Do fundamentals or a crisis of confidence drive the public into gold?

Bullion.Directory precious metals analysis 17 February, 2015

Bullion.Directory precious metals analysis 17 February, 2015

By Terry Kinder

Investor, Technical Analyst

Do fundamentals or a crisis of confidence drive the public into gold?

Every day it seems there is some new article lamenting why the gold price doesn’t move the way that some ever-changing group of fundamentals says it should. A quite sensible model has been proposed by Martin Armstrong which is based on economic confidence.

The idea is simple – people seek the protection of precious metals, including gold, when they lose confidence in government and its ability to maintain an environment of economic prosperity. Notice I didn’t say create – government creates nothing. It merely transfers money from one set of hands to another.

Trying to chase down so-called fundamentals is a bit like a dog chasing its tail. First, good luck to the dog catching its fail. Second, what’s the dog going to do with his tail if by luck he catches it?

When you have a market of sufficient size with regular price data, you don’t need fundamentals. I’m not saying fundamentals are unimportant. However, for the purposes of analyzing price and getting a bead on its direction, fundamentals aren’t that useful. The problem with fundamentals is that if you get two or three analysts in a room together it’s unlikely they will agree on one set of them. Even if they do, it’s likely that the fundamentals they choose won’t allow you to analyze price correctly over an extended period of time. Analysts are constantly moving the goalposts, modifying their views, and adding or subtracting fundamentals. How fundamental can fundamentals be if they change constantly?

The 1970’s and economic confidence

For those who are too young to recall the 1970’s economy, let me provide an example. My parents were business owners in the 1970’s and 80’s. They owned a chain of three clothing, hardware and variety stores modestly named Kinder’s. The stores were located in the state of Washington. One of those stores was in Forks, Washington (now of Twilight fame). Another store was in Twisp, Washington. Both of those areas were heavily dependent on the lumber industry.

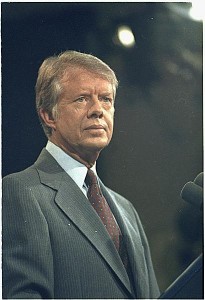

When President Carter delivered his Crisis of Confidence speech on 15 July 1979 the gold price was under $300.00. By January 1980 gold soared to over $800.00. Image: Wikimedia

The erosion of our confidence in the future is threatening to destroy the social and the political fabric of America.

Carter’s critics referred to his address as the “malaise” speech.

On Friday the 13th, the last trading day before President Carter made his speech, gold finished the trading day at $290.80. By 2 October 1979 it was up over 41% to $411.00. By 21 January 1980 the price had soared over 186% to close at $834.00.

On the Friday before Carter’s Crisis of Confidence Speech gold closed at $290.08. A little over six months later it closed at $834.00.

Should we view it as mere coincidence that President Carter had felt the need to address a crisis of confidence in July and that by January of 1980 the gold price was 186% higher? Was it some ever-changing set of fundamentals that drove the gold price higher or was it rapidly collapsing public confidence in government in general, and Carter in particular, that drove the gold price parabolically higher?

The Federal Reserve: Destroyer of Dreams

With the backdrop of this crisis of confidence, President Carter requested that his senior advisers resign. This led to then Fed Chair Miller being appointed as Secretary of the Treasury. Paul Volcker, hoping to replace Miller met with Carter on 24 July 1979 in an effort to become the next Chair.

While Volcker walked away from the meeting thinking he had blown his opportunity to win the appointment, he did in fact become the next Fed Chair. It was his Fed that continued to hike interest rates until they ultimately peaked at over 20%.

These ultra high interest rates crushed sales of new homes which, in turn, decimated the lumber industry. This absolutely devastated the two primary towns where my parents had their businesses. In Twisp, Washington, one of the major employers was a lumber mill. That mill shut down and was torn down to the ground.

Unfortunately my parents had taken out variable interest rate loans for the businesses. When interest rates spiked, the banks called in the loans (along with many, many others due to the distress in the lumber industry). Despite the fact that my parents had always paid their loans on time, they were told the loans had to be paid back immediately. This ultimately forced them into bankruptcy.

Unfortunately, the Fed continues to be a destroyer of dreams, attempting to manipulate natural economic cycles which, in turn, only makes each resulting crash worse.

Conclusion

Mismanagement of the economy by the government and central banks distorts natural economic cycles and helps create larger cycles of economic booms and busts than would normally occur. This constant interference creates false signals, e.g. interest rates that are lower than they would be, etc. Businesses depend on these signals to make important decisions such as whether to take out a loan to expand or not. When these distortions are coupled with other economic shocks they can create economic distress and a crisis of confidence.

Ultimately, it is this crisis of confidence, not some ever changing set of fundamentals, which drives people to seek shelter from government mismanagement of the economy. When people fear that government has become an imminent threat to their economic well-being, they seek safety in gold (or other things) in order to hedge their perceived risk.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.