Precious Metals Market Report

Tuesday 28 March, 2017

Fundamentals and News

Trump Stumble Propels Gold Toward Key Level in Haven Revival

(Bloomberg)

Gold futures climbed to the highest in a month as demand for haven assets surged after a failed U.S. health-care bill stoked concern over the outlook for President Donald Trump’s economic agenda.

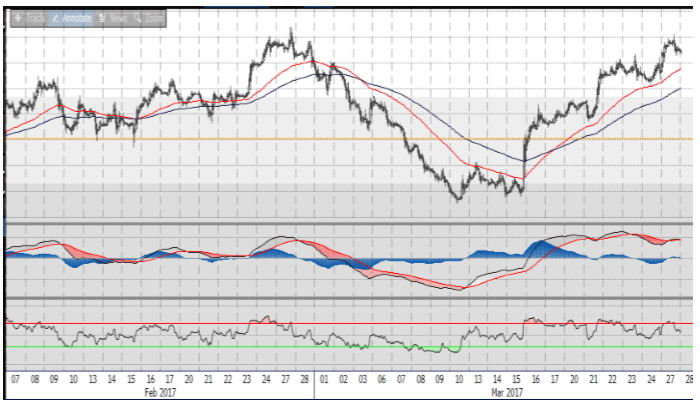

Bullion closed near its 200-day moving average as a gauge of the dollar dropped to the lowest since November. Yields on 10-year notes sunk to the least in a month, while U.S. equities declined for a third day. Gold hasn’t closed above the 200-day level since Nov. 7, the day before Trump was elected.

Bullion is up just over 9 percent this year, weathering an improving economic outlook that sent equities to record highs this month. Traders have turnedmore bullish on the metal as the aborted effort to replace the current health-care law calls into question prospects for tax reform and infrastructure spending that Trump has also promised. Commerzbank AG said a lasting rise above the 200-day threshold could spur follow-up buying.

“The Trump administration’s failure to get anything done on health-care reform has people concerned,” said Brad Yates, head of trading for Elemetal, one of the biggest U.S. gold refiners. “Some of the U.S. equity bullishness has been based on expectations the Trump administration will be pro-growth and pro-business, with fewer regulations. We’re seeing some of the optimism around that outcome unwinding a little bit.”

Gold futures for June delivery rose 0.6 percent to settle at $1,258.80 an ounce at 1:40 p.m. on the Comex in New York. The metal touched $1,264.20, the highest since Feb. 27 and above the 200-day level of $1,263.04.

“Any boost to the U.S. economy brought about by tax cuts and infrastructural measures would not materialize so quickly, which should in turn have a positive impact on gold,” Commerzbank analysts including Carsten Fritsch said in a report Monday.

(*source Bloomberg)

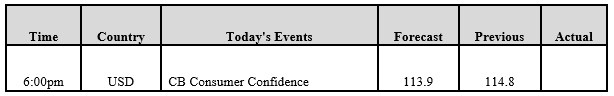

Data – Forthcoming Release

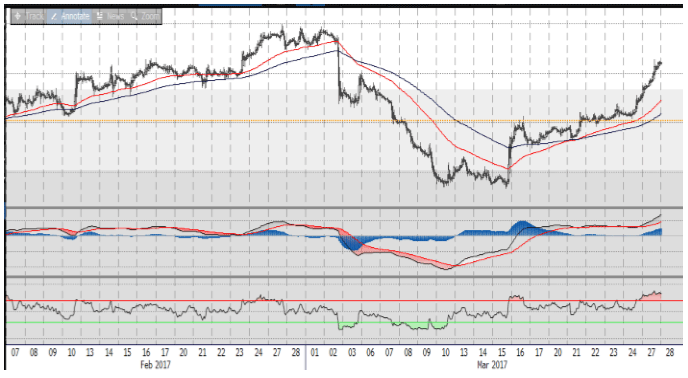

Technical Outlook and Commentary: Gold

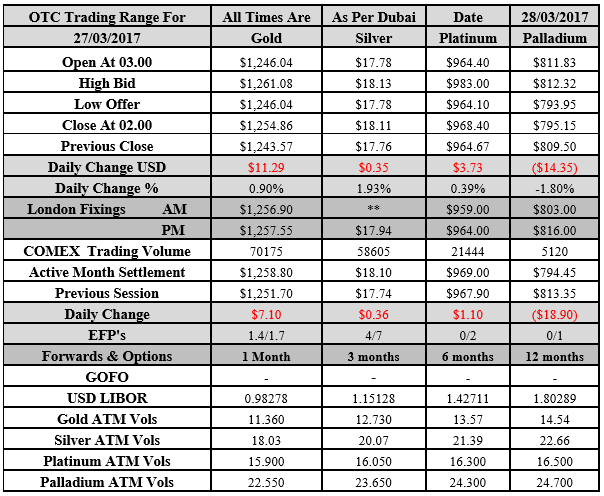

Gold for Spot delivery was closed at $1254.86 an ounce; with gain of $11.29 or 0.90 percent at 2.00 a.m. Dubai time closing, from its previous close of $1243.57

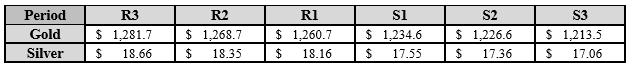

Spot Gold technically seems having resistance levels at 1260.7 and 1268.7 respectively, while the supports are seen at $1234.6 and 1226.6 respectively.

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $18.11 an ounce; with gain of $0.35 or 1.93 percent at 2.00 a.m. Dubai time closing, from its previous close of $17.76

The Fibonacci levels on chart are showing resistance at $18.16 and $18.35 while the supports are seen at $17.55 and $ 17.36 respectively

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply