Gold Hits 5-Month Low in GBP Ahead of UK Vote, ‘De-Dollarization’ to Support 2020 Prices

Bullion.Directory precious metals analysis 10 December, 2019

Bullion.Directory precious metals analysis 10 December, 2019

By Adrian Ash

Head of Research at Bullion Vault

Dollar gold prices touched $1467 per ounce as the US currency fell versus the Euro after a stronger-than-expected Eurozone investor sentiment survey.

With the US and China apparently ” working to delay” the imposition of new trade tariffs on each other’s imports scheduled for Sunday, “The deadline of December 15 is certainly top of everyone’s mind,” Reuters quotes Canadian brokerage TD Securities’ commodity strategist Daniel Ghali, “helping gold stay firm.”

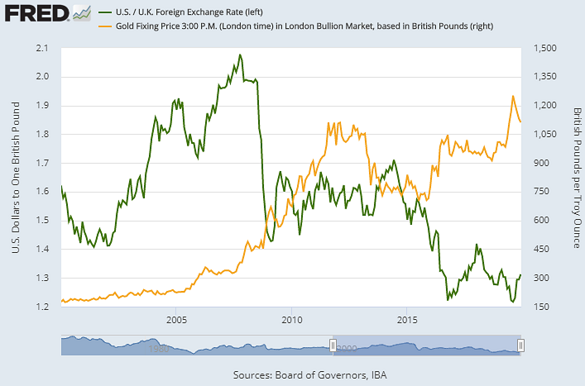

Gold priced outside the Dollar was less solid, however, struggling to regain late November levels in most currencies and rallying only £5 per ounce for UK investors from yesterday’s new 5-month lows.

The Pound today touched its highest level on the FX market since March vs. the Dollar and since February 2017 against the Euro.

That helped cap the UK gold price in Pounds per ounce at £1113, down by more than one-eighth from its peak after likely election winner and pro-Brexit campaigner Boris Johnson took over from Theresa May as Prime Minister this summer.

“De-dollarization” by emerging-market central banks will help drive gold prices higher in 2020 reckons US investment bank and London bullion market-maker Goldman Sachs’ Jeff Currie, also pointing to “late-cycle concerns” over the global economy plus “heightened political uncertainty” as boosting investment demand.

“Demand from central banks for gold is biggest since the Nixon era,” he told Bloomberg Monday, “eating up 20% of global supply. I am going to like gold better than bonds because the bonds won’t reflect that de-dollarization.”

European government bond prices slipped Tuesday, but US debt edged higher, pushing 10-year yields down to 1.81% – a 33-month low when reached in August.

New data from world No.3 economy Japan meantime orders for machine-tools sank 37.9% from 12 months before in October, the fastest annual drop since the global economic slump of 2009, falling to their lowest Yen value since New Year 2013.

The UK’s economic growth has also hit a 2009 low, the Office for National Statistics said today, with GDP showing 0.0% change in the 3 months to October, supported by the services sector as construction and industry both shrank.

Johnson’s Conservative Party vows to “get Brexit done” at the end of next month if re-elected on Thursday.

New data from China meantime said consumer-price inflation in the world’s No.2 economy hit an 8-year high of 4.5% in November thanks to soaring costs for pork as Asian swine fever continues to hit the region’s livestock.

“The implication for gold is negative,” says analyst Rhona O’Connell at brokerage INTL FCStone, because the higher cost of living will crimp discretionary spending.

Against that, top-end luxury goods sales are holding firm and China’s consumer confidence index “is actually relatively robust” she adds, holding less than 1.5% below this year’s new all-time highs on the National Bureau of Statistics’ index.

With Chinese New Year set to bring peak household demand in late-January, “Jewelry wholesalers are looking to clear inventory,” O’Connell adds, “so there is a degree of discounting that is helping [current gold] demand to some extent.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply