‘Offshore’ Yuan – or CNH – sets new lifetime lows against the Dollar

Bullion.Directory precious metals analysis 25 October, 2016

Bullion.Directory precious metals analysis 25 October, 2016

By Adrian Ash

Head of Research at Bullion Vault

Asian stock markets rose outside China, and commodity prices edged near 3-month highs.

The Dollar also gained against other emerging-market currencies such as the Turkish Lira, and held near multi-month highs versus the Euro, Sterling and Japanese Yen as well.

The plunging Yuan may curb the US Federal Reserve’s comments on raising interest rates, forcing the Fed “to rein in some of its more hawkish rhetoric because of the strong Dollar, negative risk feedback loop,” according to French bank BNP Paribas’ FX strategist Sam Lynton-Brown.

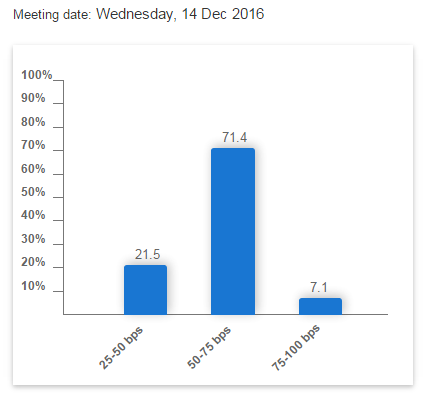

Betting in US interest-rate futures now puts just a 9% chance on the Fed raising next month from 50 basis points to 75bps immediately before the US presidential election, but that chance is seen jumping above 71% for a hike at the central bank’s December meeting.

Overtaking India as No.1 consumer in 2015, China may see gold demand increase “as a way to hedge potential currency depreciation in the face of capital controls,” reckons US investment bank Goldman Sachs in a new analysis, pointing to the Chinese Yuan’s new 6-year lows on the FX market.

Gold investing in China may also benefit “as a way of diversifying away from the property market,” the Goldman analysts say.

But jewelry sales in China have sunk in 2016 to date, diving by 17% at the mainland’s No.1 retail chain Chow Tai Fook (HKG:1929) during the 3 months ending September, and falling 37% globally for competitor Luk Fook (HKG:0590) on a same-store basis.

“There has been slight improvement in gemset sales in Hong Kong and Macau,” says Japanese brokerage Daiwa’s analyst Jamie Soo, quoting management comments, and mainland Chinese sales apparently improved during the Golden Week holiday in early October.

India’s gold demand will meantime fall to the lowest full-year total in 2016 since the global financial crisis of 2009, according to a sample of 5 jewelers and traders polled by the Bloomberg news-wire.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply