Short Covering in Gold Market ‘Could See $1300’ as Fed’s 2019 Rate Hikes Hit Equities, Commodities

Bullion.Directory precious metals analysis 18 October, 2018

Bullion.Directory precious metals analysis 18 October, 2018

By Adrian Ash

Head of Research at Bullion Vault

Prices in the professional bullion market then rallied $5 per ounce as China’s stock market closed the day at a new 4-year low and the MSCI World Index of developed-market equities fell for the 15th time in 19 sessions.

The more industrial precious metals all fell harder than gold after Wednesday’s publication of minutes from the Fed’s September policy meeting, with silver, palladium and platinum prices all dropping back below last Friday’s finish – the strongest weekly close in 14 for platinum at $838 per ounce.

Brent crude oil meantime fell back below $80 per barrel for the first time in nearly 4 weeks despite US lawmakers calling on President Trump to force “consequences” on Saudi Arabia over Riyadh’s apparent murder of US-based journalist Jamal Khashoggi.

Now overtaken by the US as No.1 oil producer, Saudi Arabia has already threatened to “respond with greater action” if the scandal leads to sanctions against it.

“The gold market [was] set-up for a short-covering rally,” says new analysis from bullion-bank ICBC Standard, pointing to the last week’s $50 gain.

“[There’s now] significant potential for a sharp short-covering rally back towards $1300,” the note goes on, as bearish traders cut their record negative bets on the metal amid this sharp drop in world stock markets.

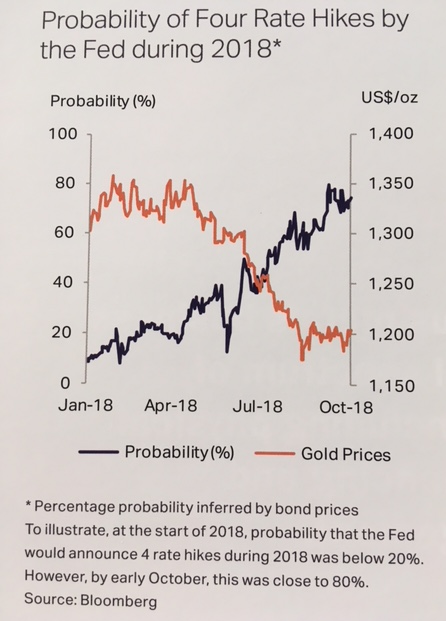

“It is easy to see why gold prices are still down 6% year-to-date,” says the new Precious Metals Investment Focus 2018/2019, launched last night in London by specialist analysts Metals Focus.

“Expectations of further [US] rate increases have remained in place, bolstered by strong US consumer sentiment [hitting] an 18-year high and robust GDP growth in excess of 4%.”

The fact that, prior to October, US equities “shrugged off” the risk of an economic slowdown from the US-China trade war also proved “a clear negative for gold”, Metals Focus goes on.

Together with rising US interest rates however, the threat of “protectionism…has led to a rout in [gold-consumer country] emerging-market currencies,” the consultancy adds, “and a flight to the safe haven of the US Dollar.”

“The last thing emerging markets or the US yield curve or equities want is a reminder that US rates are going to keep going up,” says Dutch bank Rabobank today, commenting on last night’s release of notes from the US Federal Reserve’s latest policy meeting.

The Fed’s policy team feels “there may be a greater risk associated with financial market excesses rather than traditional inflation,” adds fixed-income strategist Kathy Jones at brokerage Charles Schwab, also reading those notes.

Outside the Dollar, wholesale gold-market prices held firm for Euro investors on Thursday, trading near August’s high of €1065 per ounce as Italy’s left-right coalition government rejected calls from other European Union leaders to reduce its 2019 budget deficit plans.

Italy’s borrowing costs, over and above comparable German Bund yields, blew out to a new 5-year high at 3.25 percentage points.

The British Pound meantime fell to 1-week lows versus the Dollar as rumors spread that UK Prime Minister Theresa May wants to accept the EU’s offer of fudging Brexit and extending the “transition period” perhaps to 2021 – a suggestion immediately rejected by pro-Brexit members of her minority-government Conservative Party.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply