Precious Metals Market Report

Monday 31 July, 2017

Fundamentals and News*

Gold Heads for Monthly Gain as China Buys and U.S. Growth Misses

Gold is set for a sixth monthly gain in seven as Chinese data showed the country’s purchases of bullion bars in the first half jumped 51 percent from a year earlier.

Bullion climbed Friday as the U.S. dollar weakened after a report showed U.S. growth was lower than expected in the second quarter. Buying of bars by China rose to 158.4 metric tons, while overall demand gained 9.9 percent, the China Gold Association said. Hong Kong figures and Swiss customs data also showed higher exports to China. The gains outweighed a drop in purchases of gold exchange-traded funds.

Restocking rather than end-user demand might be behind the surge in imports,” Simona

The U.S. economy grew 2.6 percent last quarter, compared with the average estimate of 2.7 percent. Excluding food and energy, the Fed’s preferred price index, tied to personal spending, rose at a 0.9 percent annualized rate, matching the weakest gain since 2010.

“There’s not a lot of inflation in the system,” said Bart Melek, head of global commodity strategy at TD Securities in Toronto. “There is no impetus for the Fed to get overly tight going into 2018. That’s a pretty decent environment for gold.”

Traders in their longest bullish run since April in a Bloomberg survey

Gold for immediate delivery rose 0.8% to $1,269.78/oz at 2:42 p.m. in New York

Metal touched $1,270.48/oz, highest intraday since June 14

Gold futures for December delivery +0.7 percent to settle at $1,275.30/oz at 1:35 pm on Comex in N.Y.

Holdings in exchange-traded funds backed by gold fell Thursday for a fifth straight session

Funds shed 2.5% in four weeks

Holdings in SPDR Gold Trust, the largest fund, haven’t increased once in more than a month

“Gold ETFs have purchased significantly less gold than last year,” analysts at Commerzbank including Eugen Weinberg said in a note

Silver holdings down third day at 21,097.5 tons

Longest run of declines since June 6

Gold volume on LME climbed above 1 million ounces for the first time on Thursday

Volume was 1.17m oz compared with 405,100 oz Wednesday

LME introduced new precious-metals contracts July 10

Silver +0.8% at $16.7178/oz Platinum +0.9% at $933.73/oz Palladium +0.4% at $882.12/oz

(*source Bloomberg)

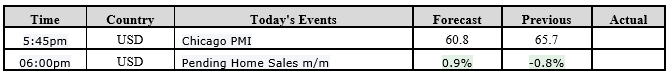

Data – Forthcoming Release

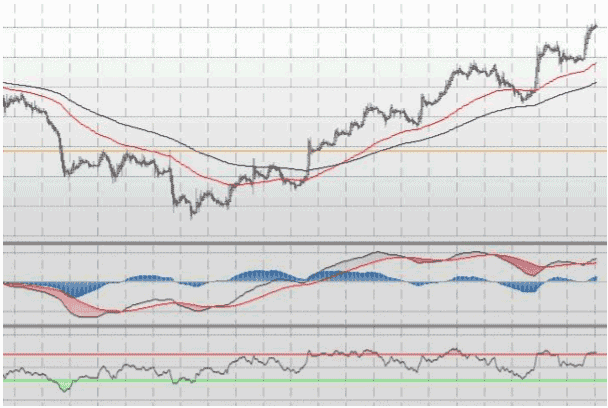

Technical Outlook and Commentary: Gold

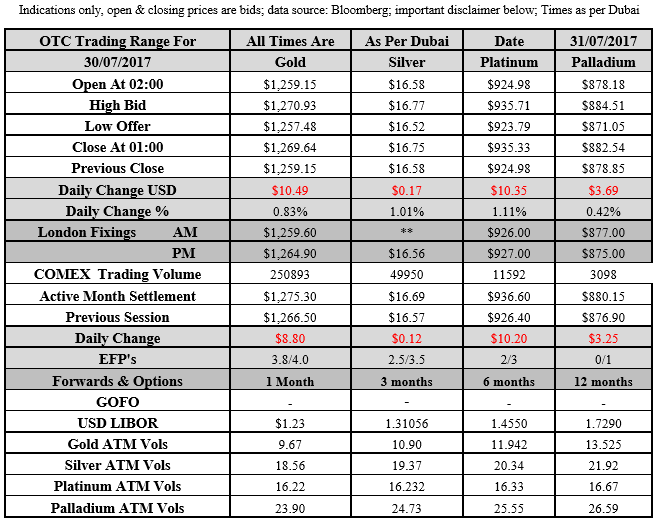

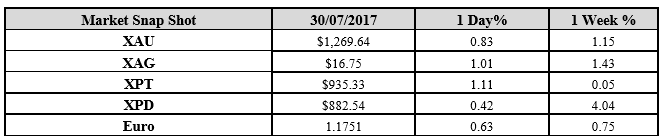

Gold for Spot delivery was closed at $1269.64 an ounce; with a gain of $10.49 or 0.83 percent at 1.00 a.m. Dubai time closing, from its previous close of $1259.15

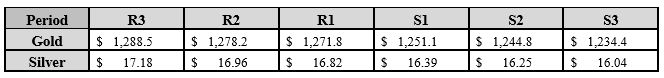

Spot Gold technically seems having resistance levels at 1271.8 and 1278.2 respectively, while the supports are seen at $1251.1 and 1244.8 respectively.

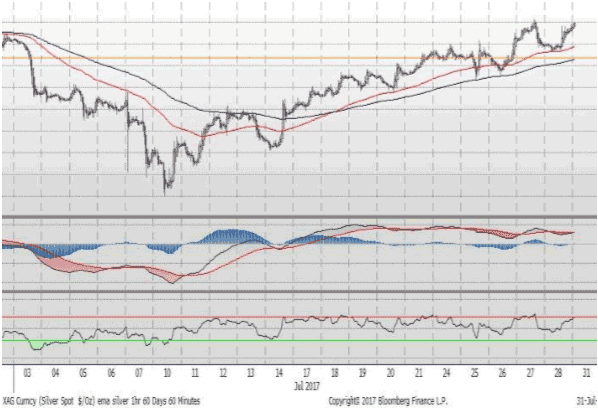

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.75 with the gain of $0.17 or 1.01 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.58

The Fibonacci levels on chart are showing resistance at $16.82 and $16.96 while the supports are seen at $16.39and $ 16.25 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply