Is there any relationship between the recent oil price plunge and the gold price

Bullion.Directory precious metals analysis 5 January, 2015

Bullion.Directory precious metals analysis 5 January, 2015

By Terry Kinder

Investor, Technical Analyst

While the recent oil price plunge isn’t yet as dramatic as the one that occurred back in 2008, there are enough similarities between what happened to the oil price, the U.S. Dollar Index (DXY) and the gold price to give it a quick look.

The parallels between the current oil price plunge, the dollar and the gold price are far from perfect as you will see in the chart below.

Oil Price Plunge and Gold: Could oil, the dollar and gold be setting up for something similar to what happened in 2008?

The parallels between 2008 and 2014-2015 are interesting:

1. The gold price made a pivot high in March 2008 at A and oil peaked in June 2008 at B. In March 2014 the gold price made a pivot high at E and oil made a pivot high in June 2014.

2. In 2008 after gold made its pivot high in March there was a steep oil price plunge. In 2014 after gold made its pivot high there was a steep oil price plunge.

Oil Price Plunge and Gold: What are the parallels between the 2008 and 2014-2015 plunges in the price of oil, and what could they tell us about the future price of gold?

3. After the oil price plunge in 2008, the gold price stayed below a declining price resistance line. In 2014-2015 after the oil price plunge, gold has so far stayed below a declining price resistance line.

Obviously any parallels between 2008 and 2014-2015 are far from perfect. In 2008 the oil price was much higher than in 2014. In 2014 the oil price plunge occurred after a record high. In 2014 the oil price appeared to be more range-bound. In 2008 the dollar was at record lows and oil at record highs. In 2014 neither oil, nor the dollar were at record levels. Surely there are other important differences as well between 2008 and 2014-2015, but those are just a few.

An interesting point to consider is what happened to the price of gold after the oil price plunge and rise of the dollar in 2008 – it declined over 34% from $1033.90 to $681.00. If something similar happened today gold would move from $1,392.60 to $917.31. At this point, just from a chart perspective there isn’t necessarily any reason to suspect any move under $1,000.00 is in the making.

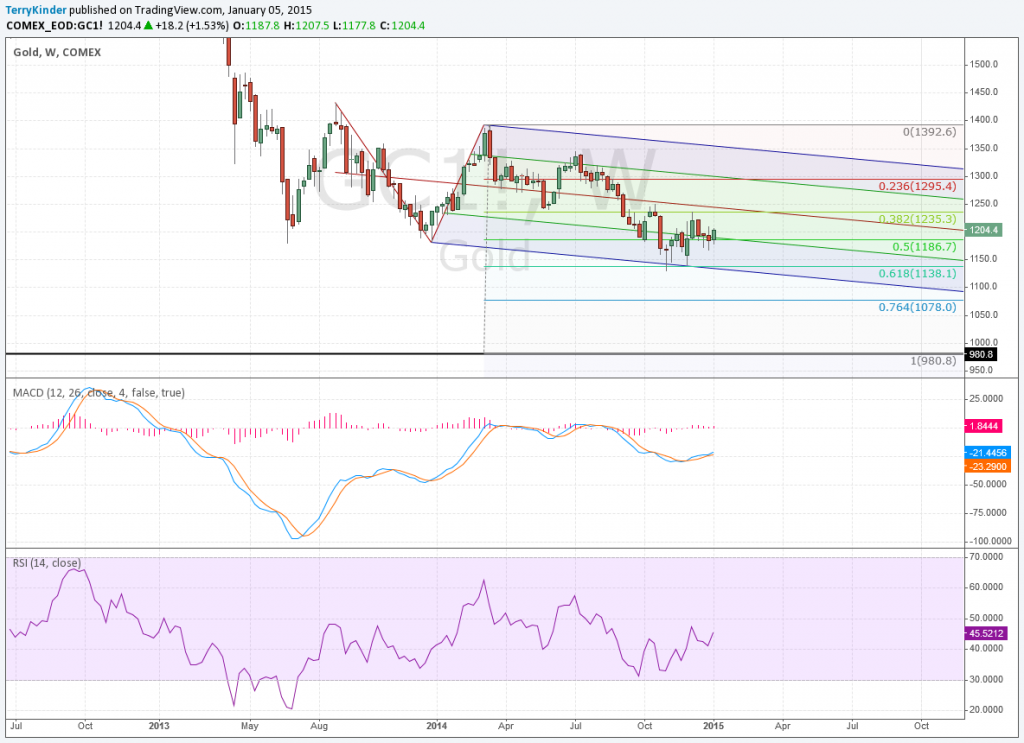

Oil Price Plunge and Gold: The gold price has been trading within a declining price range for about a year, but hasn’t shown any signs it is about to make a sudden decline.

On the flip side, Martin Armstrong has pointed out that gold support levels for 2015 are far below current prices, around $618.00 – $778.00. Harry Dent, who relies heavily on demographics to make his forecasts, thinks that gold could dip to $700.00 or below based on a deflationary environment.

Having pointed out those forecasts, it goes without saying that $700.00 is a long ways from $1,200.00 plus, as was $1,900.00 a long ways from $1,200.00 back in 2011. I’m not making any forecast here, just pointing to the fact that there are certain parallels between the oil price plunge of 2008 and the current oil price plunge of 2014-2015. There are differences between 2008 and today, and it would be a mistake to assume that gold, the dollar and oil will merely echo what happened back in 2008. In a future post I’m going to cover some stock market cycles that could exert some influence on the gold price as well.

Bottom Line: There are enough similarities between the oil price plunge of 2008 and 2014-2015 to at least consider it in terms of how it could affect the price of gold. There are enough differences, as well, that we shouldn’t yet make too much of the oil price plunge yet, as the charts aren’t yet signalling drastically lower gold prices. We’ll circle back around to oil too when we examine stock market cycles, just to make things interesting.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.

Material provided on the Bullion.Directory website is strictly for informational purposes only. The content is developed from sources believed to be providing accurate information. No information on this website is intended as investment, tax or legal advice and must not be relied upon as such. Please consult legal or tax professionals for specific information regarding your individual situation. Precious metals carry risk and investors requiring advice should always consult a properly qualified advisor. Bullion.Directory, it's staff or affiliates do not accept any liability for loss, damages, or loss of profit resulting from readers investment decisions.