Gold Bars Flood into GLD as Odds of Fed Rate-Rise Fade, Beijing’s Demand Weak as China’s FX Reserves Shrink

Bullion.Directory precious metals analysis 07 September, 2016

Bullion.Directory precious metals analysis 07 September, 2016

By Adrian Ash

Head of Research at Bullion Vault

Service-sector activity in the US suddenly slowed last month to its weakest level in more than 6 years, the private-sector ISM report said Tuesday, with the New Orders Index registering a plunge of 8.9 percentage points.

Regaining an overnight break above $1350 per ounce, prices for wholesale gold bars showed their fastest week-over-week rise since the Dollar price peak of early July at 3.2% this morning, as Asian shares closed lower but European equities rose.

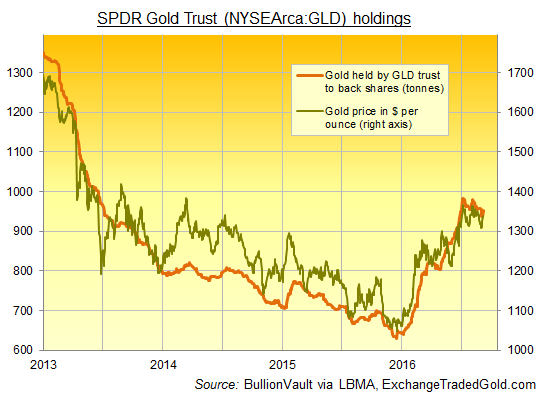

Investor demand for gold-tracking ETF the SPDR Gold Trust (NYSEArca:GLD) yesterday returned from the US Labor Day holiday to need an extra 14.2 tonnes, the heaviest 1-day inflow since immediately after the Independence Day holiday on 4th July.

That took the GLD’s total holdings of London Good Delivery gold bars – vaulted at HSBC bank in London and needed to back the trust’s stockmarket shares in issue – to a 1-week high of 953 tonnes.

“No matter the exact timing of the next rate hike, we believe safe-haven demand from investors should fade as growth risks are receding,” reckons a note on gold prices from Swiss private bank Julius Baer’s wealth management division.

Besides its belief that the US Fed will hike rates and push the Dollar higher, Julius Baer says that 2016’s gold gains mean the metal’s “insurance benefits [now] come at a price.

“We would refrain from adding it to the portfolio at the current point in time.”

Betting on a US Fed rate hike at the September meeting in 2 weeks’ time today put the odds at less than 1-in-7, sharply down from last week’s 1-in-4 peak.

10-year US Treasury bond yields fell Wednesday towards 4-week lows at 1.52%.

The Chinese Yuan meantime rallied from near 6-year lows to the falling Dollar despite new data saying Beijing’s total foreign exchange reserves shrank 0.5% in August to a 5-year low of $3.2 trillion.

The People’s Bank meantime grew China’s state gold reserves by less than 5 tonnes in August – markedly below both the last year’s average 13.7-tonne monthly addition and the previous 6 years’ average 8.4 tonnes per month – as gold bullion bar prices averaged new 3-year highs at $1341 per ounce.

That still took China’s total gold bar reserves to a new record 1,833.5 tonnes – the 5th largest national hoard behind France, Italy, Germany and the United States.

Shanghai’s benchmark gold price today fixed at ¥290 per gram, offering importers only a modest premium above wholesale London gold bar prices of $1.50 per ounce, down from the recent $2.50 average.

Silver prices today tracked and extended the move in gold bullion bars, touching $20 per ounce for the first time since mid-August and gaining 8.7% from last week’s 2-month lows.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply