…But Asian Demand Poor as Dollar Up, US Fed ‘Should Hike’

Bullion.Directory precious metals analysis 13 May, 2016

Bullion.Directory precious metals analysis 13 May, 2016

By Adrian Ash

Head of Research at Bullion Vault

Heading for a 1.3% week on week drop against the Dollar, gold bullion fared better against all other major currencies except the Swiss Franc.

Losing 0.8% from last Friday’s finish against the Euro, investment gold in wholesale bars traded unchanged vs. the Australian Dollar, and rose slightly vs. the Japanese Yen.

Japanese shares, however, rose 1.9% for the week on the Nikkei index.

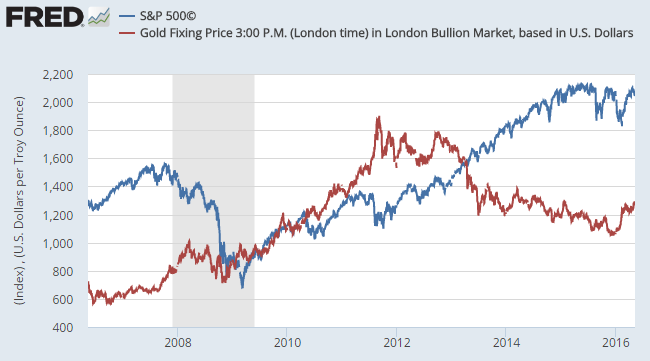

New York’s S&P index headed for a slight weekly drop, trading flat from the end of 2015.

Gold bullion, in contrast, has gained 20% versus the US Dollar so far in 2016.

“The market remains too pessimistic about the fundamental strength of the US economy,” said Federal Reserve voting member Eric Rosengren in a speech overnight.

“[Should] the economic data confirm these trends,” he went on, “it will be appropriate to continue the gradual normalization of monetary policy” following the US central bank’s first hike to 0.0% interest rates in 7 years last December.

“If market thinking moves closer to Mr.Rosengen’s scenario,” says a note from global retail, investment and London bullion bank HSBC, “gold prices may weaken.”

“I’m not a gold bug. I don’t think the world is coming to an end. But I do think inflation is beginning to pick up,” said US trader and newsletter publisher Dennis Gartman to CNBC, “turning fundamentally bullish” on gold in Dollar terms.

“It’s time to sell the dollar like it’s going out of style,” says US finance website MarketWatch.

“[Now] jewellery demand, which is generally regarded as more stable, should pick up again,” says Commerzbank, “meaning that the gold price should be well-supported in the medium term.”

Gold jewelry demand from top two consumer nations China and India collapsed by more than 27% in Q1 from the same period last year, the World Gold Council’s data said Thursday.

“As a Chinese tradition, gold jewelry sets are used for weddings,” the China Daily today quotes World Gold Council manager Wang Lixin, “but for younger generations, I’m not sure whether they would like to keep that tradition.

“They prefer jewelry that can represent themselves, something customized and personalized” which typically means lower caratage than the 0.999 fine Chuk Kam standard.

While India’s monsoon rains are now forecast to reach all parts of the sub-continent by July, the recent drought, plus two consecutive years of poor monsoon rains, are estimated to have cost the economy INR 650,000 crore (US$97 billion) according to a new study from Assocham (Association of Chambers of Commerce).

“The lack of strong physical demand in Asia right now,” wrote Japanese conglomerate Mitsubishi’s strategist Jonathan Butler this week, “[plus] perhaps overly bullish investor positioning, puts gold in danger of a short term correction or at least a period of consolidation.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply