World stock markets fell once again, and the US Dollar slipped from its highest FX rate versus the Yen in more than a week, also touching a fresh 9-month low versus the Euro.

Bullion.Directory precious metals analysis 4 May, 2016

Bullion.Directory precious metals analysis 4 May, 2016

By Adrian Ash

Head of Research at Bullion Vault

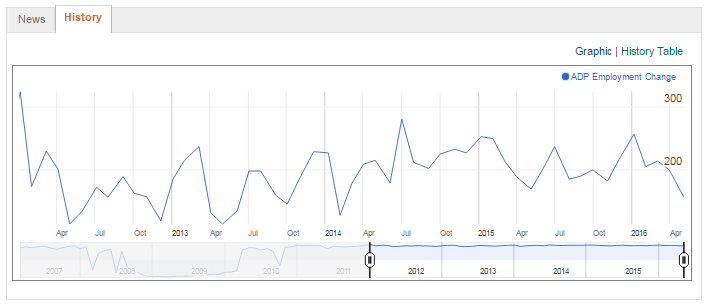

That drove the price of gold bullion for Eurozone investors down to €1110 per ounce – a level first seen in mid-February during this 2016 upturn – until popping 0.8% higher after the US employment data from private-sector payrolls provider ADP missed analyst forecasts of 196,000 net jobs with the lowest figure in 26 months at just 156,000.

Silver meantime extended the drop in gold bullion prices, falling near 1-week lows beneath $17.20 per ounce to drop almost 5% from Monday’s 16-month top, before jumping to $17.40 on the US jobs news.

“The signals that the gold rally has gone too far too quickly [have] increased in number and intensity,” says analyst Tom Kendall at Chinese-owned commodities bank, bullion market-maker and London benchmark participant ICBC Standard Bank.

Kendall points to a surge in demand for bullish options contracts, a widening premium for August futures over June, and a bump to $2 per ounce in exchange for physical contracts – all on a new 6-year high in total open interest in Comex gold derivatives.

“At the same time,” ICBC Standard Bank’s analyst adds, “another project-related [gold miner] hedge…was executed” to sell future production at today’s Canadian Dollar price, currently 15% higher from a year ago.

Gold miner hedging rose to 2009 levels in the first quarter of 2016, according to specialist analysts Thomson Reuters GFMS.

Amongst investors and speculators, “The market is very long,” agrees London brokerage Marex Spectron’s David Govett, also noting “profit taking and some light [gold mine] producer selling” on Tuesday’s failure to hold above $1300 per ounce.

“Without fresh stimulus…[gold] is going to find it hard to continue on its upward trajectory.”

Looking at the key Asian consumer nations, “The Indian market remains very subdued,” Kendall concludes, “and the Shanghai arb has dropped below $2.00.”

Today’s Shanghai Gold Price saw China’s new benchmark rally from a discount to comparable London quotes, fixing some $2.35 per ounce higher than international prices at the afternoon auction.

But the rising gold price will “smother” demand from India, says Bloomberg, with gold bullion imports already two-thirds lower last month from April 2015 according to Indian government-Swiss refiner joint-venture MMTC Pamp, down below 20 tonnes.

“Jewellers [are] betting on Akshaya Tritiya sales to clear piled up inventory,” says the Economic Times of India, quoting various industry forecasts for perhaps 2-3% growth from the same Hindu spring festival last year down to a possible decline of 15-20%.

“This year, Akshaya Tritiya falls on Monday [9 May],” says trade-body the IBJA’s vice-president Saurabh Gadgil. “So, we are getting a full weekend and sales will definitely pick up.”

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply