The road to full accountability for JPMorgan remains long and full of obstacles. But it is certainly nice to see prosecutors treating the bank without the usual kid gloves.

Full Article →Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and winner of Bullion Dealer of the Year’s E-commerce category.

A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Why Palladium is on a Tear

Physical palladium and rhodium markets are buzzing with reported prices for both metals leaping higher in recent days. The story behind palladium’s move is that a physical shortage has developed in London…

Full Article →Former Fed Head Says Government Can Borrow a LOT More

Narayana Kocherlakota, the former President of the Federal Reserve bank of Minneapolis wants you to know the Federal Government can never borrow too much money. How? By taxing the very people it owes the money to…

Full Article →Fight the Fed (and the Crooked Banks)

Market forecaster Martin Zweig famously warned investors against underestimating the power of the Federal Reserve Bank to control markets. He coined the phrase “Don’t fight the Fed” back in the 80’s. Precious metals investors are wondering if this is still good advice.

Full Article →Bullion Banks Used Paper Metals to Restrain Price Advance

The bankers and government officials behind these fiat currency systems don’t like stable monetary benchmarks such as gold putting their inflation schemes on full display. They absolutely hate that gold works as a refuge.

Full Article →Is 2020 Time for Gold and Silver to Shine?

As the Fed Reinflates Bubbles, Will Gold and Silver Shine? Bullion.Directory precious metals analysis 30 December, 2019 By Clint Siegner Director of Money Metals Exchange Gold bugs are arriving at […]

Full Article →Why Nobody Talks About Ballooning Federal Deficits

Plenty about the year ahead is unpredictable – but massive federal budget deficits and unrestrained borrowing are a certainty.

Full Article →Cracks in the Bullion Banks’ Price Management System

Cracks Spread in the Bullion Banks’ Price Management System Bullion.Directory precious metals analysis 18 November, 2019 By Clint Siegner Director of Money Metals Exchange Department of Justice prosecutors charged a […]

Full Article →Why Nobody Chants “End the Fed” Anymore

The wealth transfer from Main Street to Wall Street looks set to continue unchallenged. When the next bubble pops, Americans may again remember why a central bank which responds to every problem by printing vast sums and handing it to other bankers is a terrible idea.

Full Article →Gold “Just Sits There”

Gold, which “just sits there” retaining value over time, looks even more compelling if the alternative is holding cash which is guaranteed to depreciate.

Full Article →Powell Denies Fed Using Financial Crisis Tools

Telling obvious lies with a straight face is part of Powell’s job description. He hopes to maintain order even though anyone who is paying attention knows something extraordinary is going on.

Full Article →Will Cheated Investors Be Paid Damages?

Gold and silver investors have been watching the Department of Justice investigation of criminal price rigging at JPMorgan Chase and other bullion banks carefully…

Full Article →JPMorgan Chase and other bullion banks spent most of a decade screwing clients and investors who were naive enough to expect a fair shake in the precious metals futures markets. It was a solid racket.

Full Article →Investing in Metals? You Need This

The bullion business is competitive, and buyers can easily evaluate dealer ask prices. In this internet age, people are more inclined and able to evaluate pricing than ever. It’s easy to compare one merchant’s offer with another.

Full Article →The Case for Gold Gets Stronger As Negative Interest Spreads

Frank Holmes, CEO of US Global Investors, recently noted that a whopping 25% of all bonds sold globally now carry a negative yield. “Investors” are even buying some “junk” rated bonds which will repay the bearer less than purchase price upon maturity.

Full Article →It’s bad enough when bait-and-switch “rare” coin dealers stick it to naive customers. But when one of those shady peddlers got involved with politicians in the state of Ohio more than 15 years ago, it was a major statewide scandal. And the fallout continues today…

Full Article →Federal Debt Ceiling Reached as Federal Spending Rages Bullion.Directory precious metals analysis 15 July, 2019 By Clint Siegner Director of Money Metals Exchange The federal government will soon run up […]

Full Article →Tax Payers at Serious Risk from Bullion Banks’ Manipulation Schemes Bullion.Directory precious metals analysis 08 July, 2019 By Clint Siegner Director of Money Metals Exchange Gold and silver bugs are […]

Full Article →New U.S. Sanctions Spark Blowback against Federal Reserve Note Dollar System Bullion.Directory precious metals analysis 20 May, 2019 By Clint Siegner Director of Money Metals Exchange U.S. leaders are demanding […]

Full Article →Federal Reserve officials like to pretend they can use interest rates like a motorcycle throttle on the U.S. economy. Bullion.Directory precious metals analysis 20 May, 2019 By Clint Siegner Director […]

Full Article →New Federal Legislation Requires Full Audit of America’s Gold Reserves Bullion.Directory precious metals analysis 08 May, 2019 By Clint Siegner Director of Money Metals Exchange U.S. Representative Alex Mooney (R-WV) […]

Full Article →Three Essential Rules for Making a Winning Investment in Precious Metals Bullion.Directory precious metals analysis 15 April, 2019 By Clint Siegner Director of Money Metals Exchange The questions first-time precious […]

Full Article →The gaggle of socialist candidates vying to win the Democratic nomination for president all agree on one thing. Bullion.Directory precious metals analysis 08 April, 2019 By Clint Siegner Director of […]

Full Article →Could a Lurch Toward Socialism Sink Democrats in 2020? Bullion.Directory precious metals analysis 18 March, 2019 By Clint Siegner Director of Money Metals Exchange Rahm Emanuel, the former Chief of […]

Full Article →A year ago, Republicans in control of Congress suspended the cap on federal borrowing. Bullion.Directory precious metals analysis 11 March, 2019 By Clint Siegner Director of Money Metals Exchange The […]

Full Article →Warren Buffett’s Confusion & Disorientation about Gold Bullion.Directory precious metals analysis 5 March, 2019 By Clint Siegner Director of Money Metals Exchange Warren Buffett’s famed annual letter to Berkshire Hathaway […]

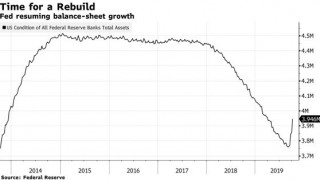

Full Article →Monetary Policy Will Not Return To Normalcy

Fed Must Face Reality: No Return to Normalcy for Monetary Policy Bullion.Directory precious metals analysis 26 February, 2019 By Clint Siegner Director of Money Metals Exchange More than a decade […]

Full Article →Supply Problems Worsen in Minted Silver

Sales of the Silver American Eagles are off to stronger start this year, and the U.S. Mint has once again been caught flat-footed. Bullion.Directory precious metals analysis 25 February, 2019 […]

Full Article →Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and winner of Bullion Dealer of the Year’s E-commerce category.

A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.