In recent months, the numbers of people standing for delivery of the metal on their futures contracts has spiked. If that trend continues in March, which is the next delivery month, it may be a bigger “Come to Jesus” moment than the shorts had in March of 2020.

Full Article →Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and winner of Bullion Dealer of the Year’s E-commerce category.

A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Demand for Physical Bullion Surges…

America will face an increasingly authoritarian federal government ruling over a largely apathetic populace… Gold bugs aren’t betting on bridges being built any time soon – demand for physical metal ratcheted up to a new all-time high in January.

Full Article →Investors Prepare for the Incoming Regime…

Last year provided extraordinary challenges to Americans as well as people around the world. Hundreds of thousands of deaths were attributed to the Chinese coronavirus. The economic carnage and the attendant death and suffering along with the loss of civil liberties was grossly underreported.

Full Article →Alarming Developments in GLD ETF…

The world’s largest gold exchange traded fund (ETF) seems to be having a lot of trouble when it comes to accounting. There’s little good reason to put any trust in GLD’s parade of CFOs or in shady HSBC bankers.

Full Article →Danger Ahead as Markets Detach from Fundamentals

Americans may start the New Year without certainty as to who will be sworn in as president on Inauguration Day. President Donald Trump and his supporters can’t find courts willing to consider their evidence of widespread voter fraud. Trump is not likely to concede.

Full Article →What Happens When Confidence Falls Apart?

While we may never know how deep and wide the political elites’ effort to gain control over our government goes, it appears to be vast. Although it’s still unknown whether fraud altered the overall election outcome, the evidence of fraud is real.

Full Article →Confidence Erodes in U.S. Institutions… Is the Dollar Next?

The U.S. election system, once sacrosanct, is losing the trust of half the country. Which half will depend on the outcome of Donald Trump’s efforts in the courts to demonstrate widespread fraud.

Full Article →The Moment Of Truth Is Here

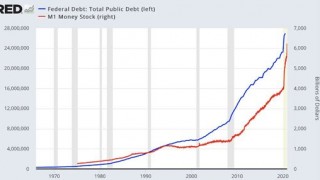

If results are contested, the fiscal and monetary response would be the same; more stimulus, more debt, and more money creation. There is no uncertainty with regards to these policies and, long term, they will be key drivers in the precious metals markets.

Full Article →Election May Impact Near-Term Action in Gold & Silver

Metals broke out earlier in the year because there has likely never been so many fundamental reasons to buy gold and silver. We’ve seen economic turmoil, political strife, social unrest, a $3 trillion federal deficit, and a dollar weakened by fiscal and monetary stimulus – all happening at once.

Full Article →America’s Political and Financial Institutions Are Broken

America’s key institutions are broken. More people wake up daily to that reality. They are preparing for the moment this realization dawns on Americans at large, which explains why the markets for physical bullion are so active.

Full Article →US Mint Not Raising Prices But…

The word on the street was that a hefty $13 price increase was coming, and many wanted to get their coins before prices rose. The news of a price increase isn’t wrong. It’s just that it won’t directly impact anyone except those people buying high-priced coins in specialty packaging directly from the U.S. Mint.

Full Article →DOJ Soft On JPMorgan Chase Wrongdoers

Gold and silver investors may have little in common with Jeffrey Epstein’s teenage victims or violent “Black Lives Matter” rioters, but there is one issue upon which they might all agree. Our system of justice often fails

Full Article →How Will US Election Impact Bullion Markets?

SPOILER ALERT: Anyone who thinks Biden has a good shot at becoming president should definitely stock up now.

Full Article →Bullion Markets Catch Their Breath

After months of frenetic activity in the bullion markets, physical buying and selling slowed a bit last week. The respite, if it persists, could be welcome news for investors frustrated by scarcity and higher premiums.

Full Article →Even basics, such as how to make payment, need a bit of explaining. Buying precious metal isn’t complicated, but there are some differences compared with other types of purchases. One of the biggest differences is that paying with your credit card will cost you.

Full Article →Physical gold and silver are useful as investment and crisis insurance, but it takes a bit of explaining.

Some wonder how they go about actually realizing profits – it’s different than logging into a brokerage account and hitting the “sell” button…

Full Article →The Federal Reserve has printed trillions of dollars without generating runaway price inflation through the use of a neat trick. It’s quite the racket…

Full Article →Anyone who is planning to buy bullion and waiting for premiums to drop might want to grab the opportunity now in case prices soon zoom higher.

Full Article →The price of silver dropped to $12.02/oz on March 18th and gold bottomed at $1,473/oz. The bullion banks – notorious for their concentrated short positions – might have made a killing. But that isn’t what happened…

Full Article →Protests egged on by the legacy media quickly devolved into large-scale riots and looting over the weekend in more than a dozen U.S. cities. Some important institutions have betrayed the public trust, and Americans facing quarantine and staggering unemployment have arrived at the boiling point.

Full Article →Unfortunately, shady coin dealers are out in force, trying to capitalize on our current financial situation. We can see it in the proliferation of these dealers advertising on TV and radio with their celebrity spokesmen…

Full Article →Today the number of ounces of silver it takes to buy one ounce of gold is at 113 – very close to those highs – and metals investors are wondering whether or not opportunity is knocking.

Full Article →Nobody in Washington even wants to know exactly where the Fed’s trillions go anymore. The rest of us, however, can make a pretty good guess just by watching CNBC.

Full Article →As cracks appear in the COMEX story, it is starting to look like a lot of speculators who hold paper gold and hope to redeem that for actual bars could be disappointed.

Full Article →It appears that while bars may exist in the U.S., too few are categorized as “registered” and therefore can’t be released for purposes of making delivery. Prices may have to go higher before the owners are willing to part with actual physical bars.

Full Article →The disconnect between paper prices for precious metals and demand in the bullion markets has never been clearer as nervous investors are frantically buying coins, rounds, and bars.

Full Article →Stocks have long been priced for perfection and suddenly conditions are looking far from perfect. The coronavirus may be the pin which pricks the latest Fed-blown bubble.

Full Article →A futures contract is not an asset with intrinsic value. It is nothing more than a wager on the price of the metal on a particular future date. There is ultimately a winner and a loser for each wager.

Full Article →Clint Siegner

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group, and winner of Bullion Dealer of the Year’s E-commerce category.

A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.