Gold Price $1.10 Below 4-Year Friday High, ‘All About’ Trump’s Dollar ‘Devaluation’

Bullion.Directory precious metals analysis 26 January, 2018

Bullion.Directory precious metals analysis 26 January, 2018

By Adrian Ash

Head of Research at Bullion Vault

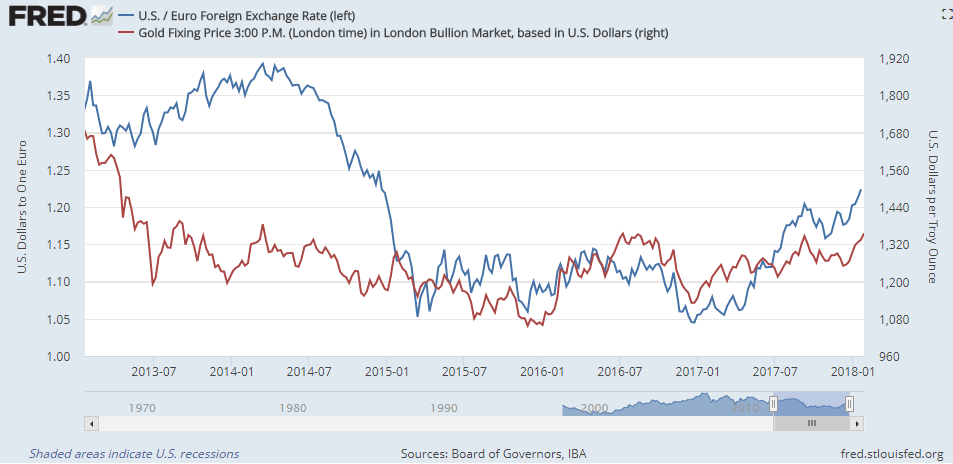

The Dollar eased back but held half of yesterday’s sharp rebound from its lowest FX value since late 2014 after US president Donald Trump tempered “weak Dollar” comments from his Treasury Secretary Steve Mnuchin.

Gold priced in other major currencies still held lower for the week however, dropping 0.9% against the British Pound and losing 1.4% against the Swiss Franc

“[The gold price] is purely and simply following the Dollar,” says a note from brokerage Marex Spectron in London.

“Yes there are other short term movers along the way…but if you want a trend to follow, it’s the Dollar, nothing else.”

After dumping almost 2 cents against the Dollar on Thursday, the Euro today climbed back above $1.24 to head for its highest weekly finish since mid-December 2014.

Gold meantime recorded a Friday PM benchmark in London at $1353.15 per ounce, its highest weekly close since 8 July 2016.

Coming at $1354.25 immediately after the UK’s shock Brexit referendum result, that Friday fix 18 months ago was the highest since mid-March 2014.

Set to widen America’s new import tariffs from solar panels and washing machines to steel and aluminum, “We support free trade but it has to be fair and reciprocal,” said Trump at the World Economic Forum in the Swiss ski resort of Davos late Thursday.

“What we all said, including the new US administration, was that we will not target our exchange rates for competitive purposes,” said Banque de France governor and European Central Bank member François Villeroy de Galhau to reporters today about a meeting held at this week’s event.

“This sentence is very important. It remains the rule of the game. It’s a rule of mutual trust.”

“We will refrain from competitive devaluations and will not target our exchange rates for competitive purposes,” said European Central Bank chief Mario Draghi yesterday after announcing a ‘no change’ decision on negative interest rates and confirming the monthly pace of €30 billion in new quantitative easing announced in December.

“We don’t target the exchange rate.”

Despite a $10 slide in global quotes for gold settled in London overnight, the Shanghai premium above that price held little changed on Friday from yesterday’s $8.30 per ounce.

With just 3 weeks to go until the Lunar New Year of the Dog coincides with Valentine’s Day weekend, the Shanghai premium remains just below the average incentive offered to new imports of bullion into the world’s No.1 private-consumer nation.

“Chinese gold demand slipped by 2% year-on-year” in the last quarter of 2017 says the latest update from specialist analysts Thomson Reuters GFMS, “with ongoing losses in the pure gold segment as consumer preferences continued to shift towards more fashionable, but lower gold content pieces.

“It does appear that younger Chinese jewellery buyers are increasingly viewing the sector as adornment rather than investment, and we expect volumes to remain under pressure.”

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply