Precious Metals Market Report

Friday 14 July, 2017

Fundamentals and News*

Gold Drops as Yellen Says Inflation Risk ‘Two-Sided’

Gold ended lower after Federal Reserve Chair Janet Yellen said it’s “prudent” for the central bank to remain on a gradual path of rate increases as inflation risks are “two-sided.”

“It is premature to conclude the underlying inflation trend is falling well short of 2%,” Yellen says Thursday in comments to the Senate Banking Committee

August futures contract -0.1% to settle at $1,217.30/oz at 1:42pm on Comex in NY o Metal +0.6% this week

Bloomberg Dollar Spot Index drop for fourth day

NOTE: The U.S. may start to see higher wages and prices as economic slack shrinks, Yellen says in a second day of testimony

Metals will fluctuate as people “assess” the Fed’s path, Guy Wolf, global head of market analytics at Marex Spectron, says by phone

There are “concerns” about interest rate hikes, the dollar and positivity around the global economic environment

Silver futures fall on Comex

Platinum and palladium drop on Nymex

August futures contract climbs 0.4% to settle at $1,219.10/oz at 1:43pm on Comex, third straight gain.

NOTE: Yellen Sees Inflation as Key Uncertainty, Amid Moderate Growth

“There is, for example, uncertainty about when — and how much — inflation will respond to tightening resource utilization,” Fed Chair Janet Yellen says in remarks prepared for delivery to U.S. House Financial Services Committee

The Fed is “questioning” the path of inflation this year, Phil Streible, a senior market strategist at RJO Futures in Chicago, says in a telephone interview “Gold is reacting to that” – “The Fed may raise rates one more time”

Bloomberg Dollar Spot Index -0.4%, falling a third day

(*source Bloomberg)

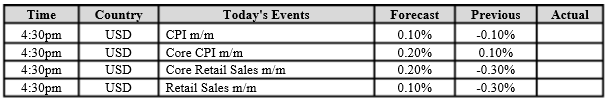

Data – Forthcoming Release

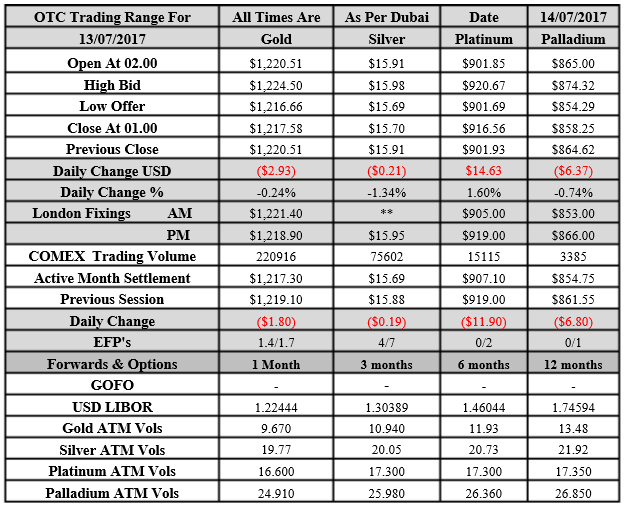

Technical Outlook and Commentary: Gold

Gold for Spot delivery was closed at $1217.58 an ounce; with loss of $2.93 or 0.24 percent at 1.00 a.m. Dubai time closing, from its previous close of $1220.51

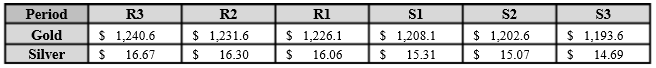

Spot Gold technically seems having resistance levels at 1226.1 and 1231.6 respectively, while the supports are seen at $1208.1 and 1202.6 respectively

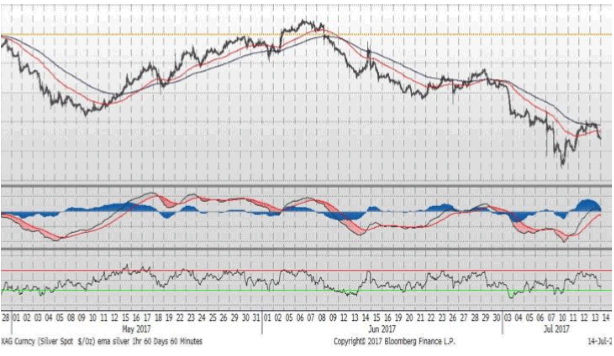

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $15.70 with loss of $0.21 or -1.34 percent at 1.00 a.m. Dubai time closing, from its previous close of $15.91

The Fibonacci levels on chart are showing resistance at $1606 and $16.30 while the supports are seen at $15.31 and $ 15.07 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply