Precious Metals Market Report

Tuesday 30 May, 2017

Fundamentals and News*

Gold near May Highs as Investors Weigh U.K. Election, U.S. Rates

Markets closed in China, U.K. and U.S. for holidays

Gold steady near its May highs as growing uncertainty over U.K. election next month counters impending interest rate increase in U.S.

Bullion for immediate delivery flat at $1,267.04/oz at 10:32am in London, after posting third weekly gain in period through May 26: Bloomberg generic pricing

Metal touched $1,269.55 on Friday, highest since May 1

A gauge of the dollar steady after +0.1% last week

U.K. election on June 8 getting tighter, with poll showing Theresa May’s Conservative Party leading main opposition Labour Party by just 5 points

“Increasing political uncertainty continues to invoke safe haven buying with polls showing Prime Minister May losing ground to her main opponent ahead of next month’s election,” ANZ analysts write in May 29 note

North Korea Fires Ballistic Missile, Drawing Ire of Neighbors

Federal Reserve Bank of San Francisco President John Williams sees inflation approaching 2% within year or so.

Three rate increases includes the Fed’s March hike, he says

Important to look at medium term, “this is now quite favorable.”

Stronger performance of economy “will help inflation move up to 2%”; some effects holding inflation down are “transitory”

With economy at full employment, “we are in a good place”

If data comes in stronger or better than expected, “we’ll probably raise rates a little faster than that,” or if it disappoints, then Fed will raise rates “a little slower”

He says not many risks in the macro economy that keeps him up at night

He’s not worried about “hard landing” in China; leaders in China have been “realistic” about economy and realized for some time it won’t be growing as high as 10% as it did in past

Williams comments to reporters in Singapore before delivering speech at Symposium on Asian Banking and Finance

Markets closed in China, U.K. and U.S. for holidays

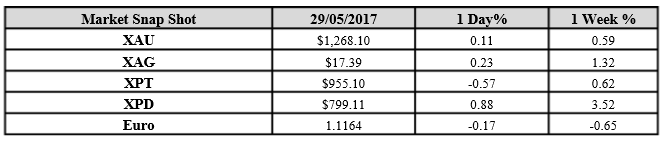

Silver +0.1% to $17.3745/oz

Platinum -0.2% to $958.70/oz

Palladium +0.6% to $796.67/oz

(*source Bloomberg)

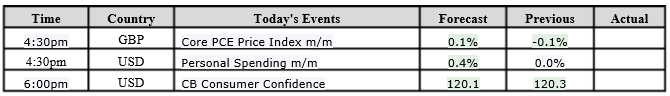

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

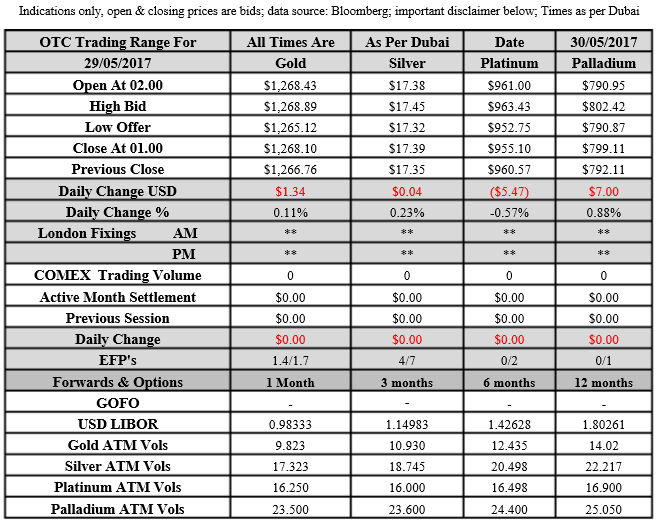

Gold for Spot delivery was closed at $1268.10 an ounce; with gain of $1.34 or 0.11 percent at 1.00 a.m. Dubai time closing, from its previous close of $1266.76

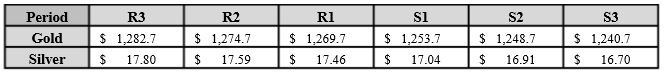

Spot Gold technically seems having resistance levels at 1269.7 and 1274.7 respectively, while the supports are seen at $1253.7 and 1248.7 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.39 with gain of $ or -0.23 percent at 1.00 a.m. Dubai time closing, from its previous close of $17.35

The Fibonacci levels on chart are showing resistance at $17.46 and $17.59 while the supports are seen at $17.04 and $ 16.91 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply