Whilst it looks next to certain that the US and Europe are in or about to be in a recession, opinion seems divided over whether Australia will follow suit.

Bullion.Directory precious metals analysis 17 August, 2022

Bullion.Directory precious metals analysis 17 August, 2022

By Paul Engeman

Director at Ainslie Bullion

Well for a start, one doesn’t ease monetary policy when everything is rosy. Indeed China is tackling a property crisis combined with the effects of its zero COVID lockdown policy and the geopolitical ramifications of its intense sabre rattling over Taiwan.

Let’s look at a few of the data prints coming out now that lead the PBOC to lower their interest rate:

- Industrial production growth slowed to 3.8% y/y in July, from 3.9% in June. Consensus was 4.3%.

- Retail sales growth slowed to 2.7% y/y in July, from 3.1% in June. Consensus was 4.9%.

- FAI (fixed asset investment) growth fell to 5.7% ytd y/y in July, from 6.1% in June. Consensus was 6.2%.

- New home prices fell 0.11% m/m in July, down from -0.10% in June. Consensus was 0.10%. Home prices fell for an 11th straight month in July.

- Property sales contracted 29%, deeper than the 18% fall in June.

- Construction starts declined 45%, unchanged from June.

- Youth unemployment rose to an all time record 19.9%

- Private-sector credit growth slowed to 8.6% from 8.9%.

And so, unsurprisingly the PBoC cut the 1-year MLF rate to 2.75%, from 2.85% when consensus was an unchanged 2.85%.

Critically for the rest of the world, and in particular Australia, Bloomberg notes:

For the rest of the world, arguably the most critical Chinese data point is the volume of its imports. For years, it has been the world’s spender of last resort. But imports, measured in dollars, have tailed off, while exports are surging as the economy tries to get under way after Covid-19.”

Indeed for Australia’s ore and coal exporters, crude steel output fell 6.4% year on year and more broadly the import of steel products are at their lowest in 24 years.

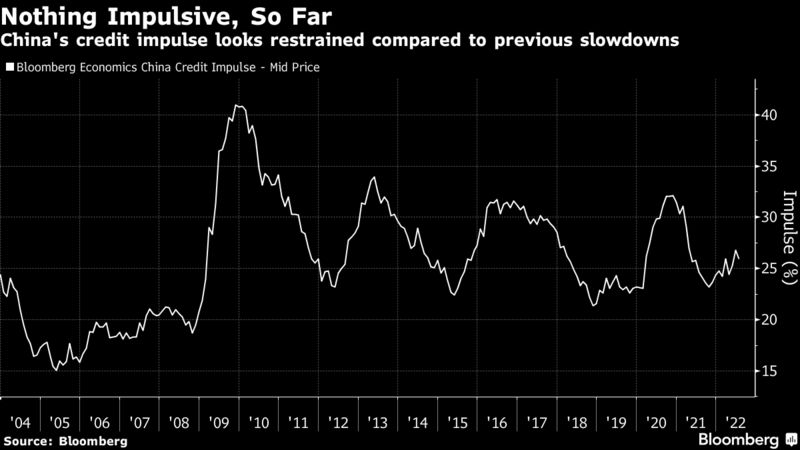

The last dot point above is important. The much watched credit impulse is barely sitting at an historic average. Whilst the PBoC may have dropped rates, its likely a sentiment move rather than a demonstrable one. Quite simply, with the implosion of the property market and impacts of COVID, there is little demand for credit in China at present.

From Bloomberg:

While monetary conditions have bottomed, we have not seen the supersized stimulus usually associated with Chinese recoveries; the Year-on-Year China credit impulse has only just reached historical average levels after bottoming in October 2021. The PBoC is easing and we expect monetary policy to remain loose; however, demand for credit is anaemic. The net result is that monetary conditions remain tighter than average. … And what stimulus has taken place has a lower monetary and fiscal multiplier than in previous cycles, as Covid outbreaks and property woes lower the efficacy of such measures.”

The other big implication is the effect on the Yuan. Crescat’s Tavi Costa tweeted below:

The implications for the US and their USD are clear and most certainly not ‘probably nothing’ per the tweet below…

A sharply devaluing Yuan has been a financial markets wrecking ball in the past and adding fuel to the USD price ascendency, a wrecking ball of a hole other kind that we spoke to recently here. It cannot go unnoticed that China has now been dumping US Treasuries for a record breaking 7 straight months to its lowest holdings since mid 2010.

Throw in the geopolitical turmoil brewing in our region and China, yet again, is set to play a huge role in how Australia fares in the coming months.

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply