There are conflicting views amongst experts around where this unprecedented economic setup ends.

Bullion.Directory precious metals analysis 30 May, 2022

Bullion.Directory precious metals analysis 30 May, 2022

By Paul Engeman

Director at Ainslie Bullion

Listening to a couple of interviews over the weekend, one clear view expressed by Raoul Pal of Macro Insiders and reinforced by those he interviewed is that the US is quickly heading toward (or already in) a sharp slowdown and recession as the Fed tightens when we are already in ‘organically’ very tight economic conditions with liquidity removed from markets via the likes of energy and commodities and supply lead inflation, and that all in a generally weak economy already.

His thesis is that as the Fed adds to this with rate rises and quantitative tightening, soon the market and economy will crash and force the Fed’s hand and they will pause and then soon re-loosen policy dropping rates and bringing back QE.

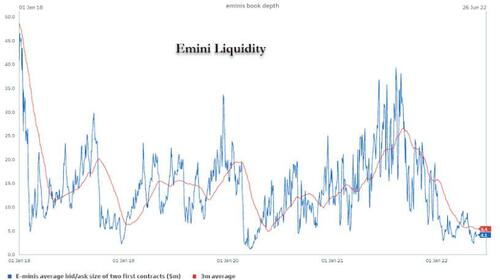

Such an about face would see the return of the (lack of) liquidity per the chart below and now pressuring growth (and particularly tech) shares, bonds and crypto. He then sees a surge in NASDAQ, bonds, crypto and gold.

Friday night in part reinforced this view. On the back of more terrible economic data out of the US, and after earlier comments from Atlanta Fed President Bostic that “it may make sense to pause in September” we saw Fed minutes confirm the Fed see inflation falling quickly.

This lead Bloomberg’s Fed watcher Vincent Cignarella to note “if their forecast is accurate, it would imply the next expected three half-point rate hikes would be the end of the current tightening cycle and set the stage for a major risk rally into second half of 2022.”

This coincided with poorer than expected GDP and home sales prints seeing the Bloomberg US Macro Surprise Index fall to its weakest since the lows of September 2021.

For a market fixated on rising rates this was celebrated and we saw strong gains on Wall Street. So to be clear, people buying shares in companies were doing so because the economic looks certain to be going into a recession but at least money used to buy them will get cheap again…

Hence we get to Pal’s thesis again. The economy will tank, value shares will get hurt, growth tech shares will find a home for new cheap money, as will crypto and bonds, and gold will benefit too as the ultimate historical benefactor of such terminally faited monetary largesse and stupidity.

Off the back of the strongest 7yr US Treasury auction since the start of COVID in March 2020, Rabobank put it succinctly to investors…

If you believe the fed will pause hiking soon, go long every bond and every commodity you can find.”

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply