Precious Metals Market Report

Monday 08 May, 2017

Fundamentals and News*

Gold Steady at 7-Week Low As Macron Wins French Election By Decisive Margin

Gold prices held at seven-week lows after Emmanuel Macron was elected president of France on Sunday, defeating far-right candidate Marine Le Pen in the second round and bringing relief to the market.

Spot gold was trading at $1,226.90 during the opening hours of the Asian session on Monday, holding largely steady as the results were announced.

Pro-Europe, market-friendly Macron won with 65.31% of valid votes cast so far, official figures from the French Interior Ministry confirmed on Sunday. The results calmed market fears of Le Pen’s threats to take France out of the European Union.

Macron’s win puts a 35-percentage-point gap between him and Le Pen, beating a previously estimated 20-percentage-point lead projection.

The next step for Macron will be to secure a majority in June’s parliamentary election for En Marche! (Onwards!), his new political movement that is not even a year old yet.

With the French election results largely matching market expectations, the focus will now shift to the U.S.monetary policy, BNP Paribas said in note to clients.

Latest positive U.S. macro data are offering additional support for a June rate hike, with market expectations rising.

“The strong April employment report, with strong job gains and the unemployment rate falling to 4.4%, followed an FOMC meeting that emphasized the importance of the labor market in their deliberations. A June hike is now much more likely. By contrast, we think the final outcomes on health care, spending, and taxes, remain far less clear,” Nomura Global Research said in a note

(*source Kitco)

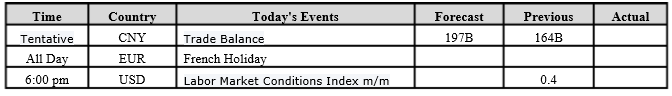

Data – Forthcoming Release

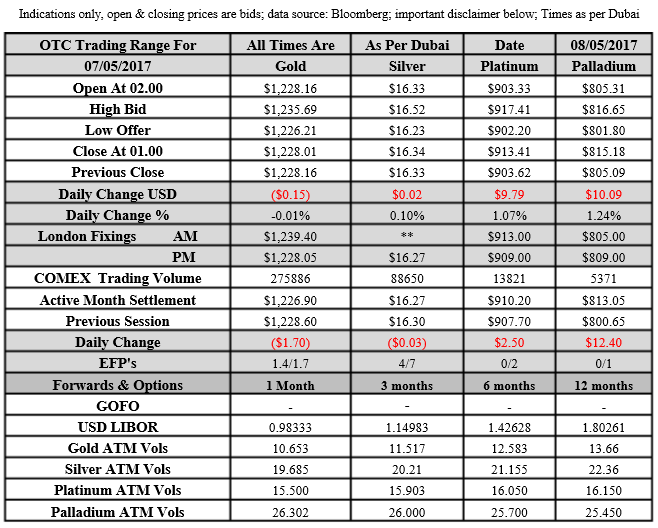

Technical Outlook and Commentary: Gold

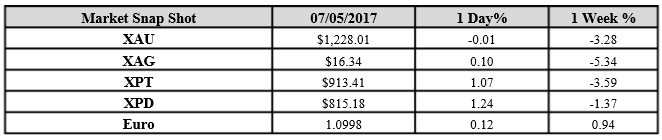

Gold for Spot delivery was closed at $1228.01 an ounce; with loss of $0.15 or 0.01 percent at 1.00 a.m. Dubai time closing, from its previous close of $1228.16

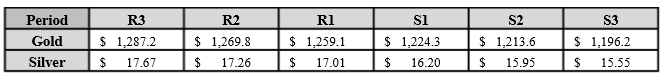

Spot Gold technically seems having resistance levels at 1259.1 and 1269.8 respectively, while the supports are seen at $1224.3 and 1213.6 respectively.

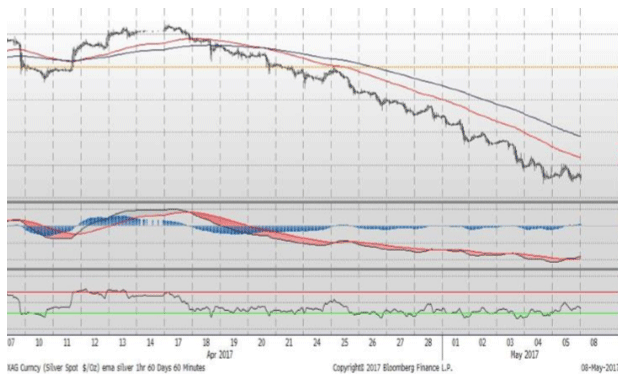

Technical Outlook and Commentary: Silver

Silver for Spot delivery was closed at $16.34 with loss of $0.02 or 0.10 percent at 1.00 a.m. Dubai time closing, from its previous close of $16.33

The Fibonacci levels on chart are showing resistance at $17.01 and $17.26 while the supports are seen at $16.20 and $ 15.95 respectively.

Resistance and Support Levels

Indications only, open & closing prices are bids; data source: Bloomberg; important disclaimer below; Times as per Dubai

Kaloti Precious Metals (KPM) does not provide trading or investment advice to its customers. The information provided in this report constitutes market commentary only and KPM assumes no liability whatsoever for the accuracy and/or any use of the information contained in this report and expresses no solicitation to buy or sell OTC products, futures, or options on futures contracts. The Customer should not regard any views or opinions given in this report as being investment or trading advice KPMI shall have no liability whatsoever for any view or opinion expressed in the report. Reproduction of this report without authorization is forbidden. All rights reserved.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply