Precious Metals Market Report

Tuesday 18 July, 2017

Fundamentals and News*

Top Peru Gold Miner to Weigh Copper Growth If Recovery Extends

Peru’s biggest precious-metals producer will consider taking a deeper dive into copper if prices of the industrial metal keep rising.

Cia. de Minas Buenaventura SA is tripling annual output at its Marcapunta copper mine to about 60,000 metric tons. Another expansion would take it to 100,000 tons, making Marcapunta one of Peru’s 10 largest mines, Chief Executive Officer Victor Gobitz said. Buenaventura subsidiary El Brocal operates the mine.

“If there was a significant increase in prices, that would be our next step,” Gobitz said in a telephone interview Friday. A subsequent expansion “would involve less risk, less capital and more returns.”

Copper has rebounded from seven-year lows and on Monday the metal breached the $6,000-aton level, or about $2.70 a pound, after data showed China’s economic growth is accelerating. Buenaventura has budgeted its projects with a conservative copper price forecast of $2.50 to $2.60 a pound over the medium term. The Lima-based company could pull the trigger earlier than planned in some of the 10 projects it has in the pipeline if prices rise higher and faster than expected.

We are aware that the number can be quite a bit higher over the long term,” Gobitz said. “But our experience over the last years with greenfield projects is that you need to be rigorous and you can’t jump any steps.”

Buenaventura’s next focus is to develop Quecher Main, a project that will allow it to extend the life of Yanacocha, the largest gold mine in Latin America, through 2025 or 2026. The company will be able to self-finance the investment, which will range from $250 million to $300 million, Gobitz said, adding that a final decision on the project is expected next quarter with production scheduled to begin by mid-2020.

While mid-sized projects such as Quecher Main and San Gabriel gold project don’t necessarily require a partner, others such as greenfield copper project Trapiche might, Gobitz said.

“We are open to the option of partnering, but we are not actively looking for a partner yet,” he said. “We are aware that the more mature the project is, the more convenient it will be for Buenaventura to look for a specific partner.”

The company will focus on developing Trapiche and reaching long-term agreements with local communities over the next year and a half. “When this phase is finished, we could actively think about a partner,” Gobitz said.

(*source Bloomberg)

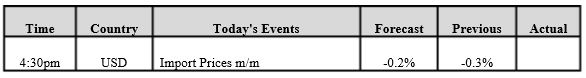

Data – Forthcoming Release

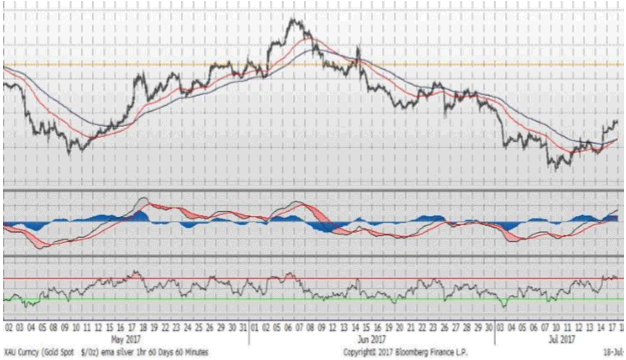

Technical Outlook and Commentary: Gold

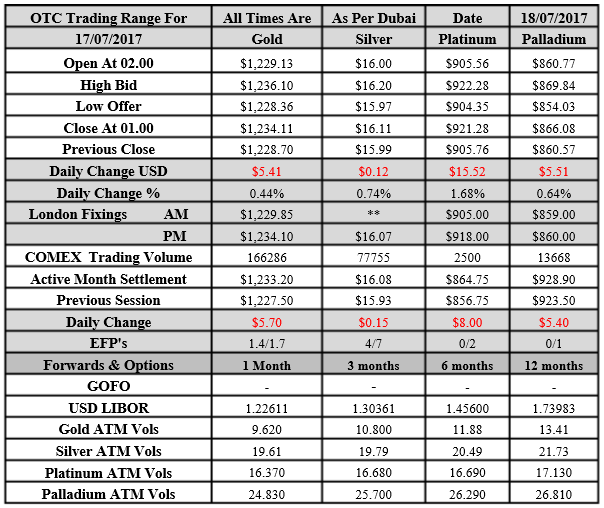

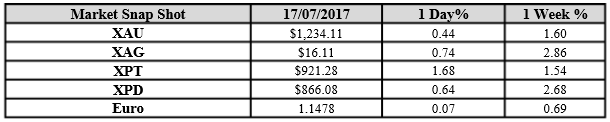

Gold for Spot delivery was closed at $1234.11 an ounce; with gain of $5.41 or 0.44 percent at 1.00 a.m. Dubai time closing, from its previous close of $1228.7

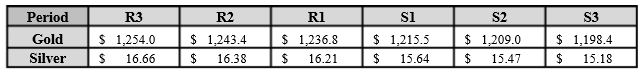

Spot Gold technically seems having resistance levels at 1236.8 and 1243.4 respectively, while the supports are seen at $1215.5 and 1209 respectively.

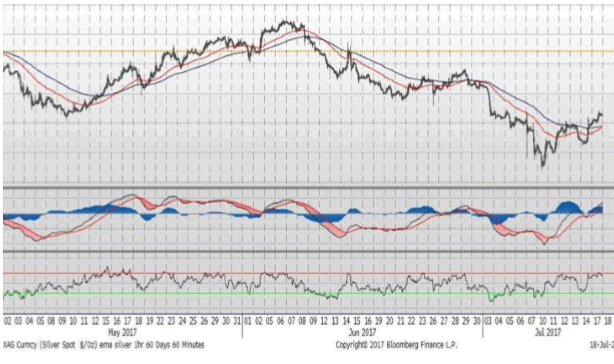

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.11 with gain of $0.12 or 0.74 percent at 1.00 a.m. Dubai time closing, from its previous close of $15.99

The Fibonacci levels on chart are showing resistance at $16.21 and $16.38 while the supports are seen at $15.64 and $ 15.47 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply