Even the rich are miserable.

Bullion.Directory precious metals analysis 32 June, 2015

Bullion.Directory precious metals analysis 32 June, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Twitter @Lemieux_26

Now, the Bloomberg consumer comfort index has hit the lowest point since November, when everyone was excited for the winter retail extravaganza with all those gas savings.

After peaking out in April at 47.9, the comfort index fell to 40.5. This was the eighth straight week of declines for the index, marking the longest point since the survey began in 1985 – that’s encouraging!

Even the highest income earners are “less” comfortable, as sentiment falls to the lowest point since September. In an article by Victoria Stilwell (here), the recent data is presented in such a way that it is almost a shock to find that consumers just are not spending and consumption has yet to materialize:

Consumer confidence in the US slipped last week to a sixth-month low as views of the buying climate softened, indicating a re-acceleration in household spending may be slow to materialize.

How many times must the hopeful beat a dead horse? Keep in mind, the April high in Bloomberg’s CCI was coupled with this:

Americans viewed the US economy in a more favorable light and said it was a better time to spend.

Perhaps, Bloomberg should just stick to the data. Retail sales and consumer prices are turning over at a rate last seen during the last recession. This is suggesting deflation could be around the corner (i.e. no spending):

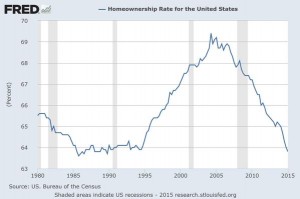

Forget housing starts for a moment. What good are they when US home ownership is at multi-decade lows and existing home sales are rolling over on a quarterly basis?

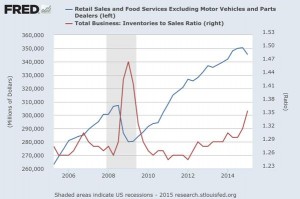

Businesses love to get overly optimistic. Record high inventory levels have needed recessions to work out the glut. Inventory-to-sales ratio is jumping to recessionary levels:

Bloomberg and alike may wonder why the consumer is not spending, all they would have to do is look at the data. The US economy has already turned, and the peaks in consumer sentiment begin to carve out a top in financial markets.

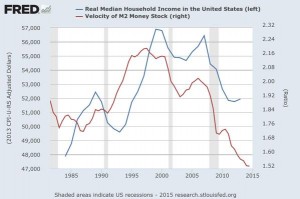

Then again, this could be the reason:

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply