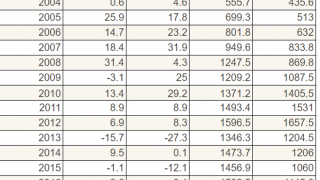

Since 2001, Gold has outperformed any other mainstream asset class, although that’s not what you are likely to hear from the mainstream. While gold lagged in 2013 and 2015, for long term investors, the yellow metal is up 553% in USD terms and 360% in AUD.

Full Article →Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

In a Capitol Hill hearing Powell was asked yesterday: “Would you say that the war in Ukraine is the primary driver of inflation in America?” Fed Chair Jerome Powell responded: “No. Inflation was high before, certainly before the war in Ukraine broke out.”

Full Article →Yesterday we heard the RBA chief assure us “I don’t see a recession on the horizon”. As we have seen repeatedly since the GFC, central banks have deployed ‘words’ as much as rates and QE in an effort to control markets…

Full Article →There are some analysts that think the only thing you need to look at to know where the price of gold and silver are going is the weekly Commitment of Traders report that presents all the positions of the big players on COMEX futures. It just got wildly bullish…

Full Article →Another night of deep red on Wall Street last night and another night of gold and silver price strength in the face of it. Markets were rocked by the surprise rate hike of 50bps by the Swiss National Bank but more particularly the expected sell off of their mountain of US shares,

Full Article →The US Fed has a new yarn to spin you. After months and months of trying to convince the market that inflation was just ‘transitory’ despite all the data, Fed Chair Powell was last night, with a straight face, telling us: “There is no sign of a broader slowdown in the economy that I can see.”

Full Article →The Japanese yen is down to 135 yen to the dollar from 127 earlier this month as the Yen is starting to crack. Against the US dollar, this is the weakest yen in 24 years. The Japanese central bank issued currency tumbled along with Japanese bonds and their stock market yesterday.

Full Article →Unless you live under a rock you will have seen the US CPI print on Friday night was a whopping 8.6%. That was higher than expected and a new 40 year high. Watching gold react live and thereafter was an interesting journey of market cognitive dissonance.

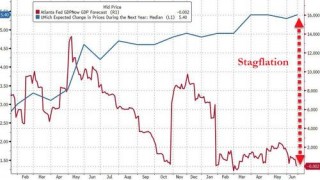

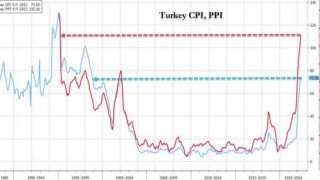

Full Article →The signs this tangled web of stagflationary high and increasingly sticky looking inflation, tumbling growth, and hawkish (tightening) central banks is fast approaching a second big capitulation in shares and property are growing.

Full Article →Six million British households are set to experience power cuts as the Government plans electricity rationing this winter. Government modelling of a ‘reasonable’ worst case scenario where Russia cuts off all gas supplies would see gas-fired power stations limited.

Full Article →Old news now but let’s talk about the implications of that surprise 50bps RBA rate increase yesterday. That it happened on the same day the World Bank dramatically downgraded global growth and openly conceded stagflation, is a reality that cannot be ignored.

Full Article →Its Monday morning so lets keep the words to a minimum and check out some compelling charts for gold and silver. First, that cup & handle formation we keep banging on about just gets better and better…

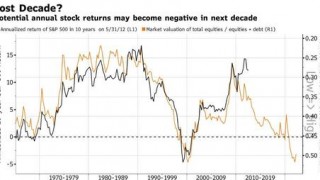

Full Article →The macro case for inflation being around at a higher rate for longer and contributing to a further bear market in financial assets is based first and foremost on structural commodity supply shortages today. There has been a multi-year declining investment trend in capital expenditures…

Full Article →Even if nominal GDP were to grow a full 20% over the next two years, not out of reason in today’s historically high inflationary environment, there is the potential for a further 78% decline in stock prices from current levels to settle at the low multiples of the last stagflationary era.

Full Article →There are conflicting views amongst experts around where this unprecedented economic setup ends. Much of the market is sitting on its hands unsure as to what to. Ray Dalio last week reminded us that ‘cash is trash’ so where does one invest now?

Full Article →Criticism continues to mount on the Reserve Bank of Australia for acting with too little too late in containing inflation in Australia. Having lifted rates for the first time in a decade to just 0.35% earlier this month, most other central banks are aggressively hiking.

Full Article →Last night saw even more poor economic data and Fed minutes confirming they have no intention of backing off at least for 3 more rounds of 50bps hikes. Clearly fuel for more share market falls one would think… However the market seemed to somehow latch on to the hope the Fed will stop in September?

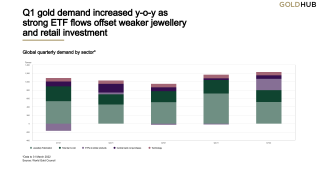

Full Article →The World Gold Council recently released their first quarter gold demand trends report for 2022. As usual we give you an expanded summary of this quarterly snapshot of global demand and supply.

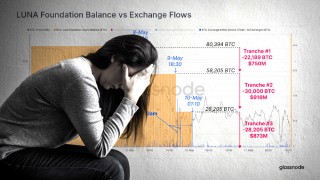

Full Article →After the industry-wide sell-off alongside the collapse of LUNA and UST last week, markets have entered a period of consolidation. In the shorter term, we can also see that the Monthly Return profile for Bitcoin has been underwhelming. In effect, Bitcoin has lost 1% of its market value every day over the last month.

Full Article →Its now official. After the NASDAQ long since crossed the rubicon, the world’s biggest equities index, the US S&P500 officially turned to bear market having crossed the 20% loss line on Friday night.

Full Article →More red on Wall Street last night on growing concerns about the US economy and its ability to handle higher rates. Whilst ending the session lower the S&P500 again miraculously bounced off the -20% bear market line in the sand without crossing it.

Full Article →Sri Lanka is running out of petrol. Citizens are being implored not to line up, that petrol will be available within the next two days. Sri Lankan news channels warn power cuts may rise to 15 hours per day, and there are numerous reports of Sri Lankans struggling to find essentials

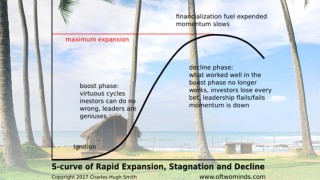

Full Article →At a time of monumental change in our global economic and geopolitical setup, financial commentator and author Charles Hugh Smith yesterday looked back at his calls on what he sees as the 5 ‘long-wave cycles’ that he first posited in 2007.

Full Article →The cryptocurrency markets experienced a week of historic volatility and chaos, with the exchange rate for two stablecoins, UST and USDT taking centre stage. Over just a few days, two top 10 digital assets by market cap (LUNA and UST) erased nearly $40 Billion in investor value.

Full Article →Its hard to pick up a paper or read the news without headlines around plummeting auction clearance rates, stalled house sales, predictions of big house price falls, and then late last week we got the ABS stats showing new home and construction finance commitments literally halved…

Full Article →Never a dull night on global markets lately… Last night was again a sea of red. The only green was yet again the US dollar (at near 20 year highs) and big cap crypto (coming off massive falls).

Full Article →While the annual consumer price reading slowed to 8.3% from 8.5%, both headline and core CPI rose 0.3% and 0.6% respectively in April, both higher than consensus expectations and still some of the highest on record.

Full Article →A lot has been written and speculated of late about the Russia’s moves to back the rouble with gold, the weaponization of the US dollar and reckless printing of it starting some kind of reset of global fiat currencies. None of this is without historical precedence of course.

Full Article →Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.