Precious Metals Market Report

Wednesday 12 July, 2017

Fundamentals and News*

Gold Prices Have Cratered

Gold extended declines in early Monday trading, touching a three-month low, amid a move by investors into higher yielding assets in anticipation of interest rate increases from the world’s major central banks.

Spot gold prices were marked 0.5% lower at $1,207.2 in European trading, the lowest in more than three months, even as the U.S. dollar gave back some of the gains booked in Asia trading.

Gold has fallen more than 6.7% over the past month, with the bulk of the decline coming in the latter days of June when three of the world’s top central bankers — Janet Yellen, Mario Draghi and Mark Carney — made speeches indicating that interest rates will begin to increase around the world as economies grow and the effects of the financial crisis are finally left behind.

U.K. listed gold mining stocks have also suffered over the past month, with Randgold Resources falling more at 14% and rival Fresnillo Plc slumping more than 15.17%. In New York, the SPDR Gold ETF has fallen 6.35% over the same 30-day period and closed at $115.28, the lowest since March 14.

Prices could decline further in the months ahead, some analysts have warned, as global bond yields continue to rise in anticipation of higher interest rates from the U.S. Federal Reserve and, potentially, the end of the European Central Bank’s €2.3 trillion program of quantitative easing.

Benchmark 10-year German government bond yields, known as bunds, have risen 32 basis point to 0.57% since last June, while 10-year Treasury yields are now 14 basis points higher, providing a safe, higher-yielding alternative to gold investment.

(*source Bloomberg)

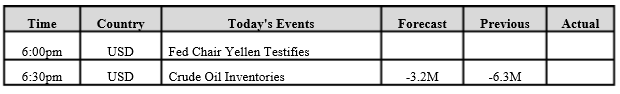

Data – Forthcoming Release

Technical Outlook and Commentary: Gold

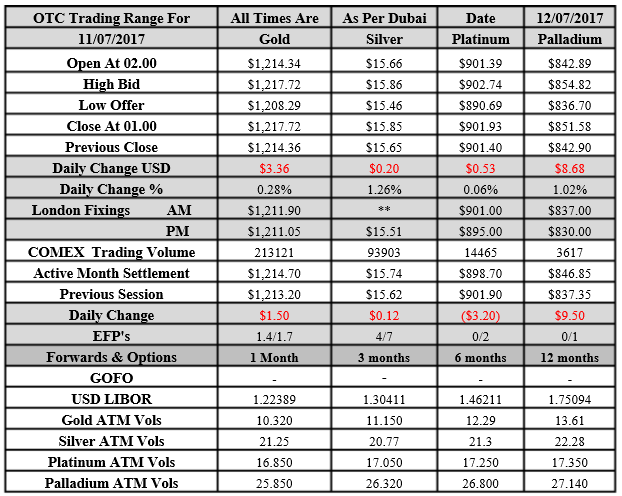

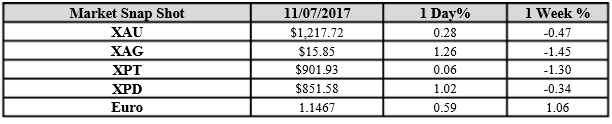

Gold for Spot delivery was closed at $1217.72 an ounce; with gain of $3.36 or 0.28 percent at 1.00 a.m. Dubai time closing, from its previous close of $1214.34

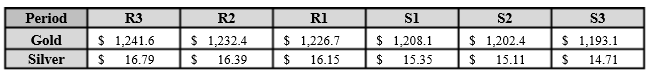

Spot Gold technically seems having resistance levels at 1226.7 and 1232.4 respectively, while the supports are seen at $1208.10 and 1202.4 respectively.

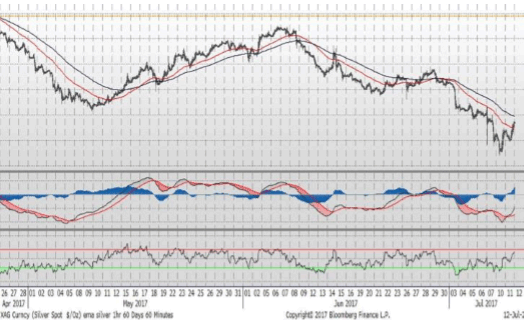

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $15.85 with gain of $0.20 or 1.26 percent at 1.00 a.m. Dubai time closing, from its previous close of $15.65

The Fibonacci levels on chart are showing resistance at $16.15 and $16.39 while the supports are seen at $15.35 and $ 15.11 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply