Who exactly has the Fed helped during this “recovery”?

Bullion.Directory precious metals analysis 26 March, 2015

Bullion.Directory precious metals analysis 26 March, 2015

By Christopher Lemieux

Senior Analyst at Bullion.Directory; Senior FX and Commodities Analyst at FX Analytics

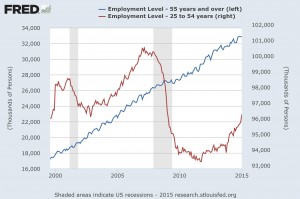

It is well-known the Federal Reserve has only widened the income gap between the top and bottom income brackets, and their outright dangerous zero-interest rate policy (ZIRP) has destroyed the lives of those who greatly depend on income derived from yields – primarily the elderly.

So, is it no doubt the reason why those 55 and older are the only demographic to have net-positive job gains since the recession ended?

A study was just released that encompassed the Fed’s utter destruction of savers between 2008 – when ZIRP began – and 2013. In this time nearly one-half-trillion of income ($470 billion to be exact) was nixed from savers.

This does not include 2014 or early 2015, so the number could easily have surpassed the half-trillion mark by now.

The Fed has garnered the idea that their misguided policies have strengthened the economy, while the average American must work multiple jobs to receive but a portion of the income they saw prior to the financial meltdown.

In fact, the only incomes to increase since then have been those of the most wealthy.

This is because most Americans do not own stocks, and so the Fed’s reckless policies have done nothing but cause reallocation of resources from a large section of the population to a small section.

The same happens every time the Fed intervenes within the markets, yet they are allowed to continue business as usual.

Swiss Re CEO Guido Furer sumed it up perfectly:

Besides the impact on long-term investors’ portfolio income, the consequences for capital market intermediation is not negligible either…. Crowding out investors due to artificially low or negative yields will reduce the diversification of funding sources to the real economy, thus representing a risk for financial stability and economic growth potential at large.

The Fed’s policies are a zero-sum game. Someone always wins at the cost of somebody’s loss. Sorry, savers. You lose.

There are winners and there are losers. And as much as we would like to help the losers, if we do it in the way that directs the limited capital of the society to support low-productivity parts of the economy, it means the rest of the economy – our overall standard of living – will not rise as much as it could (inflation.)

Former Fed Chair Alan Greenspan

So that’s $470 billion robbed from savers, robbed from the economy, probably for good.

Bullion.Directory or anyone involved with Bullion.Directory will not accept any liability for loss or damage as a result of reliance on the information including data, quotes, charts and buy/sell signals contained within this website. Please be fully informed regarding the risks and costs associated with trading in precious metals. Bullion.Directory advises you to always consult with a qualified and registered specialist advisor before investing in precious metals.

Leave a Reply