the strongest of the past 10 years.”

A perfectly positive correlation, with two prices moving together in lockstep, would read +1.0, while a reading of -1.0 would signal a perfectly inverse relationship.

“If we have both gold and stocks in a portfolio,” says Ikemizu, “you will get better risk rewards than a portfolio with just stocks…Given this strong negative correlation between the two assets, there is a good reason to hold gold in a portfolio.

“That is why many investors are buying gold this year.”

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply