Gold Prices Hold $10 Drop vs Dollar as What the Fed ‘Omits’ Spooks Traders

Bullion.Directory precious metals analysis 28 November, 2018

Bullion.Directory precious metals analysis 28 November, 2018

By Adrian Ash

Head of Research at Bullion Vault

Also seeing inflation around 2%, Clarida’s outlook would meet the Fed’s dual mandate for growth and price-stability.

Betting on a December and then January interest-rate hike firmed in the futures market and the Dollar rose back near November’s 18-month high against other currencies.

That helped curb the drop in gold prices to 0.6% for UK investors at £948 with no change for Euro investors at €1076 per ounce.

“This will become the longest US expansion in recorded history if, as I expect, [it] continues in 2019,” Clarida said in New York on Tuesday.

In contrast to short-term rates, longer-term US bond yields were unchanged after his comments, leaving 10-year Treasury rates at 3.06% – some 18 basis points below this month’s rise to the highest cost of borrowing since mid-2011.

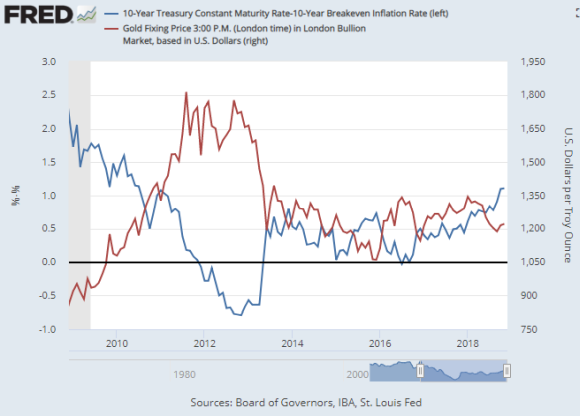

Gold prices have in 2018 broken what had become a strong inverse relationship with 10-year yields adjusted for 10-year inflation expectations.

Compared to his last speech, Clarida this time ” omitted” the word ‘some’ when saying again that “gradual policy normalization” is needed, says Bloomberg, spurring uncertainty for economists over whether the Fed is looking to pause or not after December’s rise.

“[Clarida also] omitted saying further rate hikes are likely appropriate,” notes CNBC anchor Steve Liesman, as well as omitting to say “Policy is still accommodative” and adding the word “just” to describing how the real inflation-adjusted policy rate remains “below neutral”.

Gold market traders have now “priced in” 10 of the 12 Fed interest rate hikes which Goldman Sachs expects will mark the end of the cycle starting end-2015, the investment bank said earlier this week.

“If US growth slows down next year, as expected, gold would benefit from higher demand for defensive assets,” Goldman’s analysts went on, calling current prices in commodities, oil and gold “[an] extremely attractive entry point”.

For 2019 “we are generally bullish on commodities,” agrees French investment bank Natixis, “mainly because we expect that a weaker Dollar and Chinese stimulus will help support demand.

“People are becoming a bit more worried about the Dollar,” adds Dutch bank ING’s Warren Patterson

“As we start seeing slowing growth in the US, we might see an upside in gold.”

Platinum and silver today joined Dollar gold prices near 2-week lows, falling to $830 and $14.10 per ounce respectively.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply