Gold Price Drops Near ‘Key USD 1300 Level’ But Firm in EUR and GBP as UK Data Worsen

Bullion.Directory precious metals analysis 01 May, 2018

Bullion.Directory precious metals analysis 01 May, 2018

By Adrian Ash

Head of Research at Bullion Vault

With China and most European financial markets shut for May Day, gold fell 0.4% to $1308 per ounce as the Dollar rose on the currency market.

Sales of new American Eagle gold coins last month fell to their lowest monthly level since before the financial crisis began in 2007, data from the US Mint show.

Interest in gold among larger private investors also fell again, according to data from BullionVault, with the number of both first-time and repeat buyers dropping to the smallest size since gold prices hit their bear-market lows at end-2015.

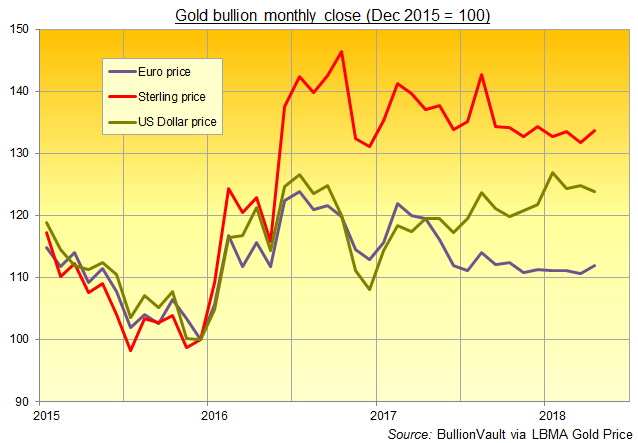

Dropping 0.8% across last month, gold ended April with its lowest monthly finish of 2018 so far in Dollar terms at $1313.20 per ounce.

Priced in British Pounds in contrast, gold ended April with its highest monthly close since December.

In Euro terms, gold set its highest monthly finish since October.

“Support-wise, we are nearing some key technical levels,” says today’s trading note from Swiss refiners MKS Pamp, “with the 200-[day moving average] at $1304 and the psychological $1300 level below that.”

“I remain bearish on gold,” says technical analyst Russell Browne at bullion bank Scotia Mocatta’s New York office, ” targeting 1304.30 – the 200 Day MA.”

Those Asian and European stock markets open on Tuesday ticked higher, with London’s FTSE100 index of primarily global corporations adding 0.5% to new 3-month highs.

The British Pound in contrast fell again after worse-than-expected UK economic data, extending its drop from mid-April’s near 2-year highs against the Dollar to 5.0%.

Defeated in the UK’s unelected House of Lords yesterday over a key plank of her 2019 Brexit plans, Prime Minister Theresa May – forced to replace her Interior Minister on Monday in a row over immigration policy – vowed a “robust response” to avoid having to give the elected House of Commons a final say on Britain’s deal with the European Union.

After US data on personal incomes, spending and living costs came in below analyst forecasts for March on Monday, new UK data today showed consumers borrowing much less that month, with a surprise fall in the number of home loans.

Manufacturing activity in the UK last month slipped to its slowest in 17 months according to the Markit agency’s latest PMI survey.

Commodity prices slipped once more on Tuesday, with Brent crude oil again finding a floor near $74.50 per barrel, while major government bonds held little changed.

The theocratic regime in Tehran today called Israel’s Prime Minister Benjamin Netanyahu a “notorious liar” over his claims that Iran has continued and hidden its nuclear research program despite the 2015 deal enabling the No.5 oil-producing nation to re-start exports.

US President Donald Trump must decide by May 12 whether to extend that deal or revoke it, triggering economic and political sanctions against Iran.

UK Trade Secretary Liam Fox today said he welcomes an extension of negotiations around Trump’s tariffs on metals imports into the US, calling it “a breathing space” for the UK‘s small sales of aluminum and steel.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply