Americans may start the New Year without certainty as to who will be sworn in as president on Inauguration Day

![]() Bullion.Directory precious metals analysis 14 December, 2020

Bullion.Directory precious metals analysis 14 December, 2020

By Clint Siegner

Director of Money Metals Exchange

The battle continues in the courts and in the swing state legislatures.

The election isn’t the only issue dividing Americans. The response to the COVID-19 pandemic also has people at odds.

Some argue government health authorities should be dutifully followed – and we must submit to restrictions in order to keep hospitals from being overwhelmed.

Others are more concerned about the loss of personal liberty and see evidence lockdowns carry hideous economic and psychological costs while not meaningfully reducing the spread.

This is the sociopolitical backdrop as markets enter 2021. That doesn’t sound like a “risk on” environment.

Nevertheless, stock markets will start the year with valuations at, or near, all-time highs. That is, unless the wheels come off in the last half of December.

The equity markets appear just as broken as the COMEX when it comes to pricing stocks based on fundamentals.

Bullion investors should keep a close eye on the equity markets. If the bubble pops there, it will drive safe-haven buying for coins, rounds, and bars. The spike in demand earlier this year may have only been a preview.

Another fundamental driver to watch is the explosion in negative yielding debt. Last week, a record $17.5 trillion in bonds yielded less than zero percent in nominal terms. That makes zero yield gold and silver bars relatively more attractive to investors looking for security.

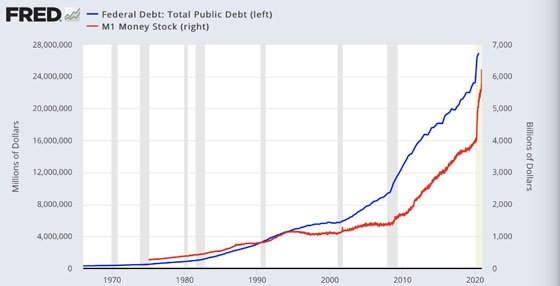

The M1 money supply quadrupled over the past decade. That freshly printed money was gifted to the banks and the Treasury Department to keep stock and bond valuations elevated. If even a fraction of that cash rotates into the precious metals markets, it will be something to behold.

There are also extremes to consider in the gold and silver futures markets. The COMEX delivered more metal in 2020 than in the prior 5 years combined.

This is not sustainable for the bullion banks. We aren’t sure how they managed thus far, to be honest.

One thing is sure. The banks and the COMEX are not to be trusted.

One way to deliver that many bars without creating a massive spike in the price is to deliver paper receipts rather than actual metal. Those who stood for delivery of COMEX bars may be wise to remove their bars from the exchange altogether and place them into segregated storage.

There is no telling if 2021 will finally be the year where powerful fundamental drivers finally break the rigged paper price discovery mechanism in metals. But 2020 brought us a lot closer to that day.

This article was originally published hereBullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply