Abenomics’ Landslide Win Dents Japanese Yen, Gold Prices Drop to $1275 ‘Support’

Bullion.Directory precious metals analysis 23 October, 2017

Bullion.Directory precious metals analysis 23 October, 2017

By Adrian Ash

Head of Research at Bullion Vault

The Japanese Yen sank to a 3-month low versus the Dollar, and Tokyo shares hit 21-year highs, after prime minister Shinzo Abe’s decisive victory for his so-called Abenomics policies now “clears the way” for more fiscal and monetary stimulus, designed to weaken the Yen, plus structural reforms for the world’s third largest single economy.

After half-a-million Catalans marched through Barcelona on Saturday in support of independence, breakaway leader Carles Puigdemont now plans to appeal to both Spain’s and the European Union courts to block the national government’s move to reclaim all regional powers.

“Money is important,” says former German foreign minister Joschka Fischer, writing today for Handelsblatt. “But it is not as important as Europe’s shared commitment to liberty, democracy and the rule of law.”

Northern Italy’s wealthy Lombardy and Veneto regions meantime voted to call for greater autonomy from Rome over tax and spending.

“The gold market is sitting in the doldrums,” says a note from brokerage Marex Spectron’s London bullion desk, “with little to no excitement in the world to push it one way or another.

“As such, the price is drifting lower and is purely following Dollar moves, especially Dollar-Yen.”

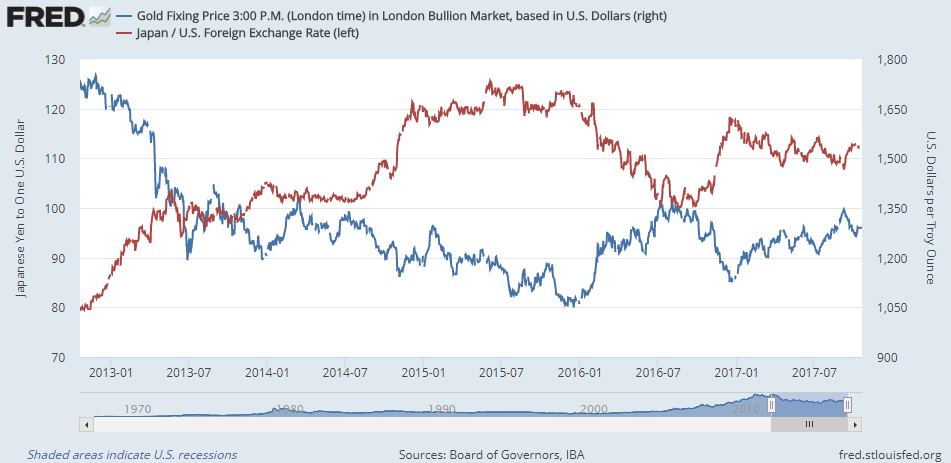

Increasingly mirroring the Dollar’s FX value on the currency markets over recent decades, gold priced in Dollars has so far in 2017 shown a 5-week correlation with the US currency’s exchange rate in Japanese Yen of minus 0.83.

That would read -1.0 if gold and Dollar-Yen moved perfectly opposite to each other.

Over the previous 5 years that statistical relationship averaged a reading of -0.46, having averaged -0.26 over the first 10 years of this century.

“Gold [was] under pressure right from the market open as the greenback pushed higher against the Yen,” says today’s trading note from Swiss refiners MKS Pamp’s Asian team.

“The sharp move lower was generally well supported toward $1274-1275, while a mild bid tone out of China buoyed the metal in early Shanghai trade.”

Shanghai premiums, over and above comparable London quotes, today held little changed in line with the historic average of $9.50 per ounce on the city’s key Au(T+D) contract.

For US Dollar traders, “Support remains unchanged at $1275.80, the 100-day moving average,” says the latest technical analysis of gold prices from Canada’s Scotiabank – itself now “weighing” a decision whether or not to sell its centuries-old London bullion market making and clearing division Scotia Mocatta.

Monday’s surge in Tokyo’s Nikkei index still left Japanese stocks 40% below the all-time peak of 1990.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Leave a Reply