Draghi has a “can do” attitude towards QE.

Bullion.Directory precious metals analysis 1 November, 2015

Bullion.Directory precious metals analysis 1 November, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Twitter @Lemieux_26

Quantitative easing is superfluous throughout the world, whether it is out right asset purchases or manipulation of interest rates. However, despite central banks – from big to small – indulging in emergency measures, nothing is working.

The Federal Reserve’s massive bond buying program may have taken a pause, but its zero interest rate policy (ZIRP) is alive and not well. With Fed Chair Janet Yellen backed into a corner, due to her predecessor’s failings, she must resort to mind games: telling market participants that a rate hike is nearing each month but acknowledges that the economic data does not support this.

The Bank of Japan’s quantitative easing program dwarfed the Fed’s, yet the chronically deflationary country has had multiple recessions since Prime Minister Shinzo Abe has held office. Abe and the BoJ’s policies have miserably failed to the point that the central bank had to prop markets up via direct stock purchases, which the BoJ owns over 52 percent of the Japanese exchange-traded fund (ETF) market (because the outright financing of deficit spending was not enough).

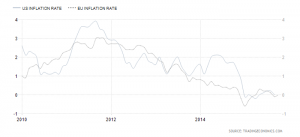

The European Central Bank (ECB) finally delivered its much anticipated QE program earlier this year, and, as I said when rumors of the program made traders’ mouths water, has not achieved what it intended. The program has pushed a record amount of sovereign debt into negative yielding territory, but both growth and inflation has flat lined. What’s even more troubling is that the strongest economy in the eurozone, Germany, is cracking.

However, the most skilled of central bank rhetoricians, ECB President Mario Draghi, pledges to do more QE to push inflation higher. During an interview with Italian paper daily Il Sole 24 Ore, Draghi said “if we are convinced that our medium-term inflation target is at risk, we will take the necessary actions.”

The four major central banks (The Fed, BoJ, ECB and Bank of England) have all implemented drastic cuts to their key interest rates, which have remained in place since the financial crisis. All four banks assumed that such policies would agitate and hold inflation closer to their collective two-percent target. Has not happened, and it will not happen. To add insult to injury, the University of Michigan’s U.S. inflation expectations going out five to 10 years hit an all-time low.

Draghi said the ECB has an extensive set of monetary policy instruments at its disposal. Let’s be very clear: the only tools central banks have are asset purchases and interest rate manipulation; and neither have worked.

The euro will likely be influenced by the perceived divergence in central bank policy between the Fed and the ECB, but it could be tough for Draghi to talk the euro down as he has in the past.

Gold priced in euros could be ready to move higher heading into the December FOMC meeting. The ECB is unlikely to add stimulus before than, and as long as traders believe the Fed will hike, gold can see some upside.

To note, Draghi may be catching on. “Global growth forecasts have been revised downwards. This slowdown is probably no temporary,” he said (Reuters). After all, it only took the St. Louis Fed seven years – and over $3 trillion – to figure out Ben Bernanke’s QE-crusade was nothing but a pipe dream.

But, they say it’s different this time.

Analysis on XAUEUR (gold priced in euros) will be available shortly.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply