April Sees Gold’s Highest Month Average Since Oct, Silver’s Best Since Sept. as India’s Festival Buying Jumps

Bullion.Directory precious metals analysis 28 April, 2017

Bullion.Directory precious metals analysis 28 April, 2017

By Adrian Ash

Head of Research at Bullion Vault

Ahead of the US open, that beat the S&P500 stock index’s 1.1% gain from the end of March.

Crude oil traded flat around $50 per barrel. Silver prices held almost 5% lower, fixing in London at $17.41 but averaging their strongest level in April at $18.05 per ounce since September.

“[Silver’s] near-term outlook is positive,” says the latest Bullion Weekly Technicals from German financial group Commerzbank, saying that “silver’s correction is expected to terminate between the five-month support line at $17.39 and the December high at $17.27.”

“Support remains firm at $17.26,” reckons bullion bank and London market maker Scotia Mocatta’s New York desk, pointing in its daily technical note to the “76.4% Fibo retracement level of [silver’s] March-April rally.

“[But] momentum indicators are bearish and risk remains…Silver appears poised to target the $17 level.”

After finding strong demand to buy gold at an opening suggestion of $1261.50 on Thursday afternoon, the LBMA Gold Price today met weaker buying and solid selling above $1266 at the 10:30 fixing.

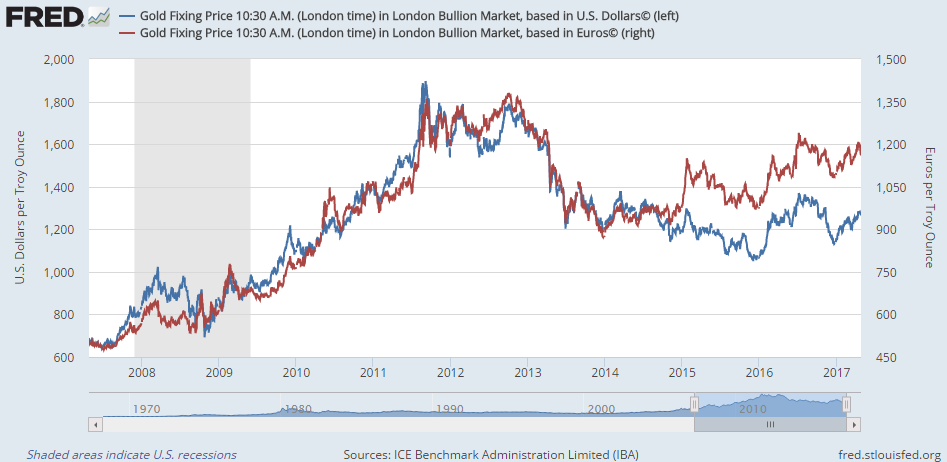

The process – now formally regulated under UK law – found a balance between buyers and sellers at $1265.55, pulling the AM benchmark’s April average up to $1267.15 per ounce, highest monthly London AM Gold Price average since October.

Gold priced in Sterling also recorded its highest monthly average since October.

Prices to buy gold in Euros averaged their highest level since September this month, despite the single currency’s strong rally on the FX market after France’s first-round election result last weekend.

“Silver may be down, but the return of ETF investors suggests it’s not out,” says Bloomberg, noting the recovery to 1-month highs in the size of the giant iShares Silver Trust (NYSEArca:SLV).

Rallying from mid-April’s drop to the smallest size in a year, the SLV ended Thursday needing 10,272 tonnes of bullion to back its shares in issue, equal to almost two-fifths of the world’s annual silver mine output.

The largest gold ETF in contrast – the SPDR Gold Trust (NYSEArca:GLD) – lost almost 1 tonne of bullion backing as shareholders liquidated 0.1% of the stock on a $1 rise in the spot price.

That took the GLD’s total backing to 853 tonnes, equal to one quarter of annual world mining output.

Friday meantime marked the festival of Akshaya Tritiya in India, a key date for new ventures and now also for buying gold on Hindu calendars.

One of the four most auspicious days on the Hindu calendar, and now the single heaviest day of Indian household gold demand, ” People have great faith on Akshaya Tritiya and we expect growth to be robust 20-30%,” said Nitin Khandelwal, chairman of All India Gems & Jewellery Trade Federation.

That matches the typical sales growth forecast by Indian jewellers around each autumn festival of Diwali, still the heaviest season for household demand.

“[But] jewellers will be looking for maximum sales for this day,” Khandelwal added, “as it will be done before GST” – the general sales tax set to apply to consumer goods across India within the next few months.

“A high GST rate such as 6-8% could adversely affect the industry,” warned specialist analysts Metals Focus in a recent report, “resulting in more off-the-book transactions.

“We believe that an overall tax structure, covering both the bullion import duty and GST, should be no higher than 12-14%.”

Mobile payments wallet Paytm yesterday launched a new gold app, offering to let Indian households trade as little as 1 Rupee of gold at a time (1.6 US cents), stored with government-backed MMTC-Pamp, the joint-venture with leading Swiss refiners MKS Pamp.

Global e-tailer Amazon meantime said that April’s jewelry promotion in India has netted 3 times its typical sales, driven by demand for 22 carat items as well as small bullion coins.

Private demand to buy gold in China – now the world’s No.1 consumer market, overtaking India since 2013 – rose 14% between January and March from the first quarter of 2016, the state-approved China Gold Association said Friday.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply