Precious Metals Market Report

Tuesday 6 June, 2017

Fundamentals and News*

Asian Stocks Face Mixed Start as Oil, Dollar Drop

Asian equity markets looked set for a mixed opening after U.S. shares retreated from all-time highs, with investors opting for a note of caution following a stellar seven-week surge for global stocks.

Japanese and Hong Kong stock-index futures pointed to an insipid start to the trading day after U.S. stocks, Treasuries and the dollar posted small drops. American services and factory figures, along with first-quarter productivity and labor costs, stayed close to forecasts, indicating steady if unspectacular U.S. growth. Oil slipped as traders downplayed concerns that Qatar’s turmoil would hamper supply from the country.

With central bank policy makers in the U.S. and Europe all in quiet periods ahead of key policy decisions, attention this week has shifted to Britain’s election and testimony from former FBI head James Comey on Thursday. The latest readings on America’s economy did little to divert from the view that growth remains intact, with traders now forecasting a more than 90 percent chance of an interest-rate increase next week.

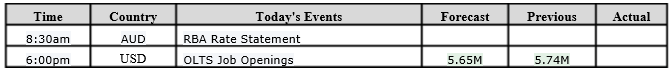

Australia’s central bank decides on policy at 2:30 p.m. in Sydney. No change to the record-low cash rate is expected, though traders will be examining the accompanying statement for comments on the housing market and inflation.

The European Central Bank releases its policy decision Thursday. Mario Draghi speaks later that day. Don’t expect policy changes, but the bank may drop the reference to “downside” risks to growth, while reiterating a weak inflation outlook, Bloomberg Intelligence said.

Surveys of U.K. voters over the past few weeks have indicated a tightening race for Thursday’s election, increasing the chance that Prime Minister Theresa May might not bolster her majority.

Comey’s testimony may offer clues to how the probe into the Trump campaign’s contact with Russian officials will impact the administration’s ability to push through its policy agenda.

The yen traded at 110.49 per dollar as of 6:53 a.m. in Tokyo. The Bloomberg Dollar Spot Index remains at the lowest since October after slipping 0.2 percent on Monday.

The Australian dollar traded at 74.85 U.S. cents after climbing more than 1.5 percent over the past two sessions.

Futures on the S&P 500 Index were little changed after the underlying gauge slid 0.1 percent Monday. Gold was flat at $1,279.99 an ounce.

WTI crude oil rose 0.1 percent in early Tuesday trading after settling at $47.40 a barrel in New York on Monday, following its 1.5 percent slide on Friday. The Monday settlement was the lowest in more than three weeks.

Qatari stocks plunged the most since 2009 after four U.S. Arab allies isolated Qatar over its ties to Iran.

(*source Bloomberg)

Data – Forthcoming Release

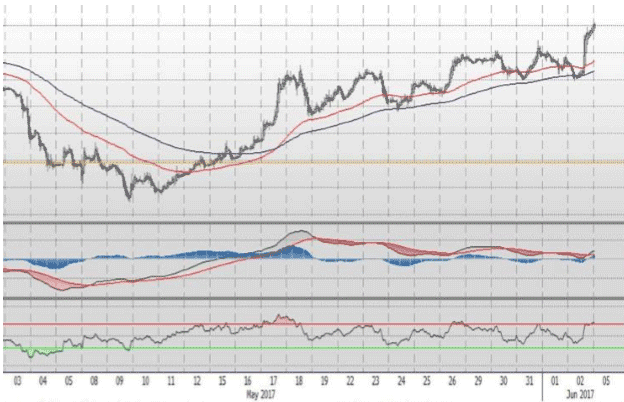

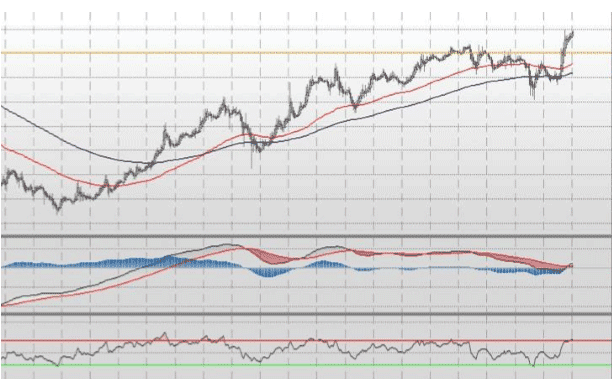

Technical Outlook and Commentary: Gold

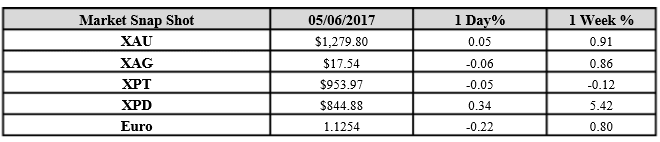

Gold for Spot delivery was closed at $1279.8 an ounce; with gain of $0.63 or 0.05 percent at 1.00 a.m. Dubai time closing, from its previous close of $1279.17

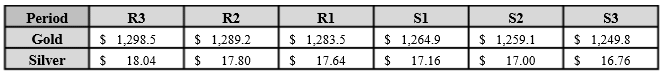

Spot Gold technically seems having resistance levels at 1283.5 and 1289.2 respectively, while the supports are seen at $1264.9 and 12459.1 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.54 with loss of $0.01 or 0.06 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.55

The Fibonacci levels on chart are showing resistance at $17.64 and $17.80 while the supports are seen at $17.16 and $ 17.00 respectively.

Resistance and Support Levels

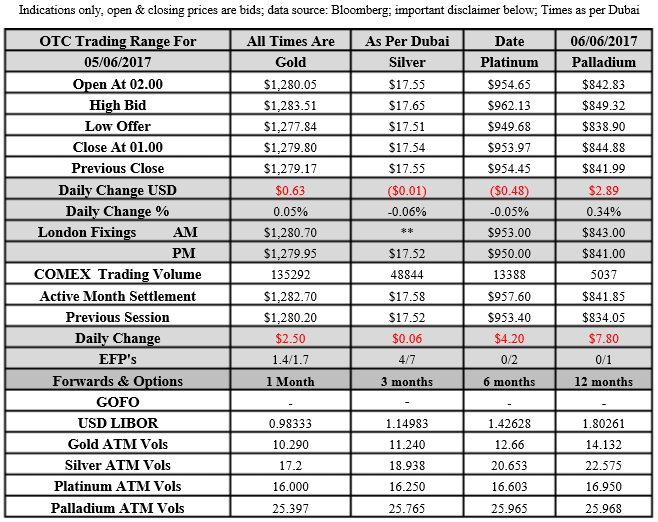

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply