The latest consumer credit data released on Tuesday showed that revolving credit in August increased by an astounding 18.1%

Bullion.Directory precious metals analysis 13 October, 2022

Bullion.Directory precious metals analysis 13 October, 2022

By Paul Engeman

Director at Ainslie Bullion

In yesterday’s news, we discussed how the “Economy is starting to go through the windshield,” which appears to align with the conclusions one can draw from the recent credit data released by the Federal reserve.

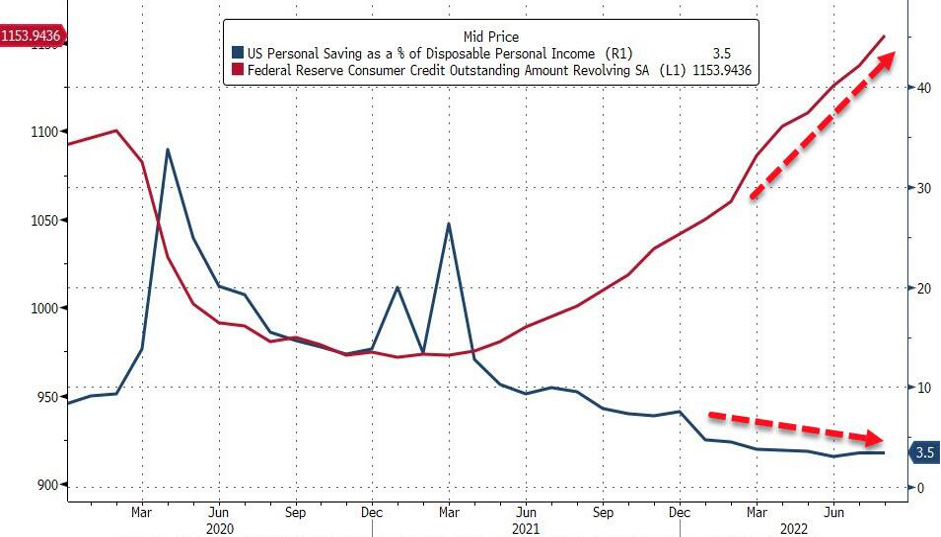

The increase of $32.2 billion in credit card debt this August greatly superseded the market’s projection of $24 billion. To put this into perspective, the average increase in 2019 was only 3.6%.

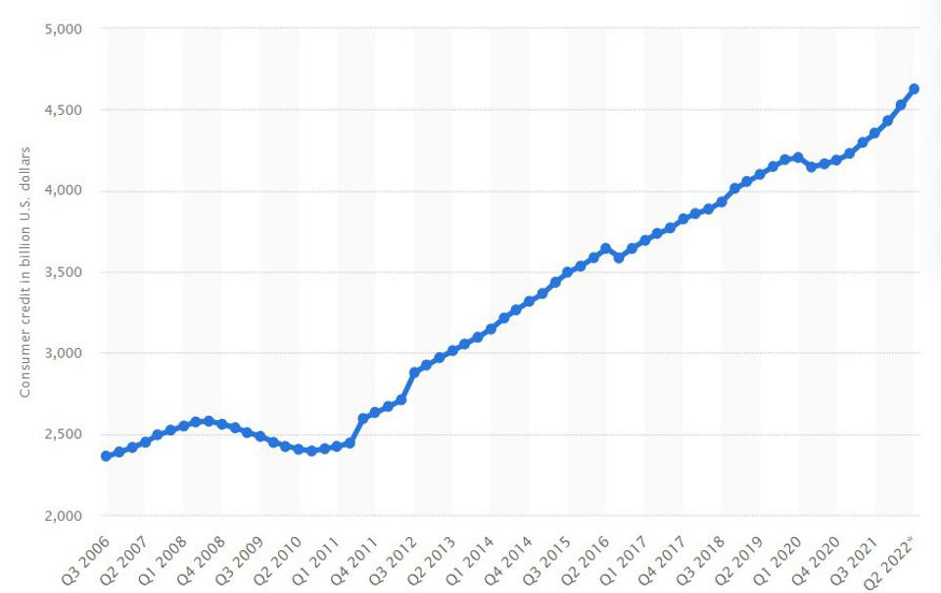

Consumer credit, which is made up of credit card debt, student loans and auto loans, now exceeds $4.6 trillion, with credit card debt alone accounting for $1.1 trillion. Both of which are unsurprisingly at all-time highs.

After the data came out, MarketWatch reported that “Some experts are alarmed at the pace of growth in consumer credit and think that households are using expensive debt to keep spending with inflation so elevated. “

Of course, these concerns are absolutely warranted, as a recent report by Lending Tree indicated that 20% of Americans have paid a bill late in the past 6 months

Furthermore, 60% of credit card users have been in debt for more than a year, up from 50% a year ago according to a recent creditcards.com report.

Household savings rates have dramatically dropped as well, all the way down to 3.5%.

With credit card interest rates currently at a record rate of 18.45% (0.42% greater than last month), it is evident that the financial burden of many Americans greatly depends on the Federal Reserve’s interest rate decisions.

This large portion of households that are being forced to turn to revolving credit to pay bills will be disproportionately impacted by upcoming interest rate hikes, effectively making it more difficult to make interest and principal repayments over time. Hence to some degree, further rate rises will only increase the wealth disparity between the lower and upper class, creating further economic and social turmoil.

These are clear signs of the dreaded stagflation where the combination of high inflation but a weak economy see the likes of this double whammy where ordinary American have both high debt due to inflation outstripping wage growth and higher interest rates payable on that debt.

To the surprise of many, Fed chair Jerome Powell believes that “households are in very strong financial shape.”

Yes, he really said that.

Many will be hoping that Powell will soon lower the burden on households during the next FOMC meeting, though considering his most recent comments it seems increasingly unlikely. Tonight we see one of the most eagerly anticipated CPI inflation prints in a long while.

Given the economic uncertainty, global instability and potential consumer credit crisis ahead, it is important to remember to balance your wealth in this unbalanced world.

Paul Engeman

Paul Engeman is a director at Ainslie Bullion, one of Australia’s leading bullion dealers, Gold Silver Standard, the precious metals-backed crypto tokens and at Reserve Vault, Australia’s largest private secure vault facility.

Paul’s in-depth analysis is published daily on Ainslie Bullion and associated companies’ websites – where he writes passionately on our current economic situation and the solutions that gold, silver and other assets can help provide.

This article was originally published here

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply