The not so Dovish hike is set.

Bullion.Directory precious metals analysis 16 December, 2015

Bullion.Directory precious metals analysis 16 December, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Twitter @Lemieux_26

In what was deemed a “historic” rate hike, the Federal Reserve moved their interest rate band from between zero and 25 bps to 25 bps and 50 bps. The only thing historic about this rate hike was how telegraphed it was.

Since failing to deliver last Spring, and again in September, the Federal Reserve dramatically changed their posture to assure markets a rate hike was indeed coming in December. To paraphrase DoubleLine’s Jeffery Gundlach, while on CNBC’s PowerLunch, the Fed hiked not because the economy is recovering but to fulfill a promise. If the Fed did not hike, there would have been substantial loss of whatever remaining credibility.

As I pointed out here, Nomura thought a “dovish” rate hike would be a tough sell. The Fed fund futures were only pricing two additional hikes in 2016, but by the Fed’s projections there will be four interest rate hikes next year. That’s one every other FOMC meeting, and, albeit not an Alan Greenspan type of tightening, it is still a steady path higher from several years of ZIRP.

Initially, euphoria set into equities on extremely low volume. However, things took a turn for the worst. Today, the S&P 500 is down almost 20 handles, and gold is having an awful day, down over $20 in today’s session. The dollar is up over one percent, with the index regaining 99. Crude is, again, below $35 per barrel, while copper, silver, coffee, cotton and other commodities are well in the red. The forex market is a mess. When one puts this together, it continues to look like deflation.

Key notes to take away from yesterday’s press conference is that Fed Chair Yellen, once again, said threats to inflation are “transitory.” One of the largest threat has been the collapse of commodity prices, most notably is crude.

During the end of 2014, both Janet Yellen and Fed Vice Chair Stanley Fischer said low oil prices were “unambiguously” good for consumers and the collapse in oil prices were “transitory.” Since then, crude prices have fallen an additional 50 percent and almost 300,000 oil industry jobs have been terminated. Moreover, the CRB Index, a basket of commodities, is down 14 percent since September.

Furthermore, the Fed is forecasting that GDP growth for 2016 will come in at 2.4 percent, which is about the new paradigm following the financial crisis and despite trillions in quantitative easing. What is more troubling is that risk management firm Hedgeye has shown that, on average, the Fed has missed their growth forecasts by an average of 100 bps, or one percent.

So, if the Fed is projecting 2.4 percent expansion next year, it is probable that it could be well below two percent.

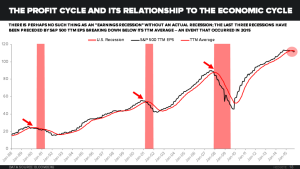

Keith McCoullough, CEO of Hedgeye, said that the “historic” rate hike was the first time since 1967 that the Fed hiked rates into a corporate profit slowdown. I have made my stance clear: if the Fed was data-dependent, they would not hike rates. If they did, they’d regret it.

Jon Hilsenrath, had an article in the Wall Street Journal, last Sunday, titled “Fed Officials Worry That Interest Rate Will Go Up, Only To Come Back Down.” At least the Fed is not alone. The policy-contrarians have believed this to be very probable and yesterday’s hike is far too late.

On CNBC’s Closing Bell, following the FOMC hoopla, the ever-wise Jim Grant summed it up concisely, as he often does:

I think that business activity which has been dwindling will continue to dwindle. And, it seems to me that the Fed will come face to face with the recognition that the stark fact is that it has raised its rate in the midst of the lowest growth environment in the past three rates hikes…I think there’s a chance that the Fed will be seen to have raised this rate at the start of a recession – that’s one possibility…It seems to me that as the evidence begins to mount that the economy is not in fact lifting off but rather continuing to dwindle, you’ll be seeing more talk and speeches from the Fed throwing up the possibility of due bouts of unconventional monetary action and some possibility for a move back to zero and I think that move will come.

Maybe we should forget moving back to zero. As former Fed Chair Ben “the hero” Benanke said during an interview with MarketWatch, “I think negative rates are something the Fed will and probably should consider if the situation arises.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply