Precious Metals Market Report

Thursday 23 March, 2017

Fundamentals and News

U.S. Stocks Rise as Rout Eases; Bonds, Gold Climb: Markets Wrap

(Bloomberg)

U.S. stocks rebounded after the first 1 percent decline since October, while havens from Treasuries to the yen remained in demand as investors assessed the prospects for pro-growth policies in America.

The S&P 500 Index edged higher, while technology-heavy measures posted solid advances. Banks slipped to an eight-week low after bearing the brunt of Tuesday’s rout. Treasury 10-year yields fell to 2.40 percent, the yen surged versus all its G-10 peers and gold rose toward $1,250 an ounce. Bloomberg’s dollar measure fell a sixth day, its longest slump since November. New Zealand’s central bank held its benchmark rate steady.

The gains in U.S. equities provided a measure of calm to the market, though havens remained in demand a day before a Republican health-care bill is set for a vote in Congress. Lawmakers have signaled any setback could delay enactment of tax cuts and spending increases, the prospects for which have underpinned the rally in risk assets since Donald Trump’s election. The depth of selling Tuesday drew some investors back in on speculation the drop went too far given data showing strength in the global economy.

“Everyone has been waiting for a dip for so long that when you get some kind of a dip, for not just tech but large-cap value too, it’s one of those opportunities to buy in,” said Mariann Montagne, a portfolio manager at Gradient Investments LLC, which oversees about $1.4 billion. “Maybe people are seeing a cue that things aren’t deteriorating across tech land. The deterioration of tech wasn’t due to fundamentals, it was just a function of pricing.”

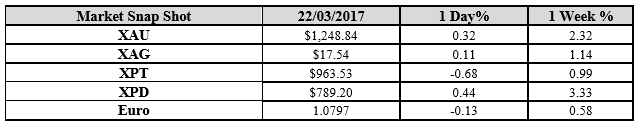

All four precious metals witnessed a rise in price on Monday, March 20, as the US dollar slipped to its six-week low. The US Dollar Index (DXY), which measures the US dollar against the basket of six major world currencies, ended the day at 100.4. DXY has fallen almost 0.9% over the past five trading days.

The rise in the US dollar has a negative impact on dollar-denominated assets like gold, silver, and other precious metals, and because precious metals are dollar-denominated assets, their demand can suffer from any rise in the value of the US dollar (UUP).

(*source Bloomberg)

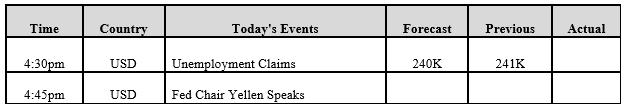

Data – Forthcoming Release

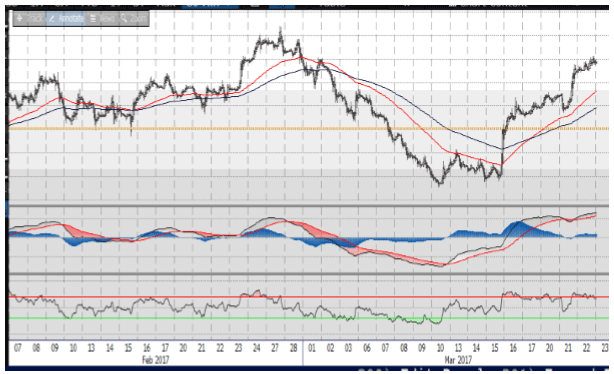

Technical Outlook and Commentary: Gold

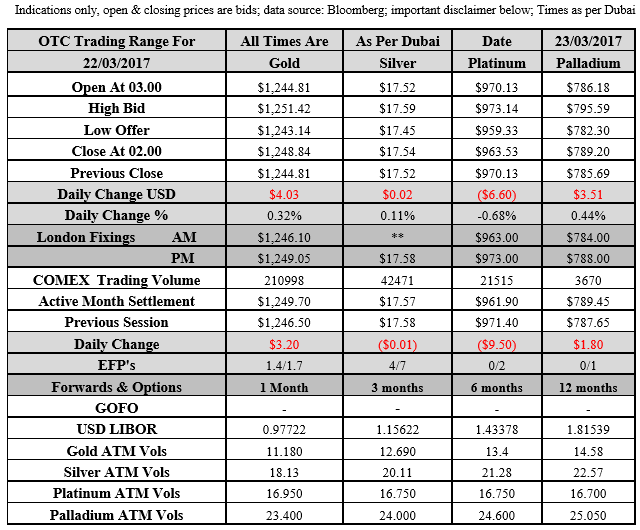

Gold for Spot delivery was closed at $1248.84 an ounce; with gain of $4.03 or 0.32 percent at 2.00 a.m. Dubai time closing, from its previous close of $1244.81

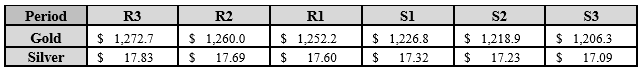

Spot Gold technically seems having resistance levels at 1252.2 and 1260 respectively, while the supports are seen at $1226.8 and 1218.90 respectively

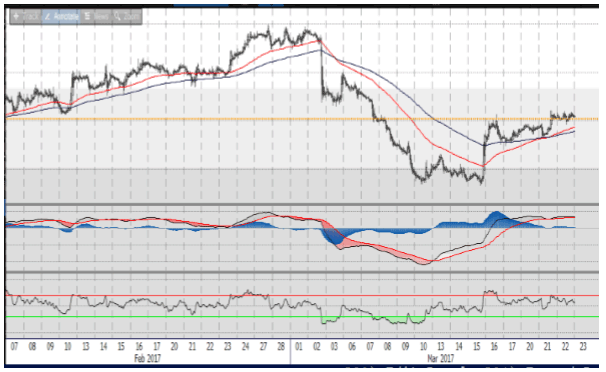

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $17.54 an ounce; with gain of $0.02 or 0.11 percent at 2.00 a.m. Dubai time closing, from its previous close of $17.52

The Fibonacci levels on chart are showing resistance at $17.60 and $17.69 while the supports are seen at $17.32 and $ 17.23 respectively

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply