Category: India Bullion Dealers

Click Indian bullion dealer listings for reviews, info, map & contact details.

Is your Indian bullion company not listed? Add bullion dealer

Showing 1–28 of 43 results

Prism Consultants

Read More

Bullion India

Read More

Kundan Refinery

Read More

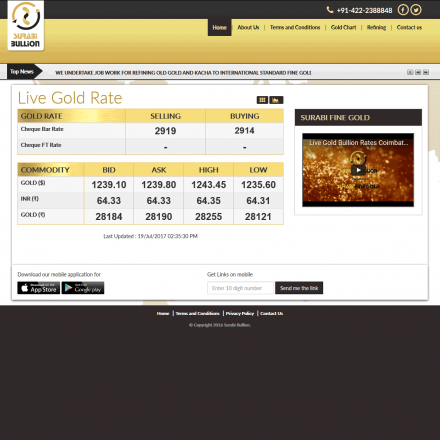

Surabi Bullion

Read More

Kosamattam Finance

Read More

Golden Leaf

Read More

Achiievers

Read More

Arihant Corp.

Read More

Amrapali SPOT

Read More

Attica Gold Company

Read More

Augmont Gold For All

Read More

Augmont Enterprises

Read More

B Bullion

Read More

Bullion Nerve

Read More

Caps Gold

Read More

dP Gold

Read More

Foresight Bullion

Read More

Gold & Silver Buyer

Read More

GoldMax

Read More

IBJA Gold

Read More

India Bullions

Read More

India Gold Ltd

Read More

Jindal Bullion

Read More

Kalptaru Bullion

Read More

Khazanchi Bullion

Read More

Kikan Goldsmith

Read More

Kuber Gold

Read More

Manokamana Gold

Read More

Buying Bullion In India

India is one of the world’s greatest gold markets which, like many countries in Asia and the Middle East, looks to gold as a store of family wealth. Indians use a combination of bullion bars and coins as well as high-purity jewellery both as a store of value and as a second currency, in a country where as much as 60% are outside the banking system.

India is one of the world’s greatest gold markets which, like many countries in Asia and the Middle East, looks to gold as a store of family wealth. Indians use a combination of bullion bars and coins as well as high-purity jewellery both as a store of value and as a second currency, in a country where as much as 60% are outside the banking system.

According to the World Gold Council (WGC) as of October 2017, the Indian central bank holds 557.8 tonnes of gold, equivalent to 5.7% of its total reserves, up from 3.4% in 2008’s official figures.

Although there are hundreds, maybe thousands of bullion sellers across India, this is a cash-based business and very few are as yet trading on the web.

The tax situation in India is fluid to say the least and wealthy Indians are buying and storing gold outside of India as much for stability as privacy from an aggressive governmental war on undeclared wealth – with Dubai seeing the majority of offshore investments.

Are Bullion Sales Taxed in India?

India started taxing gold at a rate of 3 percent under a new nationwide sales tax from July 1, 2017. This Goods and Services Tax (GST) on gold directly replaces a number of federal and state levies.

There are strict rules on importing gold bullion into India and these rules change regularly and rapidly as part of the Indian government’s effort to control the economy and black market trade. There is currently a 10% import tax due on 1kg gold bars.

Rules for Indian nationals are subject to a maximum 10kg gold per person or 100kg silver, with import tax being Rs. 300 per 10g + 3% for any non-Tola bullion bar or Rs. 750 per 10g +3% for Tola bars.

Unsurprisingly smuggling and offshore ownership is widespread.

IMPORTANT: The above tax details are listed for information purposes only and are believed correct at time of publication. Bullion.Directory are not tax experts. All enquiries about Indian taxes should be addressed to the appropriate local body. Taxes and taxation are subject to change.

The Pure Gold Company

The Pure Gold Company SWP Dubai

SWP Dubai

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.