Precious Metals Market Report

Friday 30 June, 2017

Fundamentals and News*

Europeans Paying Least This Year to Buy Gold on Currency Gains

Market interprets ECB’s Draghi’s comments as hawkish

Bullion priced in Euros has fallen about 10% from 2017 peak

Europeans are paying the least in six months to buy gold as the euro climbs amid speculation the European Central Bank is poised to withdraw unprecedented monetary stimulus.

Gold touched 1087.01 euros on Thursday, the lowest since December, as the shared currency climbed to 13-month highs against the dollar. While a lower greenback usually fuels demand for bullion, gold has slipped this week after European Central Bank President Mario Draghi said the reflation of the euro-area economy creates room to pull back monetary stimulus. That sent yields higher, damping the allure of non-interest bearing bullion.

Gold priced in euros is down more than 10 percent from its 2017 peak in April. Bullion is being kept in check by record-high equity prices and higher U.S. bond yields, which point to rising risk appetite, analysts at Commerzbank AG said in a report Thursday.

The market thinks the ECB “may be concluding quantitative easing, and maybe we could be at a low point as far as the bottom of a cycle,” Phil Streible, a senior market strategist at RJO Futures in Chicago, said in a telephone interview. We could also see economic growth and higher rates in the region, he said. Gold will continue to trade in the $1,240 to $1,260 range, according to Streible.

Gold futures for August delivery, priced in dollars, fell 0.3 percent to settle at $1,245.80 an ounce at 1:38 p.m on the Comex in New York, the first drop in three days.

Silver futures for September delivery slid 0.8 percent to $16.654 an ounce on the Comex.

Platinum for October delivery dropped 0.1 percent

(*source Bloomberg)

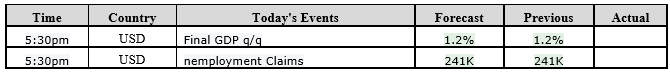

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

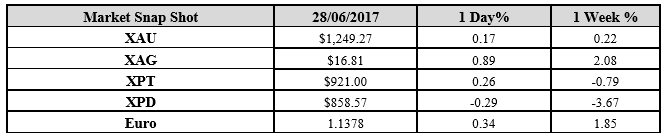

Gold for Spot delivery was closed at $1245.51 an ounce; with loss of $3.76 or 0.30 percent at 1.00 a.m. Dubai time closing, from its previous close of $1249.27

Spot Gold technically seems having resistance levels at 1255.6 and 1260.9 respectively, while the supports are seen at $1238.4 and 1233.0 respectively.

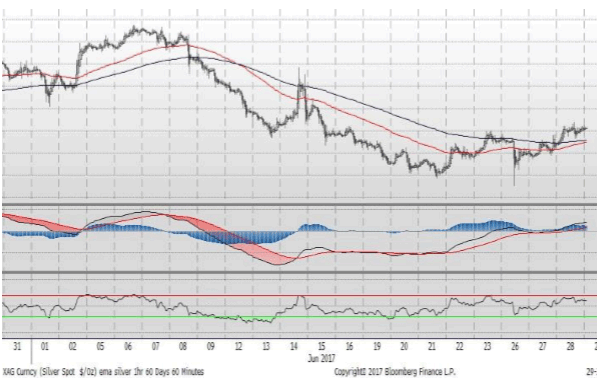

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.62 with loss of $0.19 or 1.14 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.62

The Fibonacci levels on chart are showing resistance at $16.84 and $16.98 while the supports are seen at $16.37 and $ 16.23 respectively.

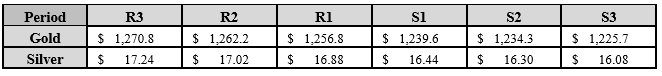

Resistance and Support Levels

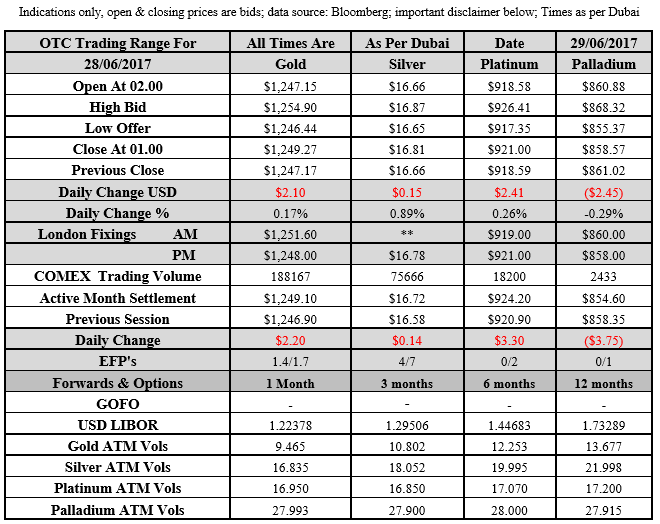

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply